- USDT peg destabilization may have been triggered by manipulation, according to Kaiko.

- Selling activity began days before USDT dipped to $0.995.

- Binance’s USDT-USDC pair witnessed substantial USDT selling.

Kaiko, a cryptocurrency data provider, has uncovered insights into the recent volatility surrounding Tether (USDT), the world’s largest stablecoin. The company’s analysis suggests that the destabilization of USDT’s peg to the US dollar may have been triggered by manipulation preceding a significant document release, which shed light on the firm’s banking relationships and commercial paper exposure.

Several days before USDT experienced a dip to as low as $0.995 on centralized and decentralized exchanges, a wave of selling activity commenced. According to Kaiko, certain holders may have advanced knowledge of the impending document release.

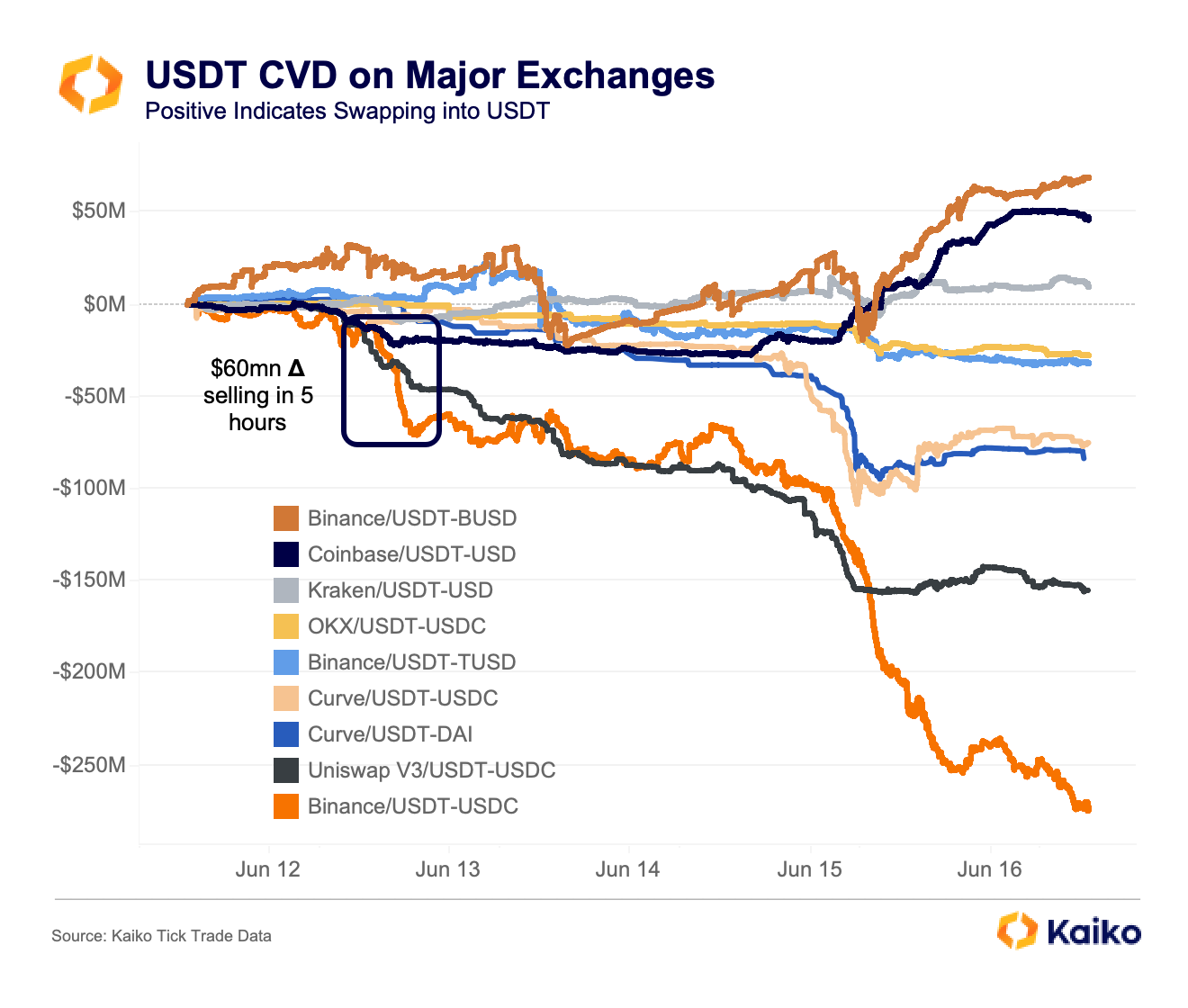

One metric that provides valuable insights into the market dynamics is the Cumulative Volume Delta (CVD) indicator, which depicts buying and selling trends for specific trading pairs. In this context, positive CVD values indicate a preference for swapping into USDT, while negative values signify the selling of USDT.

Binance’s USDT-USDC pair demonstrated the largest USDT selling activity, recording a negative CVD of $250 million from Monday to Friday. Following closely behind was Uniswap V3, which registered a negative CVD of $150 million.

Conversely, Coinbase and Kraken’s USDT-USD markets exhibited positive CVD values, indicating traders’ willingness to exchange fiat currency for a slightly discounted USDT. Additionally, Binance’s USDT-BUSD pair displayed a positive CVD, suggesting traders’ inclination to seize an opportunity to unload BUSD.

The analysis further revealed that Curve, the primary decentralized marketplace for stablecoin swaps, witnessed significant selling pressure on USDT within the pool, primarily involving DAI and USDC. This trading pair exhibited a negative CVD of $150 million, emphasizing the magnitude of the selling activity within the decentralized ecosystem.

Interestingly, amid the de-pegging event, the largest order recorded amounted to approximately $12 million worth of USDC swapped for USDT. This transaction signifies that some astute traders sought to capitalize on the price discrepancy between the two stablecoins, aiming to profit from the prevailing market conditions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.