- Crypto markets pulled back slightly Tuesday after hitting 2-week highs Monday (BTC $116K)

- Monday’s rally was fueled by strong Fed rate cut expectations ahead of Oct 28-29 FOMC

- Market now pauses (BTC ~$114K) awaiting Fed decision/Powell comments Wednesday

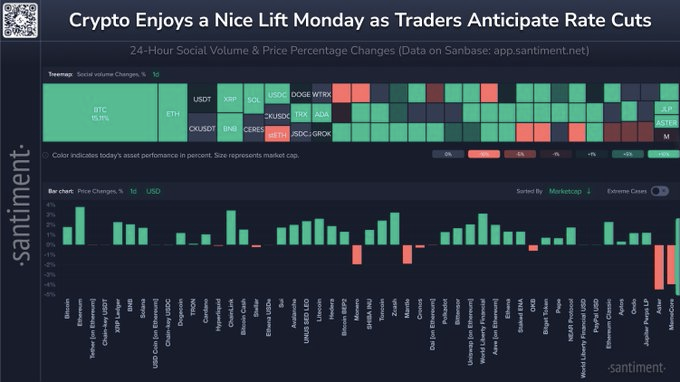

The crypto market saw a burst of optimism Monday, pushing Bitcoin above $116,000 and Ethereum past $4,240, both two-week highs, according to Santiment data from yesterday. This surge was clearly driven by traders positioning ahead of the U.S. Federal Reserve’s critical two-day policy meeting (October 28-29), betting heavily on another interest rate cut.

However, Tuesday brought a slight cooling, with Bitcoin pulling back towards $114,000 and Ethereum slipping below $4,100. This pause indicates the market digesting Monday’s gains and adopting a more cautious stance as the actual Fed decision looms.

Monday’s Rally: Pricing In the Widely Expected Fed Cut

Yesterday’s move higher was textbook front-running of a dovish Fed. The market holds a near-consensus expectation for the FOMC to announce a 25-basis-point rate cut on Wednesday afternoon (2:00 p.m. ET). This conviction stems from recent softer U.S. economic indicators, particularly in the labor market, and inflation readings that have generally undershot forecasts.

Lower interest rates typically make borrowing cheaper and reduce the appeal of holding cash, historically encouraging capital flows into higher-risk assets like crypto. Monday’s rally reflected the market pricing in this anticipated boost to liquidity.

Bitcoin and Ethereum prices stabilize as the crypto market takes a breather, anticipating the upcoming Federal Reserve decision.Rotation Signal: AI, DeFi Tokens Led Monday’s Charge (Santiment)

Further evidence of Monday’s risk-on sentiment came from sector performance. Santiment’s data highlighted that tokens associated with Artificial Intelligence (AI) and Decentralized Finance (DeFi), like Fetch.ai (FET), Ocean Protocol (OCEAN), and Render (RNDR), were among the strongest performers. This rotation into higher-beta segments signaled increasing market confidence, often seen when traders anticipate easier monetary conditions.

While Bitcoin led social media buzz yesterday, the outperformance of these riskier altcoins showed capital actively moving out on the risk curve in anticipation of the Fed’s decision.

Market Pauses Tuesday: Focus Shifts Entirely to Powell’s Guidance

Today’s slight pullback demonstrates the limits of trading the rumor. While the 25bps cut is largely expected and likely factored into Monday’s prices, its immediate impact post-announcement might be muted.

The real volatility trigger now becomes Fed Chair Jerome Powell’s press conference remarks following the decision. Think of the rate cut as the opening act; Powell’s commentary is the main event. If he signals a clear path towards further easing or downplays lingering inflation concerns, it could reignite Monday’s rally.

However, any hint of hawkishness, emphasizing data dependence, persistent inflation risks, or uncertainty about future cuts, could quickly unwind the recent gains. The market is now in a holding pattern, waiting entirely on Powell’s tone to dictate the next directional move.

Related: Bitcoin & Ethereum Ride Polymarket’s Fed Rate Cut Sentiment. Is Overbought Next?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.