- Analysts at Goldman Sachs believe that the UK will enter a recession in the fourth quarter of 2022.

- The most likely cause for the recession to happen is consumer price inflation.

- The UK’s interest rates are at their highest since 2008.

Analysts at Goldman Sachs forecast that the UK will enter a recession in the fourth quarter of 2022. The Bank of England also believes this to be true as it issued a new Monetary Policy report with revised forecasts for inflation.

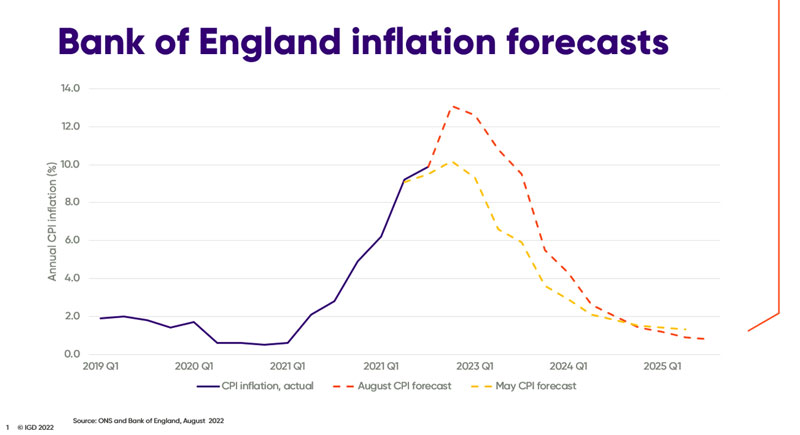

The inflation will most likely happen due to consumer price inflation driven by price increases in energy, food, and physical goods. The inflation rate for these goods hit 9.4% in June, 2022, and is expected to peak at 13.3% in Q4.

This is a significant increase when compared to the bank’s previous prediction of 10% for Q4. The change in the prediction is mostly due to the expected increase in the energy price cap. Analysts believe that the energy price cap in the UK could rise by more than 70% in October.

Additionally, inflation is expected to persist for much longer than previously forecasted. Inflation in Q3 of 2023 is expected to remain very high at 9.5%, which is a 3.6% increase from the Bank’s previous forecast.

Currently, the Bank of England expects inflation to trail off back to its 2% target by the end of 2024, without taking into account any global events that could have an effect on this prediction.

At the moment, the UK’s interest rates are at their highest since 2008, and are expected to rise even more in order to curb inflation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.