- FTX and Alameda wallets transferred approximately $1.36 million worth of Ethereum to Wintermute.

- An Alameda wallet transferred $26.8 million worth of Ethereum to another Alameda wallet.

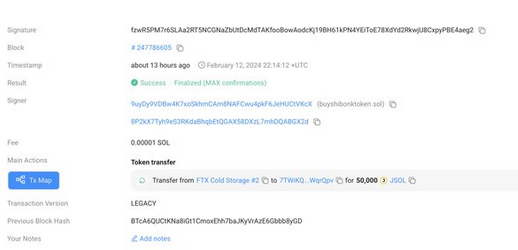

- FTX Cold Storage #2 transferred $6.6 million worth of JSOL to an unknown wallet.

Blockchain security firm PeckShield issued alerts on Tuesday, February 13, regarding several transfers from wallets associated with the now-bankrupt cryptocurrency exchange FTX and its trading firm Alameda Research.

The first alert includes a transfer of 542 ETH (worth approximately $1.36 million) from the wallets of FTX-owned Alameda Research to Wintermute. Wintermute is a market-making firm that provides liquidity to cryptocurrency exchanges. The purpose of this transfer is unclear.

The second alert concerned an internal transfer of 10.7K ETH (worth around $26.8 million) from one Alameda wallet to another. The reason for this transfer is also unknown.

The third alert reported that an address labeled as “FTX Cold Storage #2” transferred 50K JSOL (worth approximately $6.6 million) to an unknown wallet. JSOL is the native token of JPool, a liquidity pool on the Solana blockchain. The destination of this transfer, however, is unknown.

These transfers come at a time of heightened scrutiny for FTX and Alameda, following the collapse of FTX in November 2022. The company is under investigation by the U.S. Securities and Exchange Commission (SEC) and other regulatory bodies.

The cryptocurrency market experienced a significant rise of 11%, reaching a total value of $1.82 trillion. This growth was primarily driven by a surge in Bitcoin (BTC) and strong contributions from alternative currencies like Solana (SOL). Bitcoin overcame a key resistance level of $43,000 and now targets the $50,000 mark, adding a substantial $108.4 billion to its market cap within a week (a 13% increase).

Solana (SOL) benefited from the positive market sentiment, achieving six consecutive days of gains. Despite a temporary network issue that paused transactions, Solana swiftly recovered, surpassing both the $100 and $112 marks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.