- In the last 24 hours, the Internet Computer (ICP) price has risen by 5.76 %.

- Technical indicators predict that ICP prices will continue to rise in value.

- Bears tire as bulls manages to hike ICP prices.

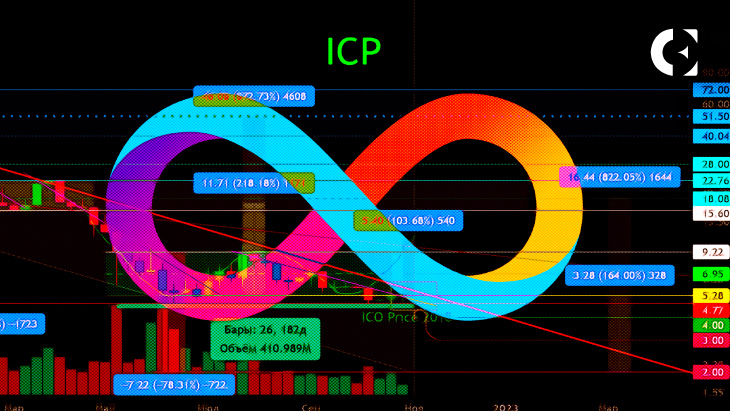

Following a sell-off in the preceding 24 hours, Internet Computer (ICP) bulls have successfully reversed the bearish trend. In light of this bullish dominance, ICP recently reached an intra-day high of $5.42.

At the time of writing, ICP was trading at $5.42, a 5.76% gain.

Supporting this bullish run is a growth in market capitalization of 4.04% to $1,436,110,248, as well as an increase in trading volume of more than 70.12% to $63,518,428.

The Keltner Channel bands on the 4-hour price chart are bulging, indicating heightened market volatility. At 5.51 and 4.87, the upper and lower bands are touching. The ICP price is approaching the top band, indicating that the upward trend will continue.

The Relative Strength Index (RSI) has a reading of 61.93 and is trending upwards. This increase in the RSI score is a definite bullish trendline because it is neither oversold nor overbought.

The Stoch RSI, at 66.67, indicates that the market’s positive trend will continue. Because the indicator signal is neither overbought nor oversold, the ICP price has room to rise further.

The On Balance Volume (OBV) and price are forming greater peaks and troughs, indicating that the upward trend will likely continue. The OBV is -51.81M and rising, indicating that accumulation is taking place to support this bullish trend.

With a reading of -0.00, the MACD blue line reveals a bullish crossover as it reverses its trend and soars over the signal line.

Bulls must fight to keep the resistance level and prices afloat if the market’s positive trend is to continue.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.