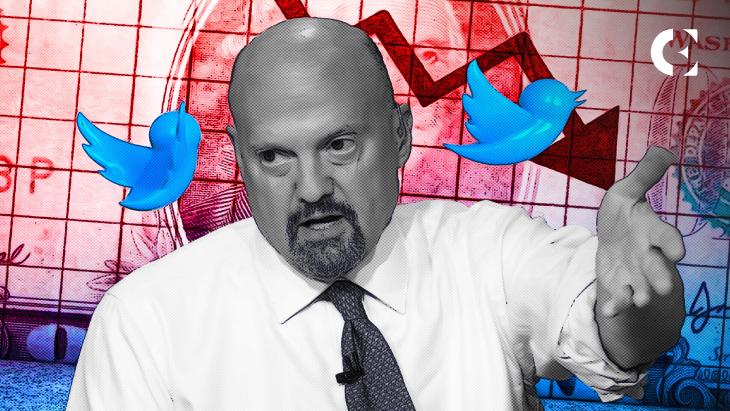

- Jim Cramer alerts investors via his latest tweet that the bull market would soon go negative.

- Cramer says the market has decided that the “fed will tighten” and a recession could approach.

- Last week, the TV host advised against investing in crypto and recommended gold instead.

Jim Cramer, the host of Mad Money on CNBC, has tweeted that the bull market would soon turn negative. Cramer tweeted that the market has decided that the “fed will tighten” and a recession could approach.

Cramer warned the investors in his latest tweet saying that “it does not take too long for this market to go negative.” In the context of S&P, the stock market index tracking the stock performance in the U.S, nearing a bull market, Jim Cramer opined that the market has already “re-digested Friday’s news.”

As per the news that broke out on Friday, Stocks slipped and the “rising interest rates” and “persistent inflation continue to worry investors” as the Federal Reserve keeps on “hiking rates”.

Interestingly, the S&P 500 still gained its “fourth weekly gain in five weeks” as investors predicted falling inflation ahead. Meanwhile, the S&P 500 index declined considerably from 1.04% to 4,136.48 even though “fighting the fed” was considered to be the “winning strategy in the stock market”.

Furthermore, since the beginning of the fourth quarter, a “20% threshold” of variation in the S&P 500 Index is evident. The fluctuation in the S&P 500 index indicated 15% up and 16% low in October.

In related news, Cramer, just last week, advised against investing in crypto and recommended gold instead. The TV personality was quoted saying: “The charts, as interpreted by Carley Garner, suggest you need to ignore the crypto cheerleaders now that bitcoin’s bouncing. And if you seriously want a real hedge against inflation or economic chaos, she says you should stick with gold. And I agree.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.