- Crypto markets face headwinds as top meme coins hit 7-day lows amid Bitcoin’s struggle to reach $28,300.

- DOGE shows resilience with increased trading volume despite price correction.

- SHIB and PEPE experience price swings, with traders capitalizing on market volatility.

Negative pessimism has permeated the last day’s markets, sending Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) to new 7-day lows. The inability of Bitcoin to break beyond $28,300 has been a significant contributor to the decline.

The slowdown is attributable to investors cashing in their gains and worrying about the Federal Reserve’s monetary policy. Investors have been wary as they await more clarification on the Federal Reserve’s inflation and interest rates position.

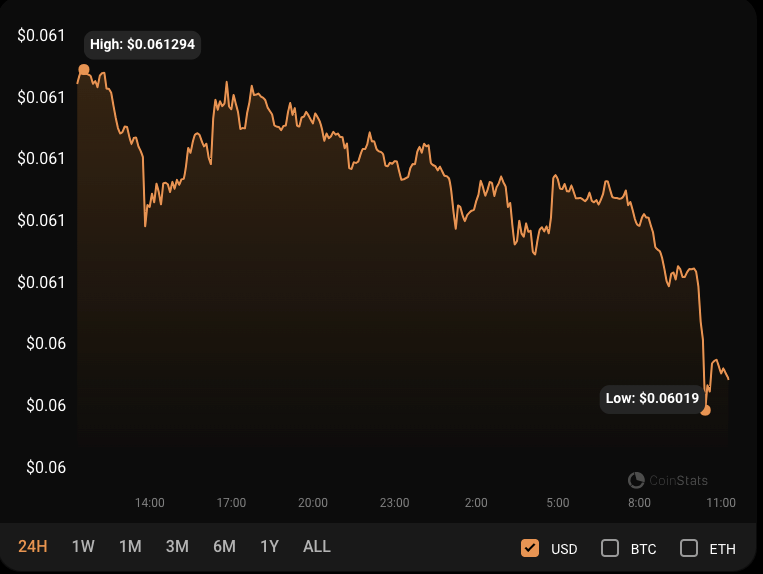

DOGE/USD Analysis

Dogecoin (DOGE) has retraced from its intra-day high of $0.06135 to its day low of $0.06057 in the previous 24 hours. At press time, DOGE was down 1.47% from its 24-hour high trading at 0.06037.

If negative momentum breaks through the $0.06057 support level, the next level to look for is around $0.059. However, if positive momentum prevails, the price may revisit the $0.06100 barrier level.

During the downturn, DOGE’s market capitalization fell 1.48% to $8,540,913,811, while its 24-hour trading volume increased by 13.45% to $105,208,987. Despite the price correction, the increase suggests increasing trading activity and interest in DOGE. Furthermore, it shows that there is still significant market involvement and room for future price volatility.

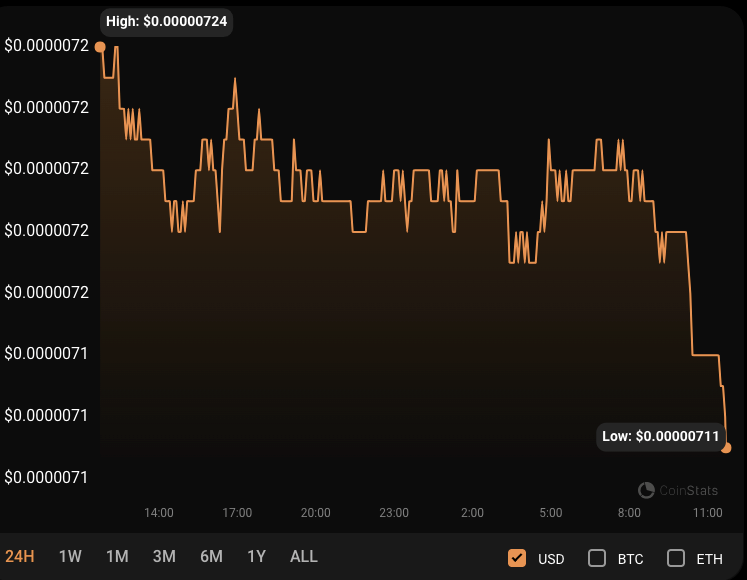

SHIB/USD Analysis

Despite kicking off the day in a bullish trend, Shiba Inu (SHIB) bulls retraced after hitting resistance at the 24-hour high of $0.000007236. Consequently, the SHIB price dropped to a 7-day low of $0.000007164 before finding support and settling at $0.000007141 at the time of publication.

A bearish breakthrough below the $0.000007164 support level might lead to a test of the next support level at $0.000007100 for SHIB. However, if the bulls retake control and push the price over the resistance at $0.000007236, it might imply a bullish continuation with the next target at $0.000007300.

SHIB’s market capitalization fell by 1.23% to $4.21 billion, while its 24-hour trading volume climbed by 11.16% to $57.15 million, indicating more significant market activity. This rise shows traders are taking advantage of price volatility to execute short-term transactions and benefit from SHIB price swings.

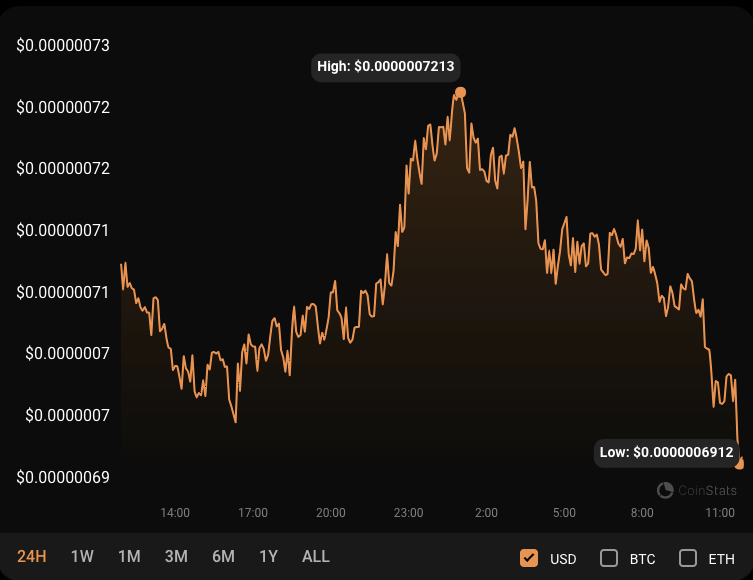

PEPE/USD Analysis

Pepe (PEPE) began the day negatively, dropping to a low of $0.0000006967, where support was established. As a result, bulls grabbed market dominance, driving prices to a 24-hour high of $0.0000007191.Up 1.06% from its previous low, PEPE traded at $0.0000006982 at press time.

Although PEPE’s capitalization decreased by 1.06% to $273.54 million during the correction, its 24-hour trading volume climbed by 27.70% to $36.49 million. Despite the adverse attitude earlier in the day, the retracement in PEPE’s market value and rise in trading volume indicate that there is still tremendous interest and activity around the token.

If bears break through the $0.0000006967 support level, it might lead to further selling pressure with the following support levels at $0.00000065 and $0.00000060. In contrast, a recovery to $0.00000075 and $0.00000080 is possible if bulls can hold off the bears at the present support level.

In conclusion, despite recent market dips, DOGE, SHIB, and PEPE show resilience and ongoing interest, hinting at potential price rebounds.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.