- USDT holdings have risen sharply amid a sluggish crypto market.

- Since August, a massive surge in USDT holdings on exchanges have been witnessed.

- The accumulation/distribution indicator suggests that the trend might continue.

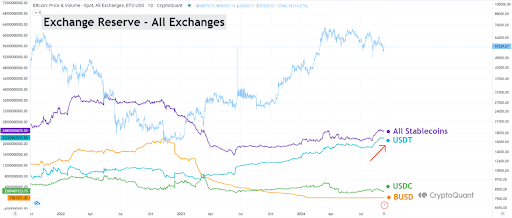

Crypto investors have massively increased their stablecoins holdings with USDT accumulation on the rise amid a sluggish market. Data from CryptoQuant reveals a sharp rise in USDT holdings since August’s market downturn.

According to CryptoQuant analyst “Yonsei Dent,” the increase in USDT reserves on exchanges is a significant shift. “USDT remained relatively stable despite price swings from March to July,” Dent noted.

The increasing presence of stablecoins on exchanges could be an indication of investors waiting to buy cryptocurrencies. However, this doesn’t necessarily mean that the price of digital assets will rise, Dent warned. It could also mean that investors anticipate a market crash or have converted their crypto to stablecoins, which could result in the market plunging.

Dent also believes that it could be possible that investors won’t exchange their stablecoins for cryptocurrencies because the global markets currently have an uncertain future, including digital assets. He added:

“Because it is ‘standing-by funds,’ it should be noted that if the market trend is unclear or the global economy is difficult, there may be no purchases due to risk aversion.”

According to the data from CoinMarketCap, Bitcoin (BTC) has been quite volatile since January and also achieved its all-time high in March this year at $73,750. Since then, the cryptocurrency has plunged 22.68% despite numerous attempts to break higher. At the time of writing, the market leader is trading at $57,014.20.

Read also: Bitcoin’s September Slump: Can History Repeat with an October Surge?

Accumulation of USDT

The accumulation of USDT, the largest stablecoin by market capitalization, has started to climb again after a significant drop last week. However, it remains below the levels seen in May.

The steep rise in the Accumulation/Distribution line’s gradient suggests investors may continue to add more USDT to their portfolios in the near future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.