- Bitcoin and Ether have crashed 24% and 31% in the past seven days.

- Over $800 million was wiped off from the crypto market in the past 24 hours.

- Altcoins including ZRO, SOL, STRK, WLD, TON, and DOGE plummeted.

The crypto market experienced a significant crash over the past 24 hours, with Bitcoin (BTC), the leading cryptocurrency, falling below the $53,000 price level. Data from Coinglass reveals over $800 million liquidated from the crypto space, with $46.13 million in the past hour, $166.27 million in the past 4 hours, and $678.62 million in the last 12 hours.

CoinMarketCap data shows Bitcoin’s trading volume surged almost 100%, now standing at $54.81 billion with a market capitalization of $1.04 trillion. After reaching a high of $65,600 on August 1st, BTC has declined for four consecutive days and is currently trading at $52,891. The world’s largest digital asset is down 24% in the past seven days. Meanwhile, Ether (ETH), the second-largest cryptocurrency, followed a similar bearish trend, dropping 31% over the same period.

Prices of leading altcoins also mirrored the dip in BTC and ETH prices. Toncoin (TON) dipped 12% to $5.24, down 22.61% over the past seven days. Dogecoin (DOGE), the largest meme coin by market cap, plunged 16.9% to $0.08954, reflecting a 33.18% decrease over the last week.

The decline continued with Solana (SOL) crashing 19.5% to $117 (down 40% in seven days), LayerZero (ZRO) plunging 18.29% to $2.96 (down 35.35% over the past week), Starknet (STRK) dropping 14.21% to $0.3457 (a 36% decrease in the last seven days), and Worldcoin (WLD) nosediving 16.73% to $1.46 (down 39.53% in the past week).

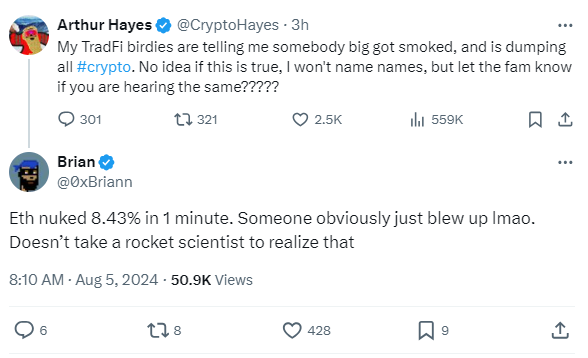

Conversations on the social media platform X (formerly known as Twitter) largely attribute the crypto market crash to traders being liquidated.

While some analysts predict an immediate rebound for Bitcoin and altcoins, one crypto investor commented, “Imagine getting smoked like this during the easiest bull market ever? Let me guess they were leveraged to the eyeballs.”

Bitcoin personality Samson Mow asserted that the Bitcoin bull market is just around the corner, taking to X to blame traditional finance markets for the recent decline in BTC’s price.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.