- Thinking Crypto podcast reveals five catalysts for upcoming Bitcoin surge.

- Stockmoney Lizards’ tweet predicts five crypto adoption cases in a year.

- The Bitcoin expert cited Crypto ETFs, Amazon and Ripple, X and the payment system, stablecoins and the hedge against inflation, and geopolitical uncertainty.

The Thinking Crypto podcast posted a new YouTube video on August 14, discussing five major catalysts for the upcoming Bitcoin run. The channel refers to Bitcoin expert Stockmoney Lizards’ tweet highlighting five use cases of BTC and crypto adoption in the next 12 months.

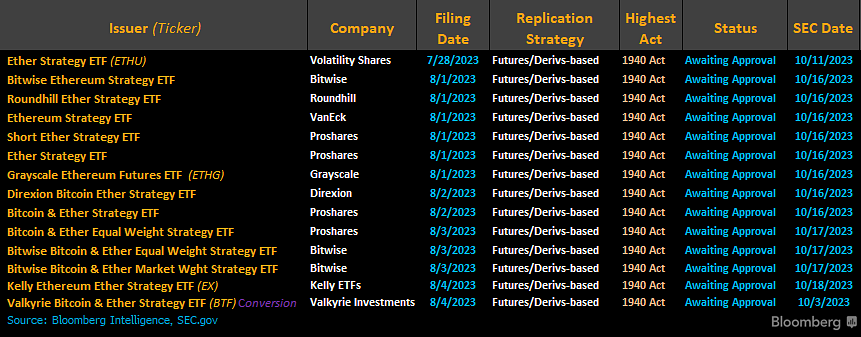

According to the Twitter user, crypto ETFs could trigger the first wave of mainstream crypto adoption. Stockmoney Lizards claims that financial giants such as BlackRock pushing crypto into the regular stock market can induce high prices due to “immense buying power.” Additionally, several BTC ETF applications will hear final decisions from the SEC in March 2024, right before April 2024’s Bitcoin halving.

On the other hand, Warren Jenson, Amazon’s CFO, has reportedly joined Ripple’s Board of Directors. Moreover, there’s speculation about Amazon introducing its first cryptocurrency product this year. Meanwhile, Ripple and XRP are already featured on Amazon’s official website, suggesting a major push toward crypto adoption from the e-commerce giant’s end.

Many users across Twitter have been speculating about a potential crypto integration for X, after the Ads Revenue Sharing feature was made live on July 28. Stockmoney Lizards shared a video where X founder Elon Musk committed to transforming the platform into the world’s leading financial system, fully embracing cryptocurrency as a crucial component. Hence, the BTC expert holds it as a major trigger for crypto adoption.

With rising inflation in countries including Turkey, Venezuela, and Argentina, there is a high demand for investment products that are not controlled by the local economies. Experts believe stablecoins would serve as a solution to the problem. However, traders are now questioning if the leading payment firm Paypal’s token is trustworthy.

Simultaneously, geopolitical uncertainty, such as the Ukraine war and the current Nigerian economic crisis, has been a testament to Bitcoin adoption, as per Stockmoney Lizards. “When the shit hits the fan, when we have crises in the world, Bitcoin is the store of choice,” notes the expert.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.