- The accumulation of BTC shrimps and crabs has reached all-time highs.

- BTC crabs have increased their holdings by 191.6k BTC over the last thirty days.

- The king coin is currently trading at $16,213.67 after a 2.11% drop in price.

A Tweet made by the blockchain analysis firm Glassnode shared some insights into the accumulation of Bitcoin (BTC) by three types of holders: shrimps, crabs, and whales.

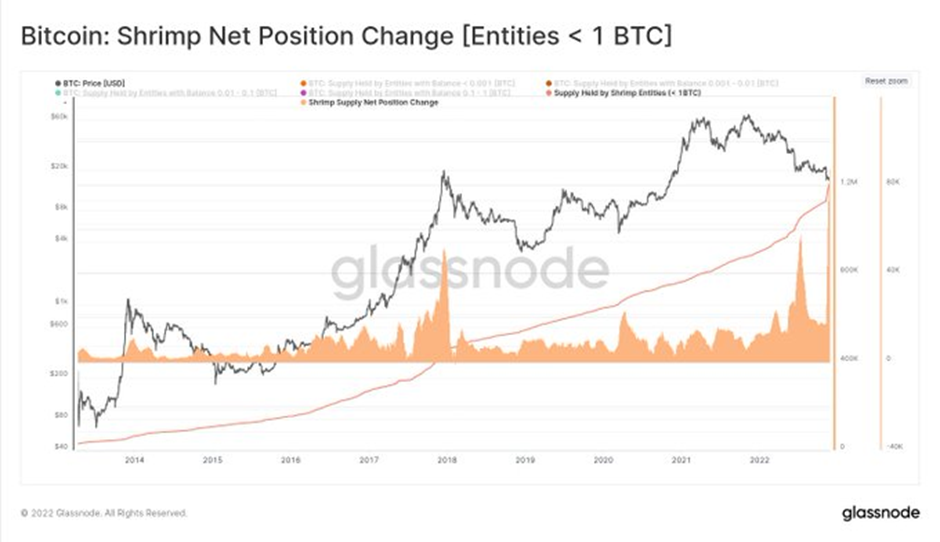

According to the post, the accumulation of shrimps (less than 1 BTC), and crabs (up to 10 BTC), has reached all-time highs. Shrimps have added 96.2k BTC since FTX collapsed. This group of holders now possesses over 1.21 million BTC, which is equivalent to 6.3% of the circulating supply.

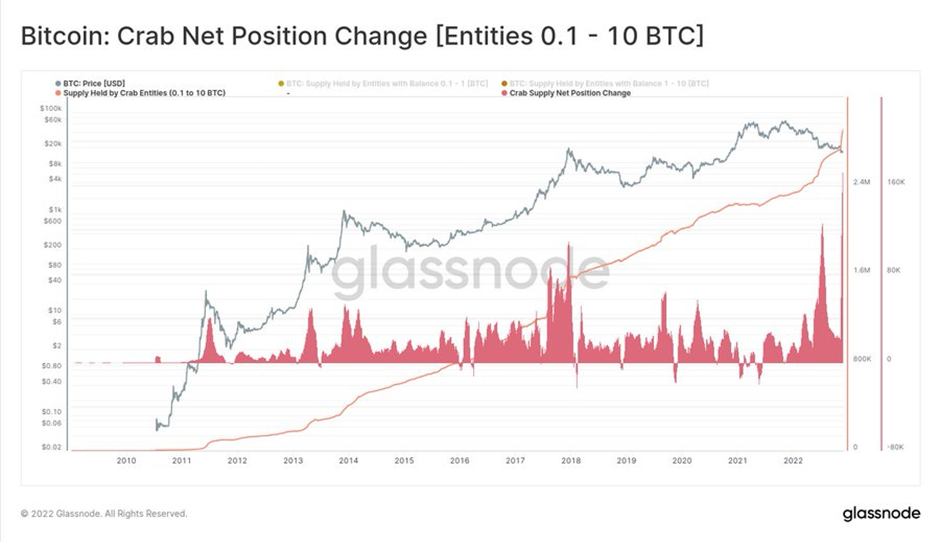

Meanwhile, BTC crabs have increased their holdings by 191.6k BTC over the last thirty days. This aggressive accumulation trumps the July 2022 peak of 126k BTC in a month.

On the other hand, whales have been lightening their BTC holdings. According to Glassnode’s data, whales have released approximately 6.5k BTC on net over the last month. Although this is distribution, the amount of BTC released by whales is still dwarfed in comparison to their total holdings of 6.3 million BTC.

According to CoinMarketCap, BTC is currently trading at $16,213.67 after a 2.11% drop in price over the last 24 hours. The crypto market leader is still, however, in the green by more than 1% over the last week.

BTC was also able to strengthen against its biggest competitor in the market, Ethereum (ETH) by about 1.66% over the last day.

BTC’s 24-hour trading volume is also in the green today and now stands at $24,767,711,120 after a more than 34% increase.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.