Introduction

In the fast-paced world of cryptocurrency, finding an exchange that strikes the balance between user-friendly simplicity and cutting-edge functionality is a pursuit valued by many. Enter FixedFloat, a fully automated cryptocurrency exchange with a mission to simplify crypto exchange through practical solutions, catering to users’ needs.

This FixedFloat Exchange Review 2024 delves into the distinctive features that set FixedFloat apart, its journey through the years, and the array of benefits it offers for an overall user experience.

Table of contents

FixedFloat Overview

FixedFloat is a fully automated cryptocurrency exchange that offers users a simplified approach to exchanging cryptocurrencies. It stands out for its non-custodial nature, eliminating the need for users to go through registration or KYC checks. Moreover, its integration with the Lightning Network enhances the speed of Bitcoin transactions.

The exchange also boasts the lowest and best rates in the market. Notably, FixedFloat facilitates cryptocurrency swaps with fixed or floating rates. Fixed rates ensure the displayed cryptocurrency amount remains unchanged, while float rates dynamically adapt to market fluctuations.

FixedFloat supports a variety of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Cardano, and is actively expanding its portfolio. Users can also perform automatic exchanges quickly on different devices.

Overall, Fixedfloat is known for its user-friendly interface, transparency, competitive fees, and lack of KYC requirements. The platform emphasizes advantages like strategy options for profitable exchange, secure transactions, and automated exchanges.

FixedFloat Crypto Exchange Details

| Website | https://fixedfloat.com/ |

| Native token | None |

| Number of orders completed | 1M+ |

| Number of regular customers daily | 1,000+ |

| Number of new customers daily | 5,000+ |

| Number of supported cryptocurrencies | 60+ |

| Available on mobile | Under development |

| Year founded | 2018 |

History Overview

Established in 2018, FixedFloat carved its niche as a Lightning Crypto Exchange, harnessing the power of automation and integration with the Lightning Network. This network allows users to transact outside the main blockchain, enhancing the speed and reducing fees.

Celebrating its fourth anniversary in 2022, FixedFloat boasted impressive statistics: over a million completed orders, a regular daily influx of more than 1,000 loyal customers, and the trust of over 5,000 new visitors daily. Additionally, it remained committed to the Lightning Network, actively engaging with the cryptocurrency community and even sponsoring a Monero fan gathering.

Platform Interface

Navigating the FixedFloat platform is remarkably user-friendly, catering to both beginners and experts in the crypto space. A distinctive advantage lies in its approach to convenience.

Users can create orders on the website by simply selecting the currencies they want to exchange, choosing a rate type, and entering the desired amount. This beginner-friendly approach is complemented by allowing users to choose between scanning a QR code or providing a wallet address to exchange in the platform swiftly.

Recently, the platform has completed a significant website redesign that showcases a modern user interface for easy navigation on all devices. In addition, Fixedfloat expanded its language support to better serve its clients. The platform now supports 12 languages, including Turkish, Ukrainian, Polish, Dutch, Simplified Chinese, and Italian languages, with plans to add Japanese, Korean, Arabic (UAE), and Hebrew soon.

Key Features and Functions

FixedFloat shines with a suite of features designed to facilitate effortless exchanges:

- Favorable fixed and floating exchange rates

- Some of the lowest fees in the crypto market

- Transparent pricing with no hidden charges

- An intuitive and user-centric interface

- Hassle-free network confirmations

- No obligatory KYC requirements

- Multi-language support

- Round-the-clock dedicated customer service

Supported Cryptocurrencies

FixedFloat currently supports an impressive array of 68 cryptocurrencies, spanning major players like Cardano (ADA), Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Solana (SOL). The platform remains committed to expanding its portfolio, evident through recent additions like Solana and Avalanche, reflecting its responsiveness to the ever-evolving digital landscape.

Services

Instant Crypto Exchange

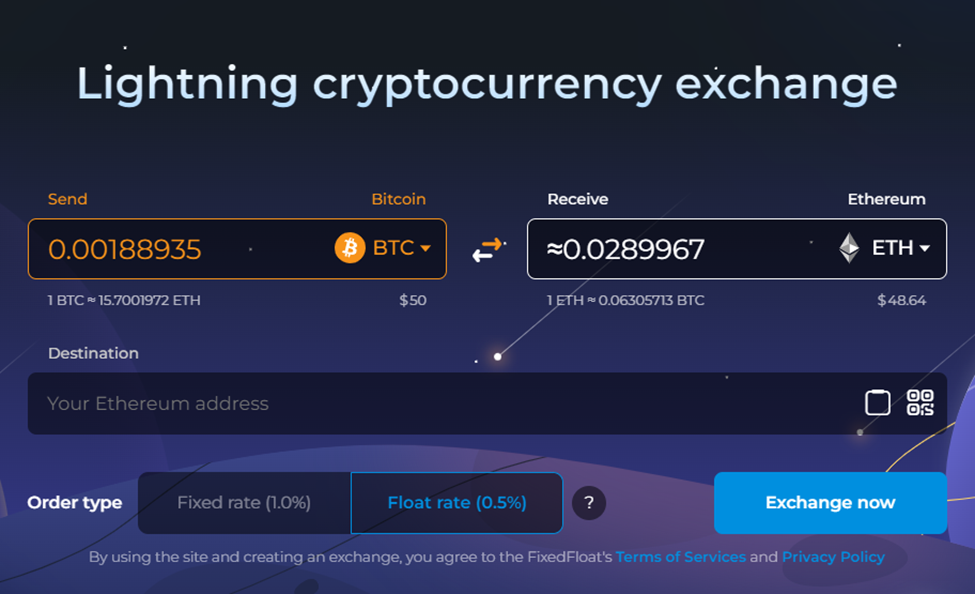

FixedFloat, as a fully automated crypto exchange, provides a streamlined process for swiftly swapping one cryptocurrency for another, with prompt fund withdrawal post-exchange.

The first step involves creating an order, wherein the user selects the cryptocurrency they intend to exchange, the currency they wish to receive, and the desired amount. The user will then provide the receiving address by typing, simply pasting it from the wallet, or scanning the QR code.

For a tailored experience, FixedFloat offers a choice between a float rate type (based on market rate) and a fixed rate type (ensuring an exact amount). Once all necessary parameters are set, users can proceed by clicking “Exchange now,” effectively initiating a new order. The subsequent page offers comprehensive insights into the order, including details on fund transfers.

Once the transaction is visible on the blockchain network, the order is automatically completed. This process is expedited once the required number of network confirmations is received, ensuring efficiency and reliability.

FixedFloat API

The FixedFloat API is a newly redesigned service that provides users with the ability to automate the process of receiving exchange rate information, creating orders, and managing transactions.

This API update includes comprehensive documentation, ready-made libraries for code reuse, and the option to earn profits from exchanges without participating in the affiliate program.

Affiliate Program

Fixedfloat also offers users a chance to earn profits through referrals. The affiliate program allows participants to register and earn 40% of the profits from exchanges made by their referred customers.

Transaction Fees

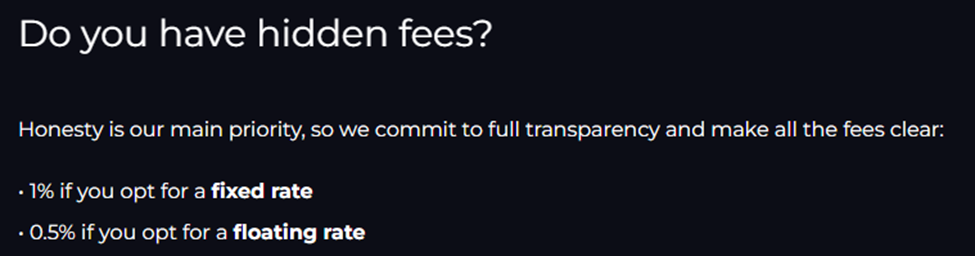

FixedFloat’s fee structure depends on two exchange strategies: fixed rate and float rate. Each strategy entails three distinct fees: FixedFloat service fee, miner fee, and consolidation fee.

- FixedFloat fee: This fee is 1% for the fixed rate or 0.5% for the floating rate. When opting for a fixed rate, which stays locked for 10 minutes, the fee is 1% of the transaction amount. With a floating rate, the fee is 0.5% of the amount until the transaction receives the necessary blockchain confirmations.

- Miner fee for a sent transaction: This fee covers the cost of miners processing the transaction. It applies to actions like fund transfers, smart contract functions, and token transfers.

- Consolidation fee for an accepted transaction: This fee relates to consolidating funds at a single address, helping reduce fees for future transactions. For example, in the Bitcoin network, one fee applies to consolidation, and in the Ethereum network, it’s for resending funds to the main address.

Security and Transparency

FixedFloat prioritizes security through its decentralized nature. Transactions occur directly between users, eliminating the need for intermediaries or third-party agents. This transparency ensures that exchanges are secure and private.

Remarkably, FixedFloat is non-custodial and, hence, does not store user deposits, minimizing the risk of losing assets from cyber attacks. To ensure users are in control of their transactions, the platform facilitates order tracking through various means, such as by email, website, and order links.

Moreover, the platform’s transparency is evident in its fee structure, with no hidden commissions.

KYC Process

One of FixedFloat’s standout features is its lack of enforced know-your-customer (KYC) compliance requirements. This unique approach appeals to those valuing personal data protection, expedited onboarding, reduced security risks, and philosophical alignment.

Unlike other exchanges, FixedFloat allows users to access the platform without requiring them to log in or register. However, if users want to have access to the history of their orders, they need to log in to their accounts.

Mobile Application

Part of FixedFloat’s plan this year is to enhance its services with the upcoming launch of a new mobile application. This move will provide users with more convenient access to the cryptocurrency exchange services.

Customer Support

To provide exceptional user experiences, FixedFloat offers 24/7 customer support through multiple channels, including live chat, Telegram, Twitter, and email.

Pros and Cons

Here are some of the pros and cons of using FixedFloat:

| Pros | Cons |

| User-friendly interface | No NFT marketplace |

| No KYC | Limited selection of cryptocurrencies |

| Fast exchange | No fiat currencies |

| Favorable exchange rates | |

| Low fees |

Final Score

| Services offered | 4 |

| Cryptocurrency support | 4 |

| Fees | 4 |

| Security | 4 |

| Review Score | 4 |

Summary

FixedFloat is a standout cryptocurrency exchange that combines user-friendly accessibility with advanced features. Its non-custodial approach and no KYC checks prioritize user security and control. With flexible and competitive rates, minimal fees, transparent pricing, and easy network confirmations, FixedFloat stands as a reliable choice. The platform also features an affiliate program and offers 24/7 customer support. Overall, FixedFloat is praised for its reliability, security, and commitment to user convenience.

FAQs

No, FixedFloat doesn’t require mandatory KYC compliance, offering a privacy-friendly option for users.

Fixed rates keep the displayed crypto amount unchanged, while float rates adjust based on market changes.

FixedFloat supports over 60 cryptocurrencies, including Bitcoin, Ethereum, and Cardano, with more being added over time.

Yes, there are fees, including a service fee (1% for fixed rate, 0.5% for float rate), a miner fee, and a consolidation fee. These ensure efficient and reliable transactions.

Yes, FixedFloat provides 24/7 customer support through various channels like live chat, Telegram, Twitter, and email.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.