- Indian Finance Minister called for a coordinated global policy response to regulate crypto.

- Sitharaman made the remarks during a session with G20 finance ministers at the IMF’s headquarters.

- It aims to develop a common framework for all countries to deal with crypto risks.

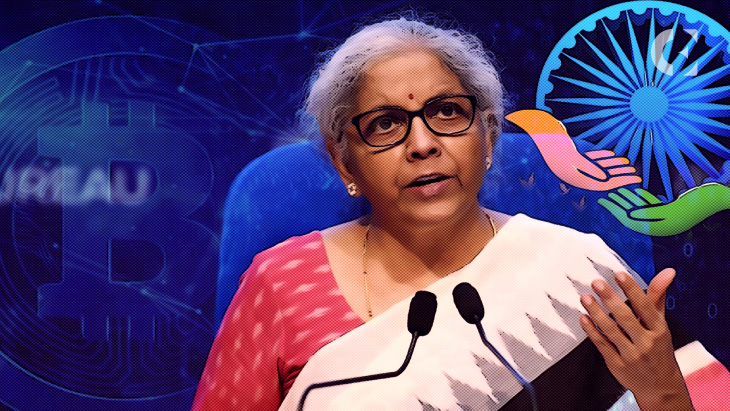

The Indian Union Finance Minister Nirmala Sitharaman has called for immediate attention to issues related to crypto assets, stating that a globally coordinated policy response is necessary to regulate the sector while protecting economies from harm.

Sitharaman made the remarks during a brainstorming session on ‘Macrofinancial Implications of Crypto Assets’ with G20 finance ministers and central bank governors at the IMF’s headquarters on Friday.

Global experts on the issue attended the session, and there was unanimity among member nations about the urgency to regulate the crypto industry. Sitharaman noted that the G20 acknowledges the work of the International Monetary Fund (IMF) and the Financial Stability Board (FSB) in bringing out key policy and regulatory framework elements.

A synthesis paper is required to integrate macroeconomic and regulatory perspectives of crypto assets. The minister noted that there was consensus among G20 members to have a globally coordinated policy response on crypto assets considering the full range of risks.

Notably, India hopes to broaden the G20 discussion on crypto assets beyond financial integrity concerns and capture the macroeconomic implications and widespread crypto adoption in the economy.

According to a local report, global standard-setting bodies are coordinating the regulatory agenda while working within their respective institutional mandates. It includes the FSB, Financial Action Task Force (FATF), Committee on Payments and Market Infrastructures (CPMI), International Organization of Securities Commissions (IOSCO), and Basel Committee on Banking Supervision (BCBS),

The FSB’s paper on crypto assets regulation will be tabled in July, and the IMF-FSB synthesis paper will be submitted in September. The aim is to develop a common framework for all countries to deal with cryptocurrency risks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.