- Ripple CTO David Schwartz emphasizes understanding tax implications in AMM transactions.

- User shares tweet showing an example of upto 24% AMM high yields upon XRP withdrawal.

- David Schwartz takes lead in the twitter conversation and sheds light on AMM’s tax challenges.

David Schwartz, co-founder of Ripple, highlights the importance of understanding the tax implications associated with AMM transactions. The CTO went on to explain that Depositing and withdrawing assets from these pools can trigger taxable events, as users effectively convert their cryptocurrency into liquidity provider (LP) tokens upon deposit and back into cryptocurrency upon withdrawal.

The concept of “basis” is of great importance in navigating the tax landscape of AMM transactions. The value of assets deposited into the AMM pool at the time of entry serves as the basis for LP tokens, guiding the calculation of capital gains or losses upon redemption or sale.

The CTO asked the investors to consider a hypothetical scenario where an investor deposits a mixture of assets into an AMM pool, subsequently redeeming a portion of their LP tokens. The gains or losses realized are contingent upon changes in asset values and the established basis at the time of deposit.

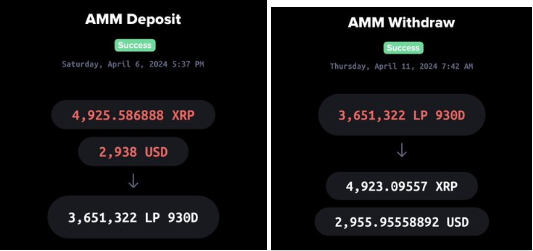

David Schwartz was replying to an ongoing conversation on twitter where he hailed the XRP AMM Yeild In the tweet, Hartner details an AMM deposit he made for 4926 XRP and 2938 USD. Then, 4.6 days later, he did a withdrawal and received 4923 XRP and 2956 USD. He calculates that over the 4.6 days, he had a combined annualized earnings of 24%.

Users like Niel Hartner shared their impressive returns achievable through AMM pools, with some users boasting annualized gains exceeding 20%. These pools allow participants to earn yields by depositing their cryptocurrency holdings, capitalizing on the liquidity provided to facilitate decentralized trading.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.