- Chainalysis’ latest Global Crypto Adoption Index does not contain any EU nations in the top 20.

- The top 10 list in the index is dominated by Central and South Asian nations, including India and Vietnam.

- The regulatory reform in the European Union appears to have had little impact on crypto adoption.

Crypto intelligence firm Chainalysis recently published the 2023 Global Crypto Adoption Index, which showed that Central and South Asia topped the list in terms of crypto adoption. Meanwhile, nations from the European Union (EU) failed to break into the top 20 list, despite the recent regulatory reforms, including Markets in Crypto Assets (MiCA) regulations.

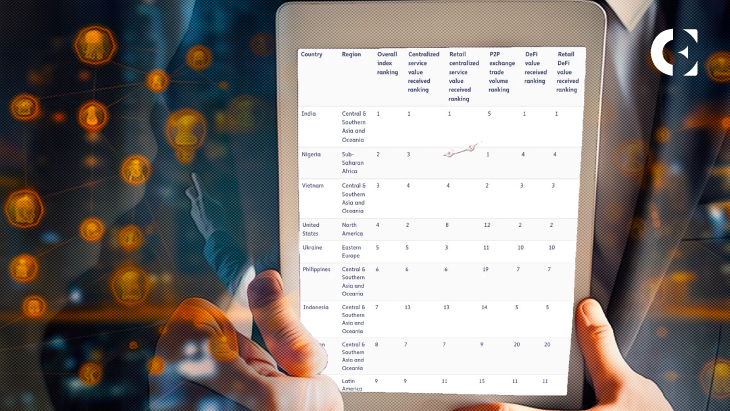

According to Chainalysis’ latest crypto adoption report, India took the top spot with a global crypto adoption index score of 1. Nigeria came in at number 2, with an index score of 0.6, followed by Vietnam, which had an index score of 0.5. Other nations in the top 10 included the United States, Ukraine, Thailand, Brazil, Indonesia, and the Philippines.

The Chainalysis report was compiled using five sub-indexes, each of which was based on countries’ usage of different types of crypto services. The sub-indexes were: On-chain cryptocurrency value and on-chain retail value received at centralized exchanges, weighted by purchasing power parity (PPP) per capita; peer-to-peer (P2P) exchange trade volume; on-chain cryptocurrency value; and on-chain retail value received from DeFi protocols.

Patrick Hansen, the director of EU Strategy and Policy for Circle, a financial services company, took to X (formerly Twitter) earlier today to highlight that not a single EU nation had made it into the top 20 list. He further pointed out that the top 10 list was dominated by Asian countries.

Hansen told his followers that the EU’s efforts towards setting up a comprehensive regulatory framework for crypto had failed to spur crypto adoption in the region. “We have regulatory clarity, but so far, sub-average adoption. It will be interesting to see how this evolves in the years post-MiCA,” the Circle executive added.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.