- Factor LLC CEO states that DOGE revolves around the same pattern.

- DOGE reaches a maximum price of $0.09 and a minimum of $0.07 within a week.

- DOGE is yet to test the 200-day MA for December; the market could support it.

Peter Brandt, the CEO of Factor LLC, a global proprietary capital trading firm, tweeted that Dogecoin was forming the “Here we go round the Mulberry Bush pattern.” Brandt made this statement taking the behavior of Dogecoin from June to December into consideration.

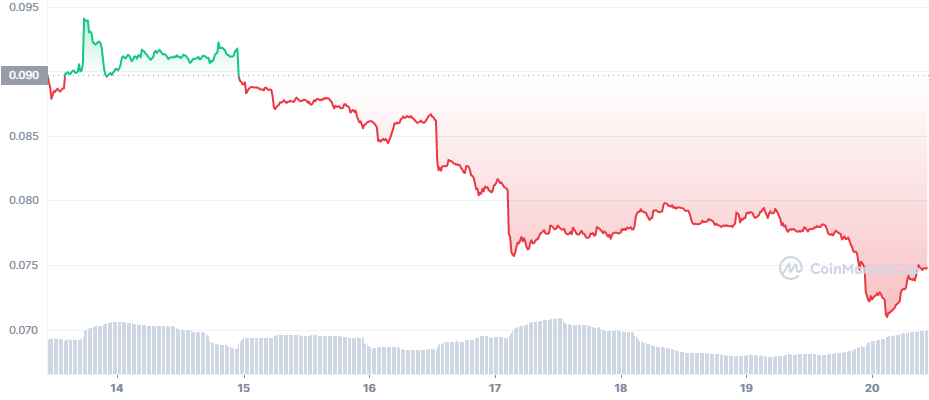

However, Considering DOGE’s behavior last week, it has been trading more in the red zone, as shown in the chart below. Notably, DOGE started the week trading at $0.09 and dropped to $0.087. Nonetheless, DOGE recovered in quick succession and reached the green zone.

DOGE fluctuated in the green zone reaching a maximum price of $0.094 for less than a day. Following its short stay in the green zone, DOGE is trading in the red zone, with its price tanking quickly. It reached a minimum of $0.07 today and is currently trading at $0.074, down 3.74% in the last 24 hours.

On November 1, DOGE was trading above the 200-day MA and hit $0.15, but came crashing down to $0.07 within ten days; this made DOGE fluctuate below the 200-day MA line. Since its fall, DOGE has been fluctuating under the 200-day MA.

However, it tested the 200-day MA in mid and late November. Although the first attempt during the mid-Novemeber was unsuccessful, DOGE broke the 200-day MA in late November.

After successfully breaking through, DOGE fluctuated in a bearish flag, rebounding on the 200-day MA for some time. Following its rebound, DOGE fell below the 200-day MA, and since early December, DOGE has not tested the 200-day MA.

DOGE has intercepted the lower Bollinger Band as the market has corrected the prices.

If DOGE breaks the 200-day MA, it could rebound on it. But, if the bulls push harder, there is a possibility of DOGE hitting Resistance 1. On the other hand, if the bears take over, then DOGE could land on Support 1.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.