- Solana was able to outperform its competitors in some areas.

- More transactions happen every day on Solana than any other Layer 1.

- Solana’s NFT space did witness some growth over the past year.

2022 has not been a great year for Solana (SOL) considering all of the network outages and the project’s exposure to FTX. Despite this, Solana was able to outperform its competitors in some areas.

Solana’s number of transactions has remained rather stable and now stands at about 19.9 million. This means that Solana has outperformed Ethereum and Polygon in this regard. In addition to this, Solana also beat other altcoins like NEAR and AVAX when it comes to daily active addresses.

Crypto analyst and investor Bill King posted on Twitter on November 27 to share some information about Solana. According to the post, “More transactions happen every day on Solana than any other Layer 1”.

On the other hand, not much happened for Solana in the DeFi space, and its TVL saw massive declines over the last few months. At the time of writing, Solana’s TVL stood at $865.14 million, which means that in this case, Solana was outperformed by Ethereum, Avalanche, and Polygon.

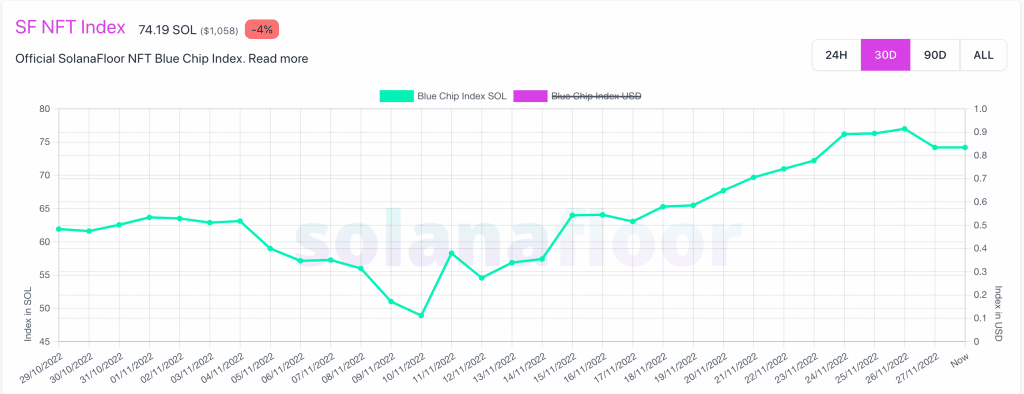

On the bright side, Solana’s NFT space did witness some growth over the past year. Not only did Solana’s BlueChip index rise over the last month, but Solana’s NFT volume also saw significant increases.

Adding to Solana’s success is the fact that stakers on its network increased over the last few days. At the time of writing, there were 577,155 stakers on the network.

Although Solana has shined in many aspects throughout 2022 and over the last few months, it still remains to be seen if a positive sentiment will form around the project.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.