- Lingering uncertainties still surround Hong Kong’s crypto regulations.

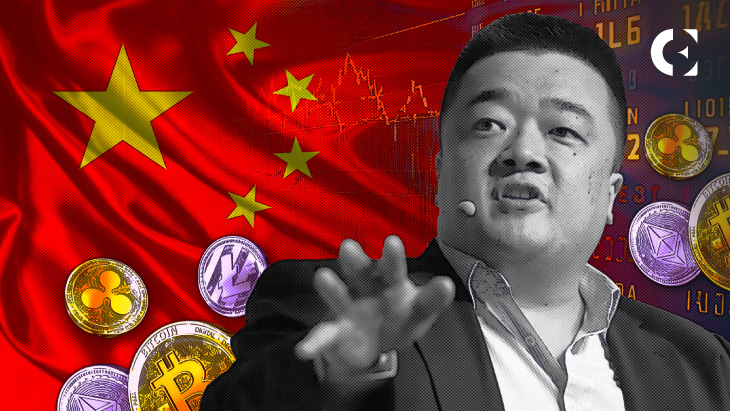

- Entrepreneur Bobby Lee warns of Hong Kong’s faltering commitment to the crypto industry.

- Lee pioneered China’s first Bitcoin exchange but was forced to close it.

In a recent warning to the crypto community, renowned entrepreneur Bobby Lee raised concerns about Hong Kong’s (HK) long-term commitment to crypto, casting doubt on the country’s digital asset ambitions.

Lee, who experienced firsthand the disruptive effects of regulatory crackdowns in China, believes his story serves as a cautionary tale for firms lured by Hong Kong’s ambition to become a prominent digital-asset hub.

Despite Hong Kong’s current efforts to introduce new regulations for the crypto sector, Lee suggests that the city may not sustain its focus on crypto in the long run. Notably, Lee pioneered China’s first Bitcoin (BTC) exchange, only to see it forced to close due to Beijing’s regulatory measures.

Following the closure of his Chinese exchange, Lee went on to establish Ballet Global Inc., a crypto storage provider based in the United States. Given his experience in the crypto industry, Lee urges caution to firms enticed by Hong Kong’s apparent enthusiasm for digital assets.

The Bloomberg report also noted that while Hong Kong aims to foster an environment conducive to crypto innovation, some experts agree with Lee that there are lingering uncertainties surrounding the city’s crypto regulations.

Recently, Eddie Yue, the visionary CEO of the Hong Kong Monetary Authority, shed light on the upcoming regulations for virtual assets, hinting at a paradigm shift in the approach compared to the past, as reported by Coin Edition.

Yue emphasized that the aim is to let the industry develop and innovate while maintaining a robust regulatory framework rather than adopting a “light touch” approach. He made it clear that crypto companies dissatisfied with Hong Kong’s regulatory environment are free to seek opportunities elsewhere.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.