- Decentraland (MANA) prices have been rising in recent hours.

- Despite technical indicators pointing to a bear run, bulls maintain control.

- Bulls must fight to reverse these bearish indicators.

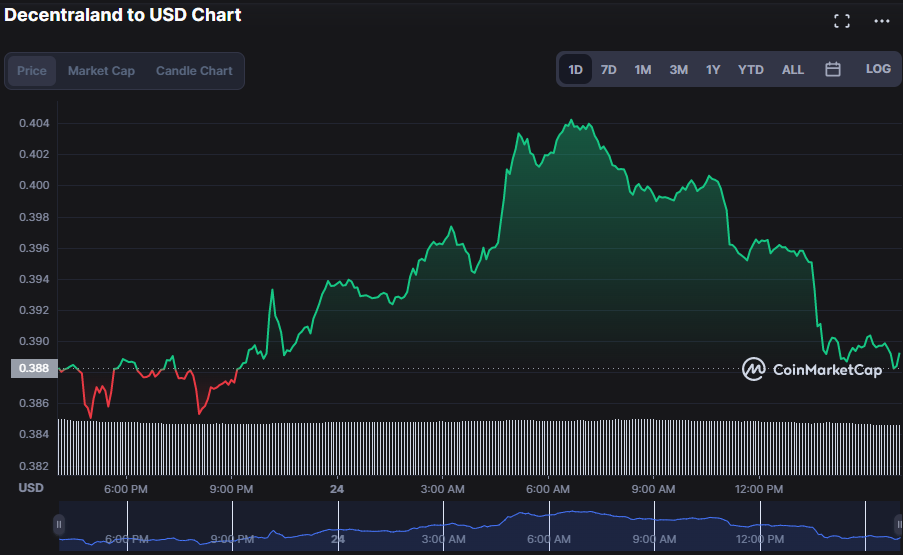

Since finding support at its intraday low of $0.385, Decentraland (MANA) has experienced bullish momentum. During the upturn, the bulls were able to consistently pull prices up to a value of $0.3905, a 1.18% gain as of press time. During this uptrend, the market capitalization increased by 0.13% to $722,400,415, while the 24-hour trading volume decreased by 12.36% to $66,038,348.

Bollinger bands are bulging on the 30-minute price chart, with the upper band touching 0.4055 and the lower band touching 0.3858. In line with BB’s strategy, the market is likely to experience more selling pressure; however, this bulging may also signal a breakout. This bull trend is expected to end soon based on the price movement toward the lower band.

Stochastic RSI movement in the oversold region with a reading of 20.14 supports this notion of bear control, but its upward pointing asserts that the market may see a possible bounceback as this reading predicts the end of the current trend.

The MACD crossing below the signal line and into the negative region with a reading of -0.0018 supports the current trend. The histogram trend, which has a reading of -0.0012, also contributes to this tendency.

Readings below the “0” line on the Elder Force Index (EFI) and the Bull Bear Power (BBP) both suggest that bear control is about to take place. With readings of -447 and -0.0065, respectively, both indicators point upward, indicating that the bulls’ momentum to reverse the predicted trend is increasing.

To avoid being overpowered, bulls in Decentraland need to battle on and raise prices higher.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.