- Ethereum crashed to $3,681, triggering $884M in total liquidations; $764M were longs

- ETH price rebounded to $3,849 as funding rates turned negative, a historically bullish signal

- The Fusaka upgrade on Dec 3 provides a future catalyst, but CryptoQuant warns of more leverage

Ethereum fell sharply to $3,700 earlier today as fear gripped the broader crypto market. The drop was accompanied by massive liquidations over the past 24 hours with Fear & Greed Index slipping to 31.

At the time of writing, ETH trades at $3,849, rebounding from its daily low of $3,681.91. Prices have risen over 1.6% in the past 24 hours. Coinglass data shows $884.82 million in total liquidations over the same period, with $764.39 million in longs flushed out versus just $120.42 million in shorts.

Related: Ethereum Price Prediction: Traders Target Key Breakout as Futures Surge

Funding Rates Signal Panic; A Historically Bullish Setup

On-chain analytics firm Santiment stated that Ethereum’s funding rates have turned deeply negative across exchanges. Historically, similar conditions, when short positions dominate, have preceded price recoveries, as seen multiple times throughout September and October.

Santiment also added that when traders become overly greedy and long positions pile up, prices tend to correct. Conversely, when short interest spikes, Ethereum has often bounced shortly after. This current setup mirrors the latter scenario, with shorts climbing sharply as the market retreats to sub-$3,700 levels.

Long Liquidations Intensify as Leverage Unwinds

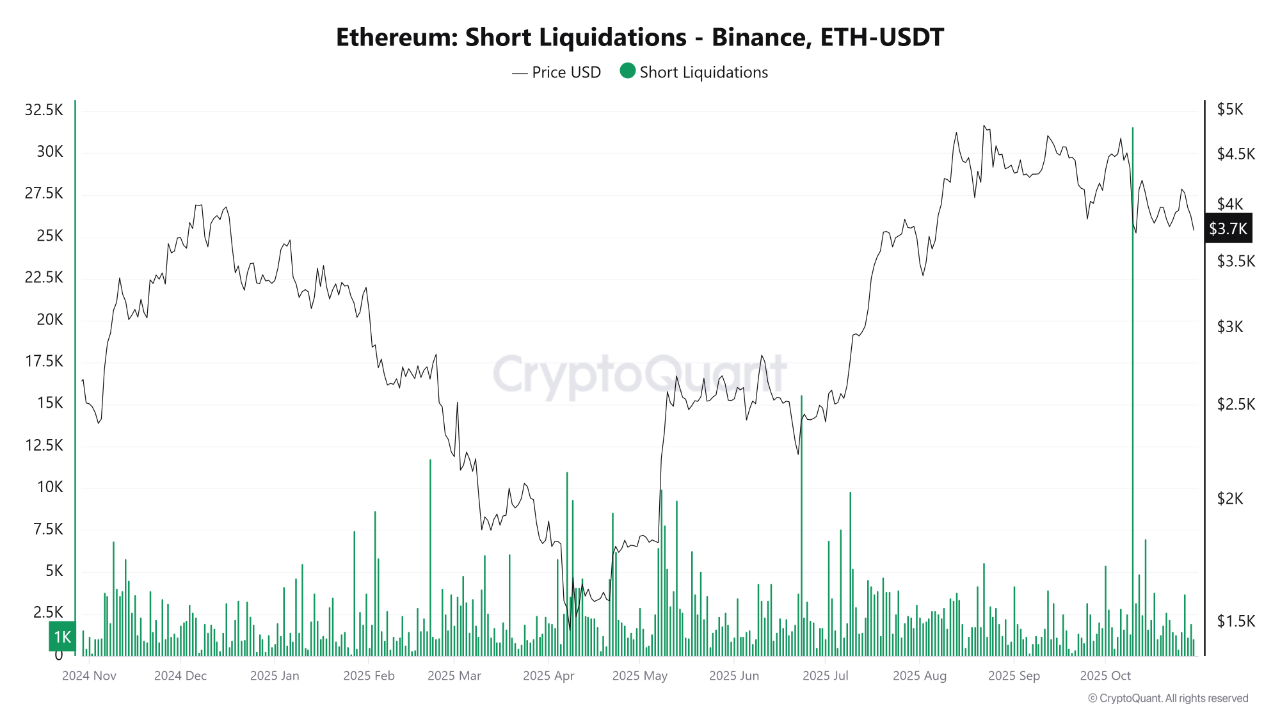

Data from CryptoQuant suggests that Ethereum’s correction could deepen further in the short term. Analysts noted that recent long liquidations have been larger and more frequent than short ones, reflecting an over-leveraged market still dominated by bullish bets.

Several high-volume liquidation spikes have triggered cascading sell-offs, accelerating pullbacks. Meanwhile, short liquidations remain far less severe, i.e., traders continue to lean heavily long.

Several high-volume liquidation spikes have triggered cascading sell-offs. The fact that short liquidations remain low suggests traders are still leaning heavily long. While the recent wave cleared many positions, continued long liquidations could push ETH toward new local lows, potentially testing the $3,400 support zone.

Fusaka Upgrade Brings Long-Term Optimism

Ethereum’s long-term outlook remains ideal with developers confirming that the network’s next major upgrade, Fusaka, will go live on December 3, following a successful final testnet run. The update aims to enhance scalability by optimizing data collection and verification from layer-2 chains.

Building upon the 2024 Dencun upgrade, which introduced temporary data “blobs” to reduce gas fees, Fusaka will expand blob capacity per block, enabling faster and cheaper transactions across Ethereum’s layer-2 ecosystem.

Related: Vitalik Buterin Reignites 51% Attack Debate, Clarifies What It Can and Can’t Do

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.