- The Finance Minister of India has emphasized the need for proper regulation and government backing in the digital currency market.

- The Reserve Bank of India is testing its retail and wholesale CBDC for cross-border payments.

- India plans to introduce cryptocurrency and AI lessons in schools to prepare students for the digital world.

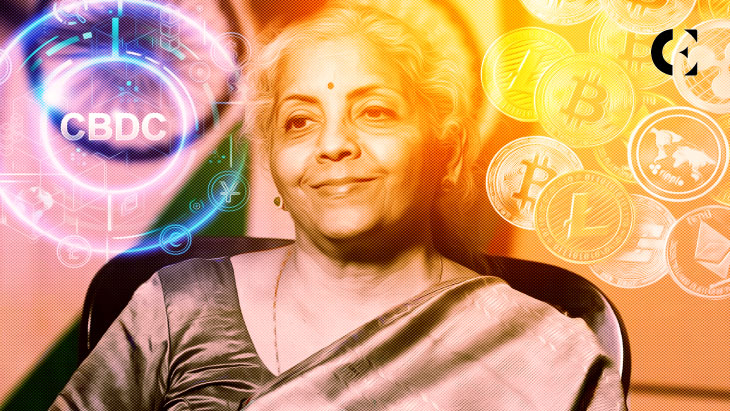

In a recent event in Bengaluru, India, the Finance Minister of India, Smt. Nirmala Sitharaman has declared that India is not against financial technology but emphasized that when it comes to digital currency, it must be backed by either the government or the central bank. According to the Finance Minister, without their guidance, there is a risk of events like FTX, which caused massive spillover effects worldwide.

Sitharaman pointed out that India was an early adopter of digital currency. The Reserve Bank of India has been testing its retail and wholesale CBDC to facilitate cross-border payments in bulk. While the digital currency has much potential, she warned that the technology must be used cautiously and responsibly and only under proper regulation.

The Finance Minister stressed that digital currency technology has many other applications beyond just currency, and India should take advantage of this to promote collective benefit. She added that the government or central bank must take the lead to ensure the stability and security of the digital currency market.

India is still catching up as the world continues to experience the digital revolution. However, the country is allegedly taking a cautious and measured approach to digital currency to avoid the pitfalls of unregulated markets. According to cryptocurrency proponents, other countries need to take a cue from India and regulate the digital currency market to prevent the chaos witnessed in the past.

The South Asian country also plans to introduce lessons on cryptocurrency and artificial intelligence in some school curriculums starting next academic year. The move aims to prepare students for the digital world and keep up with technological advancements.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.