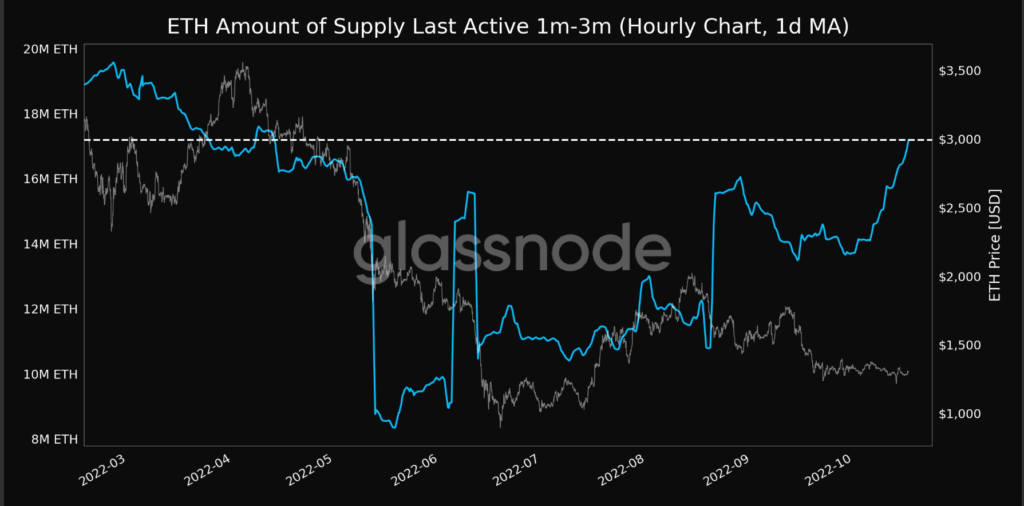

- Glassnode reported that ETH hit a 6-month high of $17M in the amount of supply.

- This was the amount last active on 1m-3m metrics (1d MA).

- Meanwhile, ETH’s price is relatively low between $1.3K and $1.4K.

Ethereum (ETH) showed an astronomical rise in the amount of supply last active, reaching a 6-month high of 17,186,333.998 ETH. Glassnode reported this rally based on the 1-day Moving Average (MA).

From the metrics above, the blue line represents the latest amount of ETH supply, which has reached over 17 million in the past 6 months. At this highest moment, ETH was trading between $1,300 and $1,400. However, it is a well-known fact that the price of a coin sheds when the amount of circulating supply increases. This has happened for ETH as there is a notable difference between 17 million supply and $1,300 on the graph.

Earlier in January 2022, ETH hit the highest amount of supply at nearly $19.5 million. During this period, the coin traded in a tight range of around $2,200. Contrastingly, in April 2022, when the price of ETH was near $3,500, its amount of supply was relatively low at $16.3 million.

Meanwhile, in another on-chain report, glassnode alerts tweeted that, on 7-day MA, the number of transactions for ETH reached a 1-month low of 43,284.917.

However, despite ETH’s price standing low compared to its high amount of supply, the coin signaled a 2.08% hike in the past 24 hours. Currently, ETH trades at $1,309.6. Nevertheless, the coin should look at $1342 as its next challenging level. Also, this level can be considered the nearest resistance zone.

Additionally, if the 50-day EMA line touches the current green candle of the coin, the price could be expected to take another hike or dip. Major coins, including Bitcoin, have signaled green in the past 24 hours, but the weekly performance of the coins has precipitated, specifically due to a red day on October 13.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.