- Ethereum consolidates near $4,116, signaling short-term recovery and bullish potential.

- Surging futures open interest and exchange activity point to rising market engagement.

- Security focus persists as 51% attack risks emphasize decentralization importance.

Ethereum is showing renewed bullish energy after rebounding from the $3,435 low. The cryptocurrency now trades near $4,116, where price consolidation signals a pause before potential continuation.

Market analysts observe that the current pattern reflects a short-term recovery that could evolve into a broader expansion phase if key resistance levels are cleared. Consequently, Ethereum’s rising open interest and growing exchange activity point toward increased market engagement from both institutional and retail traders.

Fibonacci and EMA Levels Define the Next Direction

Ethereum’s latest rally has seen it reclaim the 0.5 Fibonacci retracement level at $4,099, turning it into immediate support. The next major resistance lies near the 0.618 retracement around $4,255, a confluence zone with the 200-EMA. A breakout above this region could unlock a path toward $4,478, the 0.786 retracement target. However, a close below $4,099 could expose downside pressure toward $3,948.

Besides, the alignment of the 20-, 50-, 100-, and 200-EMAs reinforces a strengthening trend. Price remains above all short-term moving averages, with the 50-EMA at $4,077 acting as a key pivot.

Related: XRP Price Prediction: $60M Outflows and $1B Treasury Push XRP Toward Key Breakout

Sustained closes above the 200-EMA at $4,103 would likely confirm a move toward the $4,250–$4,300 zone. The current market setup suggests that bulls are gradually regaining control, but resistance remains firm.

Derivatives and On-Chain Activity Support Positive Outlook

Ethereum futures open interest has surged to $49.24 billion, the highest level since mid-2025. This sharp rise signals growing trader participation and capital inflows into derivatives markets.

Elevated open interest often precedes major volatility spikes, hinting that market participants expect a decisive breakout soon. Moreover, the trend mirrors the strong sentiment seen across leading altcoins, reinforcing Ethereum’s pivotal role in the broader recovery.

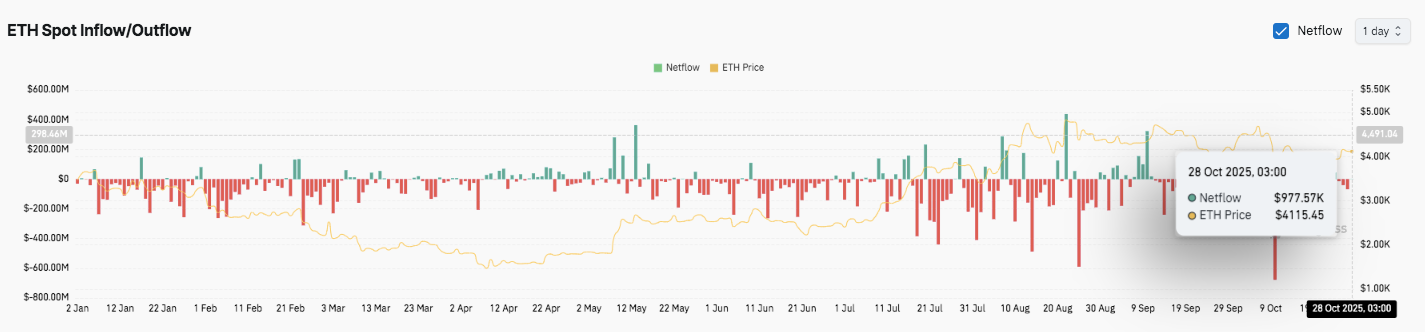

Additionally, on-chain data reveals persistent exchange outflows throughout 2025, reflecting investors’ preference for self-custody during market consolidations. While outflows dominated, brief inflow spikes in May, July, and September showed selective accumulation.

Recently, Ethereum recorded a modest positive netflow of $977,000, suggesting renewed confidence as price stabilized near $4,115. This subtle shift hints at a cautious accumulation phase that could precede a stronger move upward.

Security Debate Returns to Spotlight

Separately, Ethereum’s co-founder reignited debate over blockchain security by revisiting the implications of 51% attacks. He emphasized that while validators can collude to disrupt network consensus, they cannot alter valid blockchain history or seize assets.

His remarks underline the ongoing need for decentralization and trust minimization within proof-of-stake systems. Hence, even as Ethereum’s price shows resilience, the discussion highlights that security remains equally crucial for long-term sustainability.

Technical Outlook for Ethereum Price

Key levels remain clearly defined as Ethereum trades near $4,116, holding firm after a strong recovery from the $3,435 low. Upside targets include $4,255 (0.618 Fibonacci) and $4,478 (0.786 level), both acting as critical resistance zones. A breakout above $4,255 could pave the way toward $4,500 and potentially $4,700 if momentum builds.

Related: Chainlink Price Prediction: Whales Accumulate as LINK Eyes a Bullish Reversal

On the downside, initial support lies around $4,099 (0.5 Fibonacci) followed by $4,030 and $3,948, where buyers previously defended the trend. The 200-EMA near $4,103 forms the key pivot area, with sustained closes above it likely confirming continuation toward higher targets.

The technical setup shows Ethereum consolidating within a tightening range, suggesting volatility compression before expansion. Hence, a decisive breakout above $4,255 may trigger a strong rally, while failure to hold $4,099 could invite short-term correction.

Is Ethereum Preparing for Another Leg Higher?

Ethereum’s outlook for late October depends on whether buyers maintain control above the $4,099–$4,070 zone. Increasing open interest and minor inflows hint at growing confidence among traders. If bullish volume expands, ETH could retest $4,255 and extend toward $4,478.

However, rejection from resistance may lead to range-bound movement before a larger directional shift. For now, Ethereum remains in a pivotal phase where sustained strength above the 200-EMA could define the next major move.

Related: Hedera Price Prediction: HBAR Gains Investor Momentum as ETF Launch Nears

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.