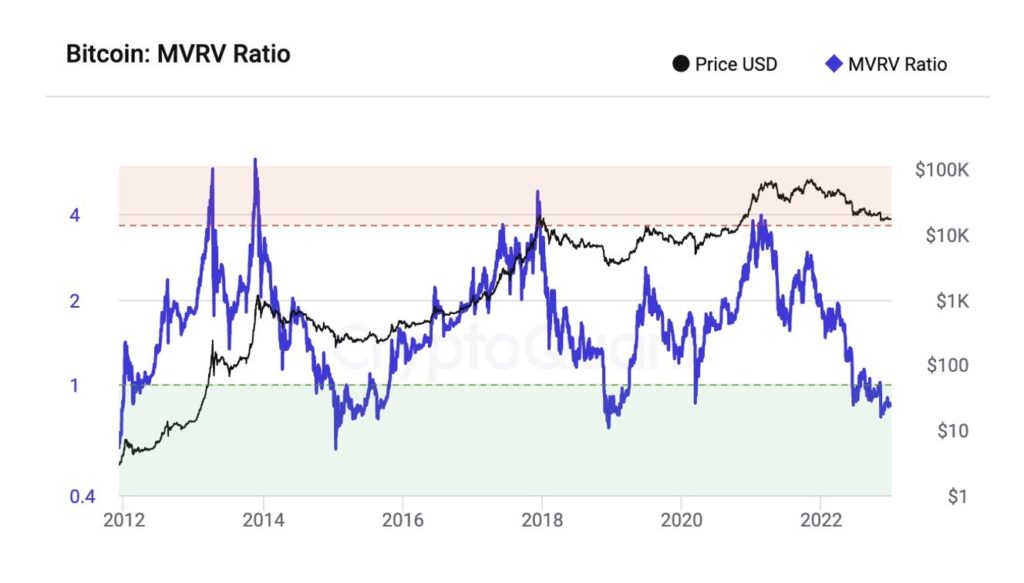

- Ki Young Ju tweeted a snapshot of BTC’s MVRV ratio today.

- The price of the crypto market leader has risen slightly over the last 24 hours.

- BTC’s bullish trend will continue if it closes above the 9 and 20-day EMA lines today.

Ki Young Ju, the co-founder and CEO of Cryptoquant, tweeted a chart today of the MVRV ratio of the crypto market leader, Bitcoin (BTC).

As can be seen by the chart shared in the CEO’s tweet, the MVRV ratio for BTC has plummeted. This has also dragged the price of BTC down since BTC’s all-time high (ATH). Young Ju stated that this is a sign of investors’ interest in BTC diminishing.

Despite this, BTC’s price has risen 0.65% over the last 24 hours according to CoinMarketCap. The market leader’s price is also up 1.45% over the last 7 days. At press time, the price of BTC stands at $16,589.11.

BTC has also strengthened 1.78% against Ethereum (ETH) over the last 24 hours. Its dominance, however, has dropped 0.22% in the same time period. As a result, BTC’s market dominance is estimated to be 39.64%.

BTC’s price has been in a multi-day positive sequence over the last 3 days, with today looking to continue the trend. This has elevated BTC’s price to above the 9-day and 20-day EMA lines.

Technical indicators suggest that BTC’s bullishness will continue. The daily RSI line has crossed above the daily RSI SMA line and is also sloped positively towards the overbought territory.

A strong confirmation that the bullish trend will continue for BTC will be when the 9-day EMA line crosses above the 20-day EMA line. Should this technical flag occur on BTC’s daily chart, then BTC’s price will overcome the $16,900 resistance level and make a move toward $17,200.

This bullish thesis will be invalidated if BTC’s price is unable to close above the 9-day and 20-day EMA lines at the end of today’s trading session.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.