- Hyperliquid price today trades near $39.05, moving deeper into a six week symmetrical triangle as volatility tightens.

- Spot flows stabilize, with a small net inflow marking the first shift after weeks of aggressive outflows.

- $38.90 support and $39.80 resistance define the breakout zone, with a decisive move expected as the triangle apex nears.

Hyperliquid price today trades near $39.05, sitting inside a narrowing symmetrical triangle that has compressed volatility for nearly six weeks. The token continues to trade below the 20 and 50 day EMAs, creating a cautious backdrop as spot flows show uneven participation across exchanges.

Triangle Structure Narrows As Buyers Defend Higher Lows

The daily chart shows Hyperliquid moving deeper into the apex of a symmetrical triangle. Price continues to form higher lows along the rising support line near $38.90, but every rally has been capped by the descending trendline that has held since September.

The EMA structure reflects hesitation. The 20 day EMA sits near $39.80, while the 50 day EMA is positioned at $41.51. Both remain above current price and flattening, which suggests a neutral to slightly bearish trend. The 100 day EMA at $42.12 forms the next barrier if buyers attempt a breakout.

Related: Zcash Price Prediction: ZEC Retains Bullish Bias While Cypherpunk Boosts Holdings

The Supertrend line on the daily chart sits near $35.77, marking the broader support zone that buyers have defended through several shakeouts. As long as Hyperliquid stays above this level, the higher time frame structure remains constructive.

Price is approaching the triangle vertex, which typically precedes a decisive move. Traders expect a breakout or breakdown within the next few sessions as compression reaches its limit.

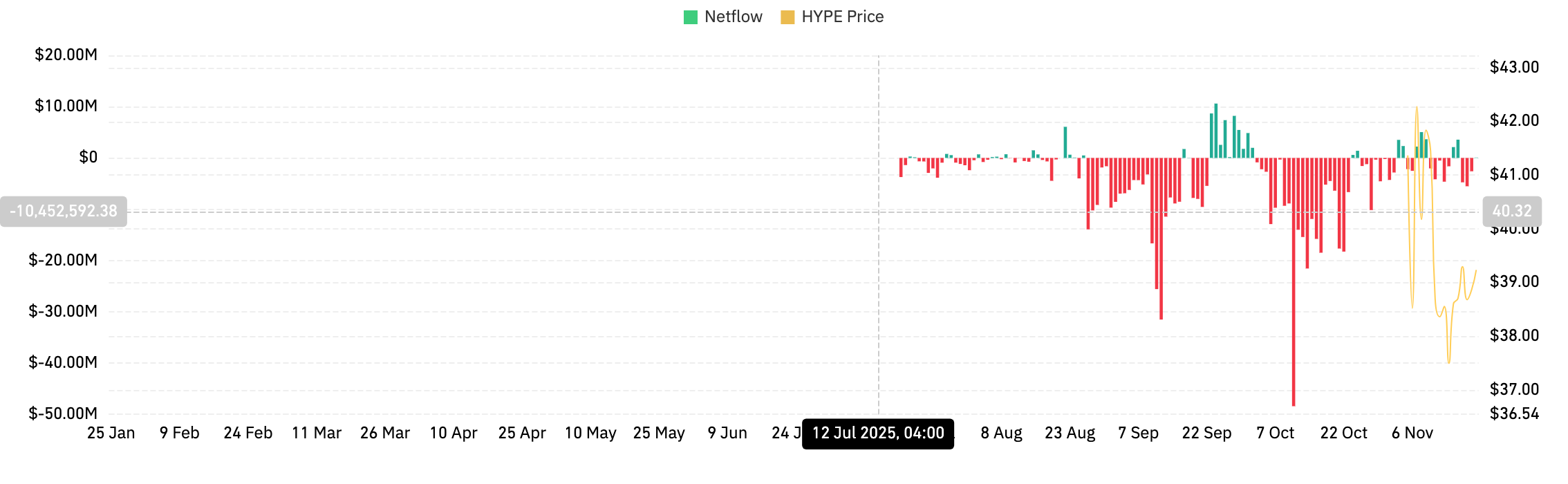

Spot Flows Stabilize After Weeks Of Aggressive Outflows

Coinglass data shows spot flows have finally calmed after a long stretch of net outflows through September and October. The latest reading on November 20 shows a modest $60.5K net inflow. This is a small figure in absolute terms, but it marks a shift from repeated multi-million dollar outflow days seen earlier in the quarter.

The broader flow picture is still mixed. Hyperliquid experienced heavy distribution in late summer, with several days showing negative flows below $10M. The recent stabilization suggests sellers are no longer driving liquidity aggressively back to exchanges.

Intraday Momentum Shows Cautious Consolidation

Shorter timeframe charts show a more balanced tone. The 30 minute chart highlights a modest pullback after price failed to break above $40. Parabolic SAR dots have flipped above price, showing intraday loss of momentum after a series of higher highs earlier in the session.

RSI sits near 51, reflecting equilibrium after cooling from the 63 zone. Buyers continue to defend the $38.70 to $38.90 band, which has acted as intraday support over the past 24 hours.

A move above $39.70 would flip SAR signals and place Hyperliquid back into a positive momentum swing. Failure to reclaim this level keeps intraday pressure intact.

Outlook. Will Hyperliquid Go Up?

The next move hinges on how price behaves near the triangle apex. Momentum remains neutral, but the structure is close to resolution.

- Bullish case: A breakout above $39.80 followed by a close above $41.50 confirms strength. That would shift sentiment and target $47.50 as the next major upside zone.

- Bearish case: A daily close below $38.90 breaks the rising support and signals a move toward $36. Losing that level turns the pattern into a full corrective phase.

Hyperliquid sits at a decision point. The consolidation is mature, and the next directional move will likely set the tone for the remainder of November.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.