- Dogecoin holds above key EMAs, signaling cautious short-term bullish structure.

- Rising open interest highlights renewed trader confidence in DOGE futures market.

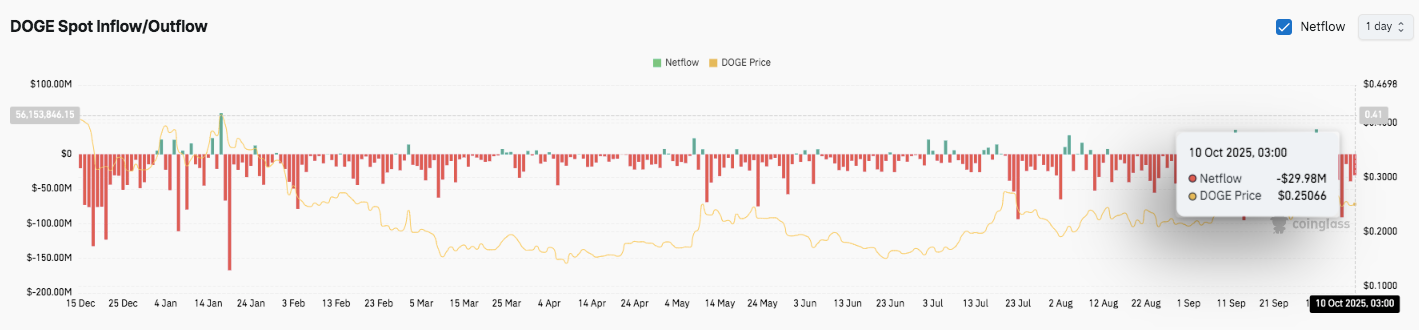

- Persistent exchange outflows indicate growing accumulation and long-term holding.

Dogecoin (DOGE) is showing a gradual recovery after rebounding from its recent swing low near $0.2408. The token trades around $0.2522, holding slightly above the 20-day and 50-day exponential moving averages (EMAs).

This mild recovery follows several weeks of tight consolidation, with traders watching closely for a potential trend confirmation. Besides, Dogecoin’s derivatives market has also regained momentum, hinting that speculative participation could soon drive stronger price action.

Technical Structure and Support Outlook

DOGE’s short-term trend remains cautiously bullish, provided the price stays above the $0.2450 area. This range aligns with the 100-day EMA and marks a zone where buyers have repeatedly defended positions.

Significantly, a fall below $0.2460 could invite renewed selling pressure, exposing lower supports around $0.2408 and $0.2305. These levels coincide with the 23.6% Fibonacci retracement and an earlier accumulation base.

On the upside, the first resistance cluster appears near $0.2548–$0.2610, overlapping with the 38.2%–50% Fibonacci range. A clean breakout could push DOGE toward $0.2737 and $0.2882, representing the 61.8% and 78.6% retracement zones. Hence, a sustained move above $0.2600 would strengthen bullish momentum, potentially targeting the $0.30 level, which marks the previous local high.

Futures Activity Suggests Renewed Trader Confidence

Dogecoin’s open interest has risen notably after months of subdued activity. It reached $4.4 billion by October 10, signaling a rebound in speculative positioning.

Related: Litecoin Price Prediction: Traders Bullish on LTC as ETF Optimism Fuels Momentum

This follows a sharp decline after July’s peak of over $6 billion, when traders took profits following a mid-year rally. Consequently, the concurrent rise in both open interest and price suggests growing leverage in the market.

Such developments often indicate an increase in trader participation ahead of key market events. If open interest continues to climb alongside stable prices, it may confirm stronger conviction among bullish traders. Moreover, this pattern could precede larger directional moves in the coming weeks.

Persistent Outflows Reflect Holding Sentiment

Exchange data shows that DOGE continues to record net outflows, reflecting a shift toward off-exchange storage. As of October 10, about $29.98 million in outflows were reported while the token traded at $0.25066. This trend suggests that investors may be accumulating for mid-term holding rather than active trading.

Technical Outlook for Dogecoin Price

Key levels remain clearly defined as Dogecoin (DOGE) trades near $0.2520 heading into mid-October.

- Upside levels: $0.2548, $0.2610, and $0.2737 act as immediate hurdles for buyers. A breakout above these points could extend the rally toward $0.2882 and $0.3000, marking the next resistance zones aligned with Fibonacci extensions.

- Downside levels: $0.2480 and $0.2460 form the first key support band, backed by the 100-day EMA. A clear breakdown below this region could expose DOGE to $0.2408 and $0.2305, where the prior accumulation base and 23.6% retracement meet.

The 20-day and 50-day EMAs currently converge near $0.2500, signaling short-term equilibrium between buyers and sellers. The technical structure suggests DOGE is compressing within a narrow range, indicating possible volatility expansion in the next move.

Will Dogecoin Rally to $0.30?

The future of Dogecoin in October is determined by whether bulls will be capable of sustaining the price action beyond the area of above $0.2450 to 0.2460. Maintaining this base would strengthen the bullish bias and clear the way to another test of $0.2610 and $0.2737. Long-term closes above $0.2600 might invite a momentum breakout to the $0.30 target, where profit-taking can take place.

Related: Cardano Price Prediction: Hydra Node 1.0 Launch Sparks Fresh Optimism

On the other hand, falling beneath $0.2450 could tempt more profound corrections down to $0.2305 prior to possible accumulation reemerging. As the open interest creeps out of the market, beyond $4.4 billion and the market shows long-term holding by outflows, the market mood is cautiously optimistic. In the meantime, DOGE is in a critical crossroad where any breakout direction may determine its path throughout the month.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.