- High-rated NFTs were reportedly moved to Gnosis Safe address.

- NFT tracker Nansen reported that Starry Night Capital’s collections were also moved to the address.

- Several other NFTs by digital artist, XCOPY were also liquidated to the Safe address.

Crypto and NFT insight provider Nansen reported that the NFTs gathered by Starry Night Capital had been moved to a Gnosis Safe address. Notably, over 300 NFTs had been locomoted to the address, including Pepe the Frog NFT Genesis and Fidenza #718.

Starry Night Capital is an NFT fund backed by Three Arrows Capital (3AC), whereas, Gnosis Safe is a platform to manage digital assets on Ethereum.

NFTs previously collected by Starry Night Capital are moving to a Gnosis Safe address.

These NFTs include:

– Pepe the Frog NFT Genesis, sold for 1,000 ETH (~$3.5M) on Oct 5, 2021

– Fidenza #718, sold for 240 ETH (~$1.1M) on Nov 13, 2021Some other notable NFTs below👇 pic.twitter.com/8PU13CqMnn

— Nansen 🧭 (@nansen_ai) October 4, 2022

Furthermore, in a string of Twitter posts, Nansen tweeted that several other NFTs by XCOPY, a London-based unknown digital artist, was also moved to the Gnosis Safe address. This includes Some Other Asshole, DANKRUPT, and DECAY. These three NFTs were sold for 550 ETH, 469 ETH, and 345.69 ETH, respectively.

Adding on, AI prodigy artist Robbie Barrat’s AI-Generated Nude Portrait #7 Frame #184 was also sold for 300 ETH, which is worth $1.1 million. CrypToadz #5634, Meridian #684, and Pudgy Penguin #6869 are the remaining NFTs that were moved to the Gnosis Safe address.

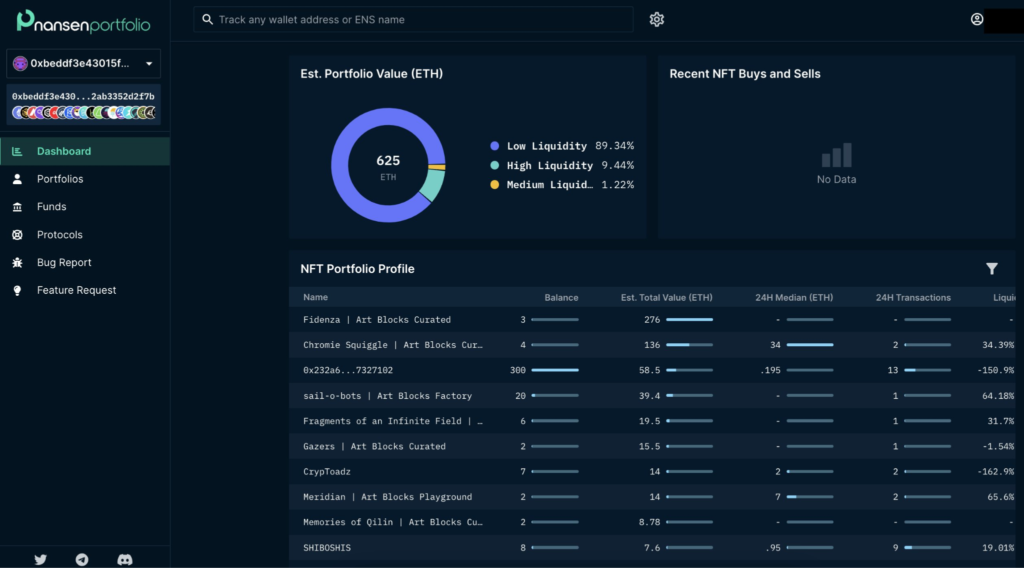

Importantly, all these aforementioned NFTs were moved to the address in 2021. As clear from the data above, the current estimated “portfolio value of the Gnosis Safe is 625 ETH”, where 89% of the NFTs have low liquidity and 9.44% of NFTs have high liquidity.

For the uninitiated, 3AC executives Kyle Davies and Su Zhu, and NFT artist Vincent Van Dough are the co-founders of Starry Night Capital. Earlier in May 2022, the crypto market tumbled down due to, one of the reported reasons being the fall of 3AC. However, it is in the midst of the bankruptcy proceedings, the Starry Night Capital NFTs moved from the 3AC wallet to theGnosis Safe address.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.