- Dogecoin holds above key Fibonacci support as traders await a decisive breakout

- Rising open interest signals heightened speculation and possible short-term volatility

- Continuous exchange outflows highlight profit-taking and weakening bullish momentum

Dogecoin’s price movement remains cautious as the market consolidates after a steep pullback from the $0.27 high. The asset has been hovering near the $0.19 zone for several sessions, showing mild bearish pressure.

This consolidation period reflects indecision among traders following recent volatility. However, the underlying data reveals growing speculative participation, suggesting that Dogecoin’s next move could be more significant than it appears.

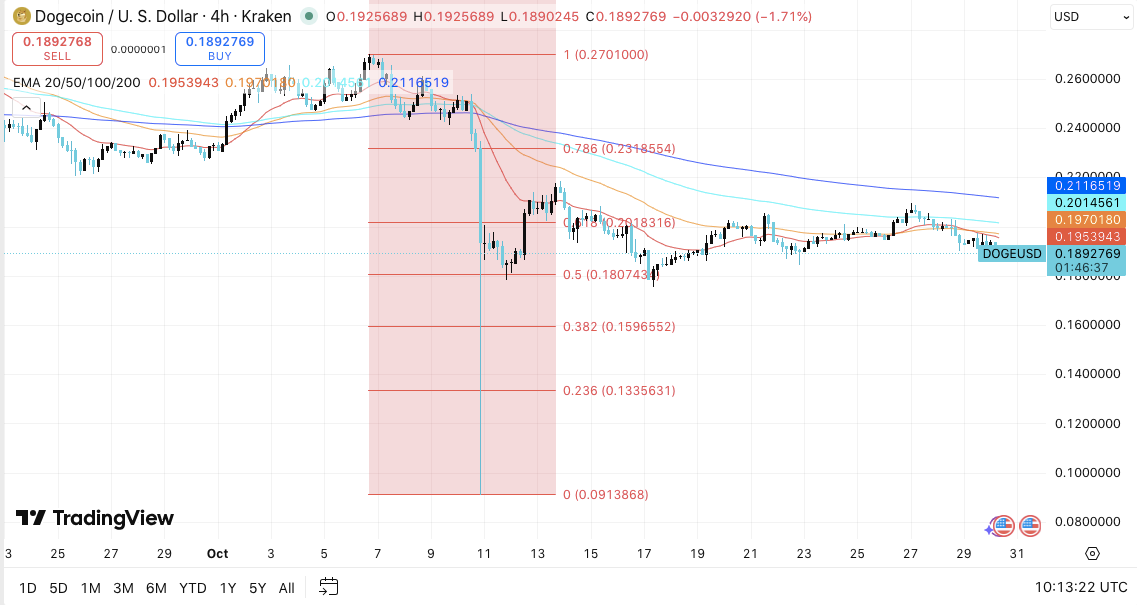

Consolidation Within Key Fibonacci Levels

Dogecoin’s chart outlines a broad Fibonacci retracement pattern from $0.27 to $0.091. The 0.5 retracement level near $0.1807 has held firm as a support region, where buyers continue to defend positions. A decisive move below this point could trigger a decline toward $0.159 and potentially $0.133, which correspond to the 0.382 and 0.236 Fibonacci levels, respectively.

On the upside, Dogecoin faces immediate resistance near the 20-day EMA at $0.195, while the 200-day EMA near $0.211 represents a major barrier. Additionally, the 0.618 Fibonacci level at $0.218 remains a critical pivot for a possible trend reversal. A breakout beyond $0.23 could re-establish bullish momentum, opening the path toward retesting the $0.27 swing high.

Rising Open Interest Reflects Market Speculation

Besides the chart structure, derivative market activity shows increased participation. Open interest has surged to $1.79 billion, up from below $1 billion in early September.

This sharp rise indicates that traders are positioning aggressively, likely expecting a directional breakout. The combination of higher price levels and growing open interest suggests elevated leverage in the market.

Related: Bitcoin Price Prediction: Analysts Warn Of Deeper Pullback as BlackRock Sells $2B BTC

However, this setup often precedes short-term volatility. If funding rates remain positive, upward continuation becomes likely. Conversely, a drop in open interest could indicate profit-taking and lead to a temporary pullback. Hence, traders may need to watch for sudden shifts in derivative activity as potential signals of market direction.

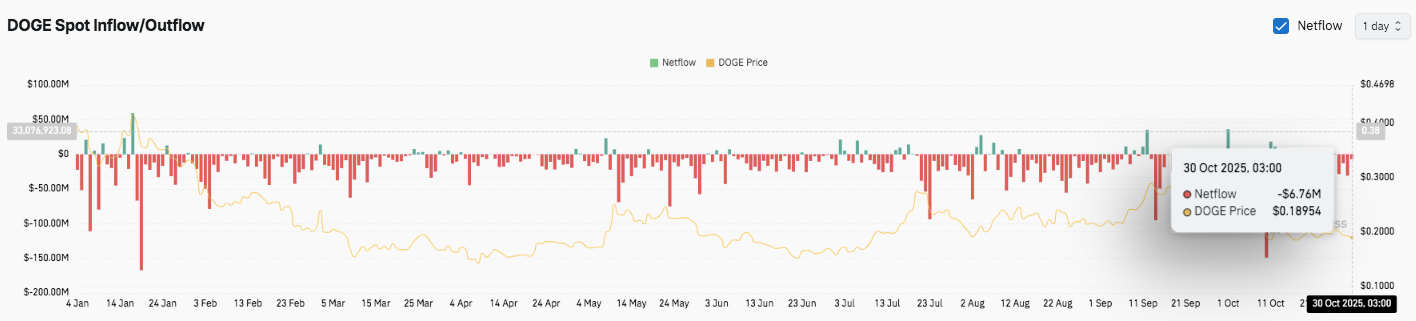

Persistent Outflows Indicate Profit-Taking

Dogecoin’s spot market data further shows continuous outflows, totaling $6.76 million on October 30, 2025. This trend highlights profit-taking behavior and limited accumulation among investors. Moreover, consistent outflows reduce liquidity support and often precede weaker price recoveries.

Consequently, for bullish sentiment to return, sustained inflows must replace current selling patterns. Until then, Dogecoin is expected to remain within its consolidation range, with short-term moves defined by derivative market shifts and the strength of the $0.18 support zone.

Related: Zcash Price Prediction: Zcash Rally Builds as Open Interest Hits Yearly High

Technical Outlook for Dogecoin Price

Dogecoin’s price structure remains well-defined as it consolidates near the $0.19 mark following a strong rejection from the $0.27 swing high. Key Fibonacci levels between $0.133 and $0.23 continue to map critical zones for traders.

- Upside levels: $0.195 (20-day EMA) and $0.211 (200-day EMA) are immediate hurdles, while $0.218 (Fib 0.618) and $0.23 (Fib 0.786) form the key breakout zone. A decisive move above these levels could propel DOGE toward the $0.27 high, marking a full recovery from its recent correction.

- Downside levels: Support remains at $0.1807 (Fib 0.5), followed by $0.159 (Fib 0.382) and $0.133 (Fib 0.236). Losing the $0.18 handle could open room for deeper retracement, with potential retests of $0.16 and $0.13 zones.

The broader structure suggests DOGE is compressing between the mid-term support at $0.18 and resistance at $0.21, forming a symmetrical consolidation that often precedes large directional moves.

Will Dogecoin Rebound?

Dogecoin’s next move largely depends on whether buyers can defend the $0.18 floor amid ongoing outflows. Strength in derivatives markets, where open interest has surged past $1.79 billion, hints at rising speculative demand. However, persistent selling pressure in spot markets continues to cap upside momentum.

If inflows rise alongside stable funding rates, DOGE could gain enough strength to retest $0.21 and potentially reclaim $0.23. Failure to sustain above $0.18, however, may trigger a breakdown toward $0.16 and delay any meaningful recovery.

Related: Cardano Price Prediction: ADA Risks Breakdown As $25M Outflows Clash With Leios Milestone

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.