Bitget Wallet, a crypto wallet with its native token BWB, is committed to providing a comprehensive user experience that prioritizes both security and ease of use. In this interview, we speak with Alvin Kan, Chief Operating Officer of Bitget Wallet, to delve into the challenges of Web3 wallet development and Bitget Wallet’s approach to overcoming them. He also discusses the upcoming Bitget Onchain Layer designed to simplify user interaction with the Web3 world.

- Taking into consideration the current industry landscape, what are the most necessary features a wallet should have to stand the competition and respond to the user’s needs?

After conducting extensive research on user needs, we arrived at the conclusion that there are four primary things that drive user engagement with Web3 and crypto: Asset Management, Asset Discovery, Onchain Trading, and Earning. Among these, On-Chain Trading and Earning stand out as the most significant focal points. To cater to these needs, Bitget Wallet has invested heavily in building a comprehensive trading platform that supports instant and cross-chain swaps over a wide array of blockchains. Bitget Swap, our native swap feature on the wallet, is capable of aggregating liquidity across hundreds of different blockchains to present users with the most optimal trading routes available. At the same time, we’ve also cultivated a robust Earning center, that provides users with a myriad of opportunities to earn airdrops and rewards for interacting with featured DApps. To bring even more value to our users, we’ve also created a native launchpad on our wallet, that will also offer users early access to emerging projects, allowing users to best capitalize on their time spent on Web3.

All of these features are engineered specifically to cater to the user needs we’ve identified, and we believe this is what gives us the necessary edge to stand out from the competition.

2. Going deeper into security matters, what are the most frequent security concerns of web3 wallet users? Are there any concerns that are yet impossible to be addressed?

Web3 wallets are primarily divided into custodial and non-custodial types, each differing in terms of control, convenience, security, and risk.

Custodial wallets are managed by third parties, such as exchanges or wallet service providers, meaning users do not directly hold their private keys. This setup has several advantages: users do not need to back up and manage private keys themselves, making custodial wallets easier to use. Additionally, these wallets support recovery through identity authentication in case of lost access, such as forgotten passwords, and offer customer service assistance.

However, custodial wallets come with certain risks. Centralization risk is a major concern, as third-party platforms may suffer from hacks or other issues leading to private key leaks and user fund losses. Trust risk is another factor, requiring users to trust that the third-party company will not misuse or lose their funds. Lastly, regulatory risk is present, as some countries may impose regulations on custodial platforms, potentially freezing or seizing user funds.

On the other hand, non-custodial wallets give users full control and management of their own private keys, allowing them to securely manage their crypto assets. This setup offers several advantages: better privacy and security, as only the user can control their assets. As long as the private key remains secure, the funds are safe.

However, non-custodial wallets also come with risks. Management risk is significant, as users need a certain level of technical knowledge to protect their private keys. If a private key is lost or stolen, the assets cannot be recovered. Phishing risk is another concern; users may inadvertently expose their private keys or authorize transactions to phishing sites, which are prevalent and pose significant challenges. Additionally, the complexity of operations can be daunting for novice users, potentially leading to fund losses due to operational errors.

Overall, regardless of whether it is a custodial or non-custodial wallet, private key security is the most critical concern for wallet users. Users should choose the type of wallet based on their specific needs. Wallets are a fundamental core component of blockchain technology, so there are no unsolvable issues regarding asset record-keeping.

3. It’s known that security is one of the vital preferences of decentralized wallets, while user-friendliness is frequently a downside for them. How do you manage to keep security strong while providing fast & efficient UI?

For most decentralized platforms, user-friendliness often comes at the cost of security. However, there are still certain strategies that wallets can employ to maintain a balance of both. On the security design side, having Multi-Factor Authentication helps to ensure that even if one security layer is compromised, additional security parameters will still exist to protect user assets. Additionally, having hardware wallet compatibility and biometric authentication (such as fingerprint or facial recognition) will also help provide a robust security framework without compromising on user-friendliness.

Another key area would be user education, as we believe that users also play a key role in ensuring the security of their assets. At Bitget Wallet, we regularly produce high-quality tutorials and educational pieces to keep our users informed on the latest security trends and features, together with a comprehensive help center.

Under the hood, having efficient coding practices and writing optimized codes can ensure that the wallet runs smoothly and quickly, enhancing the overall user experience. Leveraging caching and preloading techniques will also help to improve response speeds and reduce loading times.

At Bitget Wallet, we also conduct regular security audits with leading security firms in the industry, and we also build our main core codes in open-source, allowing the community to review and contribute to our overall defenses. These are some examples of building a robust security framework without compromising on user experience.

4. How is the wallet activity after the BTC halving event? Do you see a lot of deposits and withdrawals or are the wallets dormant?

On April 20, 2024, BTC completed its fourth halving. In the month since the halving:

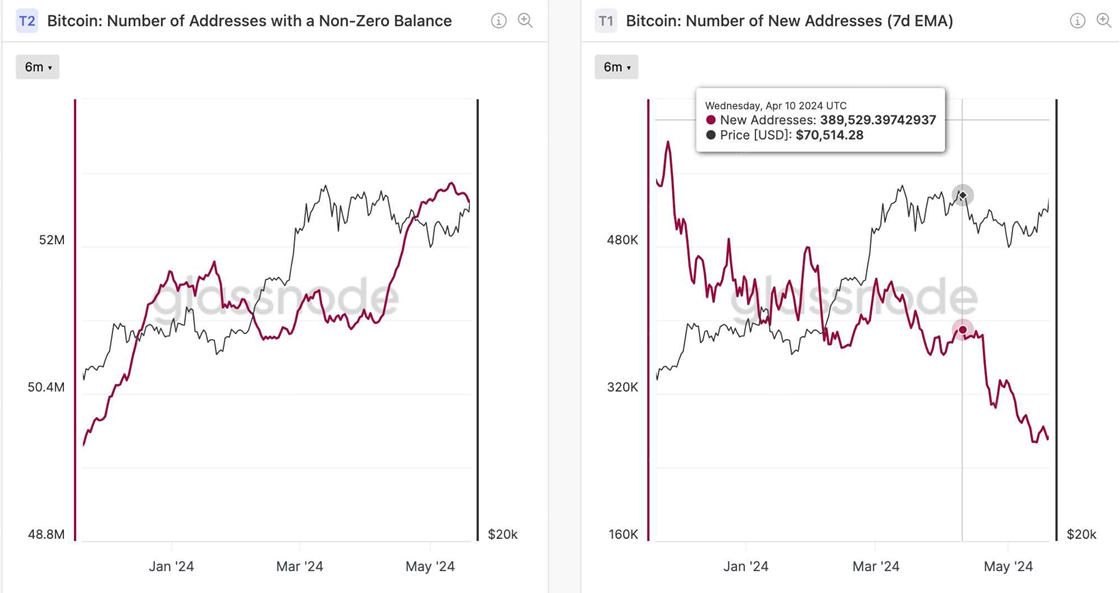

4.1 The number of active addresses on the BTC network first increased and then decreased. This may be related to various on-chain activities such as the launch, minting, and speculation of tokens.

4.2 The number of non-zero balance addresses on the BTC network also increased, while the number of new daily addresses on the BTC network decreased. Both metrics follow cyclical trends and do not seem to have undergone significant changes around the halving period, indicating that the halving may not have impacted these indicators.

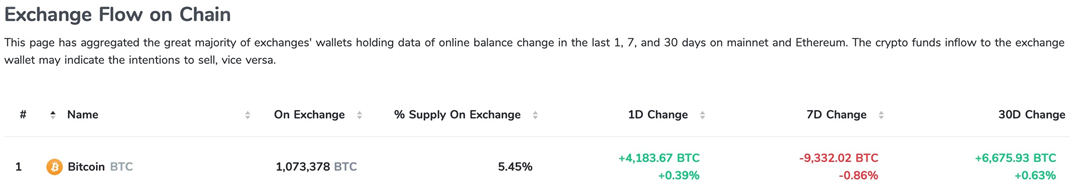

4.3 Examining the net inflow/outflow of BTC from the chain to CEXs:

- In the month following the halving, there was a net inflow of 6.6k BTC to CEXs.

- In the past seven days, there has been a net outflow of 9k BTC from CEXs.

- This corresponds to the price decline and volatility of BTC over the past month and its recent increase in the last seven days.

4.4 Looking at a broader timeline: It is evident from the data that since 2018, the number of investors willing to sell BTC has been decreasing. Many long-term holders have stopped selling their tokens, continuing to be bullish and accumulate BTC.

5. There’s been plenty of news about BWB. What is it exactly, and what are your aims for it? What is the token’s value for users?

As the official platform token for Bitget Wallet, BWB not only brings with it a host of meaningful use cases to users but also symbolizes a significant milestone in Bitget Wallet’s development growth. For starters, BWB token holders can expect to enjoy perks such as community governance, staking, the payment of gas fees on multiple chains, access to Bitget Wallet’s Launchpad and Bitget’s platform events, and more.

Additionally, BWB is also available for subscription on our launchpad. 1,000,000 BWB, or 0.1% of the total supply, will be offered during the BWB Launchpad subscription event. Subscriptions will be divided into whitelist and public rounds, with eligibility for the latter being available to users who have completed at least one Bitget Swap transaction in the past three months. Each BWB token is offered at a subscription price of $0.1, distributed on a first-come, first-served basis.

6. Can you share the roadmap’s teaser? What features targeted at smoothing UI are planned?

Our roadmap for the future lies in the creation of the Bitget Onchain Layer – an intermediate layer that abstracts away complexities for users to interact with the Web3 world. This will be our key initiative to produce a perfectly seamless UI to facilitate mass onboarding. To achieve this goal, we have introduced the integration of Modular Feature DApps (MFDs) as part of the Bitget Onchain Layer. These specialized DApps can function both as standalone DApps as well as native features integrated directly into Bitget Wallet. The main objective of these MFDs is to serve as native gateways for users exploring a wide breadth of Web3 DeFi services, right from the convenience of their Bitget Wallet app, enjoying unique advantages such as heightened security, enhanced liquidity, and an unmatched user experience.

Co-building has always been a core tenet for us at Bitget Wallet, and we are extending this to the Bitget Onchain Layer as well. We have established a $10 million BWB Ecosystem Fund to incubate and invest in emerging projects building on the Bitget Onchain Layer that will span a wide range of DeFi sub-sectors, including Telegram Tot, Pre-Market, and the On-Chain Derivatives Market.By working with industry developers to create effective and purposeful MFDs, we envision the Bitget Onchain Layer to not only be our next big step in revolutionizing the overall user experience for our users but also the blueprint of Web3 innovation for the entire Bitget ecosystem.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.