- Youtube crypto content creator tweeted whether XRP had the potential to become the number one crypto.

- Crypto netizen says that DustyBC Crypto was shilling XRP as he was paid.

- XRP has two major obstacles to break: the rebound line and 200-day MA.

DustyBC Crypto, Crypto Content Creator on Youtube asked his Twitter followers whether XRP had the potential to become the number one crypto. The crypto community’s opinions were mixed following DustyBC Crypto’s tweet.

When many crypto netizens believed that XRP had the potential to become the first crypto, others objected and said that it was hard to beat Bitcoin and Ethereum. Some others put forward various other altcoin names excluding XRP as the ones that have the potential.

Interestingly, one crypto netizen commented: “No, but I can tell you’re getting paid to promote that [expletive] coin”.

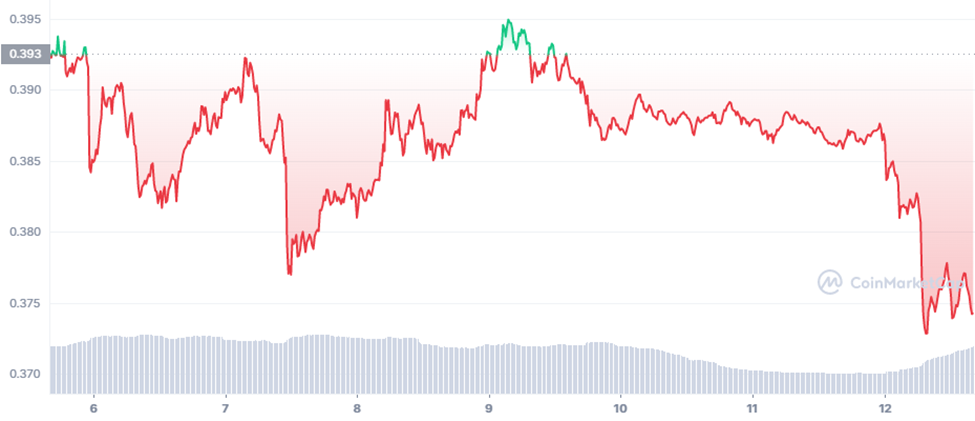

Meanwhile, XRP has been trading in the red zone as shown in the 7-day price chart. It reached the green zone only on a couple of occasions when it traded in the $0.393 – $0.395 range. XRP reached its lowest of 0.374 earlier today.

As of press time, XRP is down by 3.17% within the last 24 hours and is trading at $0.374, according to CoinMarketCap.

On Monday, November 21, XRP was trading at $0.34 in a rising bearish wedge (grey lines), and by Friday, XRP hit $0.41. However, the high dwelling place of XRP was short-stayed as it fell back to $0.37, which is in the former support region as indicated in the chart.

Significantly, from early December, the price of XRP has been rebound on the green line (Rebounding Area). XRP tested Resistance 1 ($0.39-$0.40) on numerous occasions, however it wasn’t able to break through. Similarly, XRP kept its prices from tanking below its former support.

Currently, XRP is fluctuating in the former support range. Additionally, the Bollinger bands are widening, which indicates that there is more volatility. XRP has touched the lower Bollinger, and the market has corrected the price of XRP.

The Relative Strength Index is at 38.02 and is parallel with the horizontal line indicating a well established trend. Moreover, the 200-day MA is slightly tilting downwards which indicates that the prices could go down.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.