- Ethereum price battles $4,650 resistance while $4,500 acts as the key defense in the short-term range.

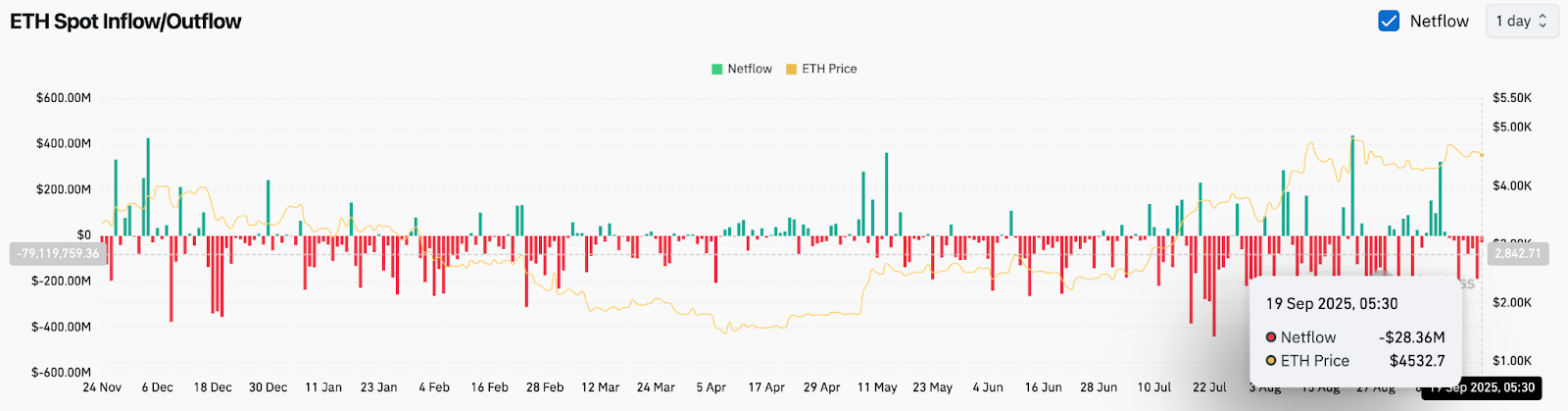

- On-chain data shows $28.36M outflows, reflecting cautious accumulation as traders await stronger conviction.

- Fusaka upgrade set for December 3 could double blob capacity and strengthen Ethereum’s scalability narrative.

Ethereum price today is trading near $4,533, slipping slightly after defending the $4,500 zone. The short-term battle centers on whether buyers can reclaim $4,650 resistance or if sellers will push ETH back toward deeper liquidity near $4,480.

Ethereum Price Holds Above Trendline Support

On the 4-hour chart, Ethereum continues to trade within a broader ascending structure. Price action has respected the rising trendline that began in early September, with the $4,500 level acting as a pivot zone. The 20-EMA sits at $4,531 while the 50-EMA provides reinforcement near $4,492, keeping immediate momentum in check.

Related: Bitcoin (BTC) Price Prediction For September 20

RSI is hovering around 52, reflecting neutral conditions after easing from overbought territory earlier in the week. The 200-EMA remains well below at $4,383, underlining that the broader bullish cycle is still intact despite recent consolidation. A clean breakout above $4,665 would confirm strength and open the door to higher levels.

On-Chain Flows Reflect Investor Caution

Exchange flow data shows that Ethereum recorded a $28.36 million net outflow on September 19. While outflows often suggest accumulation, the scale remains modest compared to the heavy inflows seen in July and August. Spot flows have lacked consistency, with alternating periods of accumulation and profit-taking.

This reflects cautious positioning among traders. Open interest has steadied, but futures flows have not shown aggressive bullish conviction. Without stronger inflows, Ethereum price action may continue to trade sideways, leaving $4,650 as the decisive ceiling.

Market Narratives Build Around Fusaka Upgrade

Ethereum’s fundamental story is gaining momentum with the upcoming Fusaka mainnet upgrade scheduled for December 3. The phased rollout through Holesky, Sepolia, and Hoodi testnets from October will prepare the network for higher data capacity.

Fusaka will double blob capacity through two BPO forks, enhancing throughput and laying the foundation for greater Layer-2 adoption. Analysts highlight that this upgrade strengthens Ethereum’s role as the leading settlement layer while addressing long-standing scalability concerns. If market sentiment ties this narrative to strong inflows, ETH could attract new liquidity into year-end.

Analysts Highlight Critical Levels

Market strategist Ted Pillows emphasized that Ethereum remains in consolidation below its major resistance. He noted that reclaiming $4,650 would likely trigger strong upside momentum, while losing $4,500 could accelerate volatility to the downside. The $4,220 zone stands out as the next defense if ETH breaks lower.

Related: Shiba Inu (SHIB) Price Prediction For September 19

This aligns with chart structures showing liquidity clusters at $4,488 and $4,383, which act as stepping stones before any deeper retracement. Conversely, if buyers regain momentum, upside levels extend toward $4,750 and $4,880.

Technical Outlook For Ethereum Price

Ethereum price prediction for the short term revolves around the $4,500–$4,650 range.

- Upside levels: $4,665, $4,750, and $4,880 if momentum strengthens.

- Downside levels: $4,500, $4,488, and $4,383 as immediate defenses.

- Trend support: $4,220 remains the deeper liquidity zone if sellers regain control.

Outlook: Will Ethereum Go Up?

Ethereum price action remains in a consolidation phase, with $4,650 resistance shaping the next decisive move. On-chain data shows only mild accumulation, but the Fusaka upgrade narrative could add long-term confidence.

As long as ETH holds above $4,500, analysts lean toward a bullish continuation. A decisive breakout above $4,665 could trigger momentum toward $4,750–$4,880, while losing $4,500 would likely delay the bullish thesis and shift focus to $4,383 and $4,220. For now, Ethereum remains balanced between cautious flows and a compelling upgrade narrative.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.