- HT and CHSB might be looking at a price drop soon.

- CHSB’s price is already dropping as it is down more than 3% today.

- HT investors may need to prepare for a retracement as the $8.00 approaches.

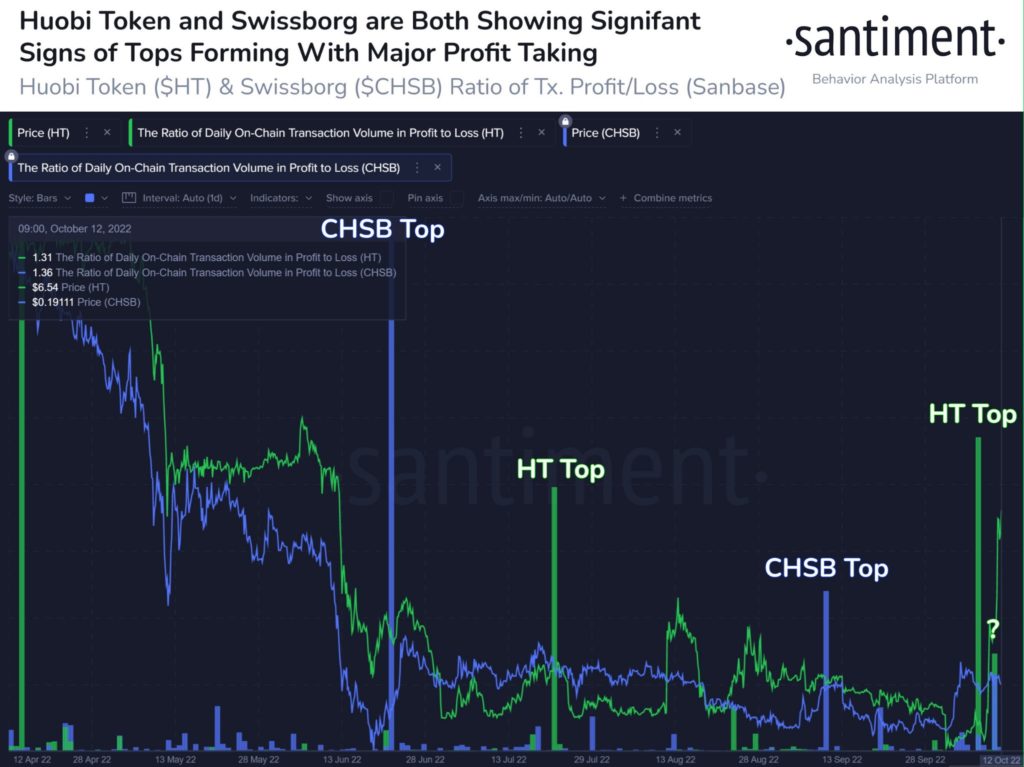

On October 12, the market intelligence firm Santiment took to Twitter to share some information about what two cryptocurrencies, Huobi Token (HT) and Swissborg (CHSB), have been doing over the last few days.

According to the post, price assets tend to drop when significantly high ratios of on-chain profit transactions are forming. Historically, it is evident that this is the case when it comes to HT and CHSB. At the moment, both of these cryptos are seeing large spikes in their price.

Data from CoinMarketCap indicates that CHSB is currently trading at $0.1901 after a 3.30% drop in price over the last day. HT is already up 12% for the day so far and the crypto is more than 70% in the green over the last week.

From a technical perspective, we see the daily chart for HT/USDT shows that the price of HT has exploded past the daily 9 and 20 EMA lines, and it now looks to challenge the resistance at around $8.00. There may be some momentum left as the RSI line is sloped positively and is positioned bullishly above the RSI SMA line.

In addition, the 9 EMA has crossed above the 20 EMA line, which is another bullish flag. This indicates that HT has entered into a short-term bullish cycle. Investors and traders may need to prepare for a retracement as the $8.00 approaches.

CHSB double-tapped the resistance level at $0.2 over the last week as it was unable to break past this level. Other than that, trading volume for the token has been very low as it now seems to be entering into a consolidation pattern.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.