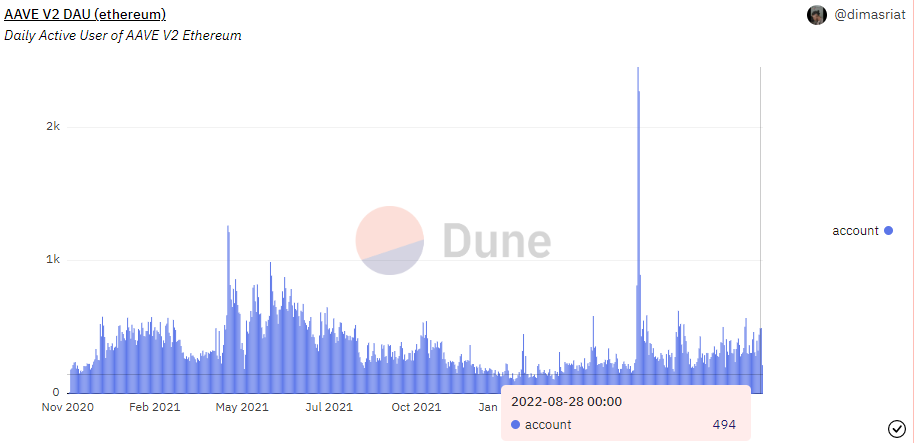

- The daily active user on Ethereum of Aave is down by 80% from its May high.

- As of yesterday, only 494 daily active users used Aave.

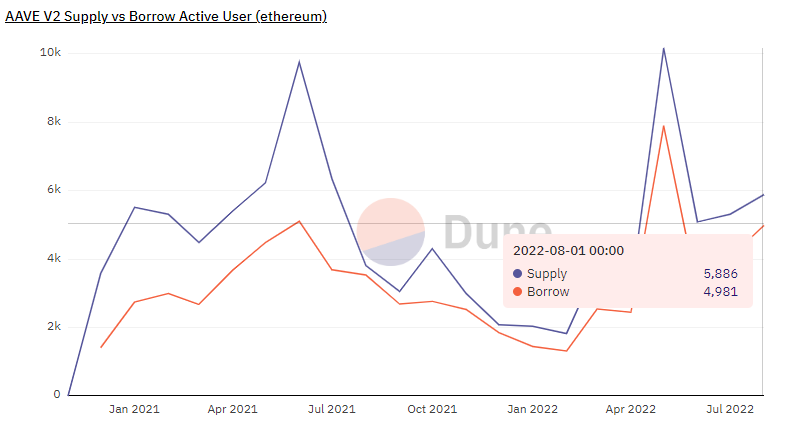

- Following a drop in June, the Aave “Supply vs Borrow” active user count appears to be recovering.

In today’s Aave Research published by cryptocurrency analytics portal Dune, the open source liquidity protocol is still struggling to ramp up its daily active user count similar to the numbers from early May to early July.

According to Dune’s Aave unique active users on the Ethereum blockchain, only 494 daily active users (DAU) used the service on August 28 versus 568 on August 14. The platform sees 216 DAU at the time of writing.

Notably, the highest the DeFi platform attained in terms of DAU was logged on May 7, with 2455 users actively performing DeFi activities during the day. From this massive number of users, the platform has now tapped to its current number, a decrease of 79.87% from its May high.

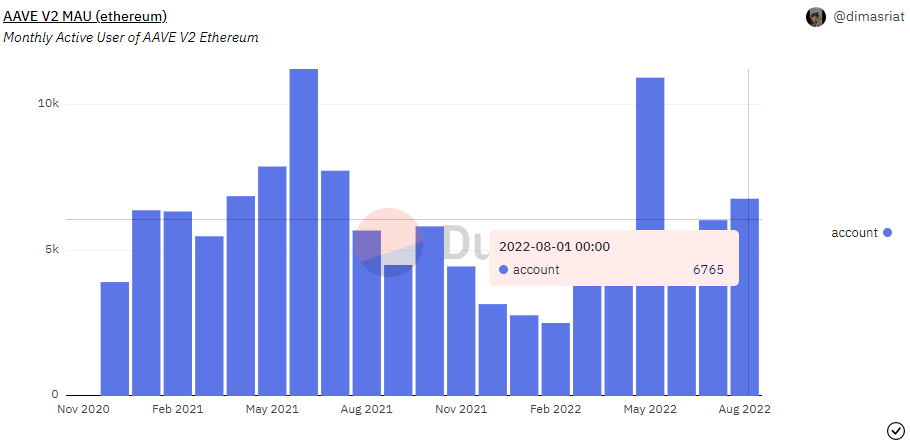

Meanwhile, the Aave monthly active users (MAU) on Ethereum slightly improved compared to the digits of the previous two months. Recorded on August 1, the Aave MAU reached 6765 monthly active accounts. The number is 19.88% and 12.22%, higher than the numbers noted on June 1 and July 1, respectively.

Notably, the May Aave MAU on Ethereum also saw a similar trend to the May DAU numbers. During the whole month, the protocol saw 10,917 monthly active users. From this high, the number is down by 38%.

After a steep drop in June, the Aave “Supply vs Borrow” active user count appears to be recovering. As of August 1, 5,886 users supplied coins, while 4,981 used the service to borrow cryptocurrency.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.