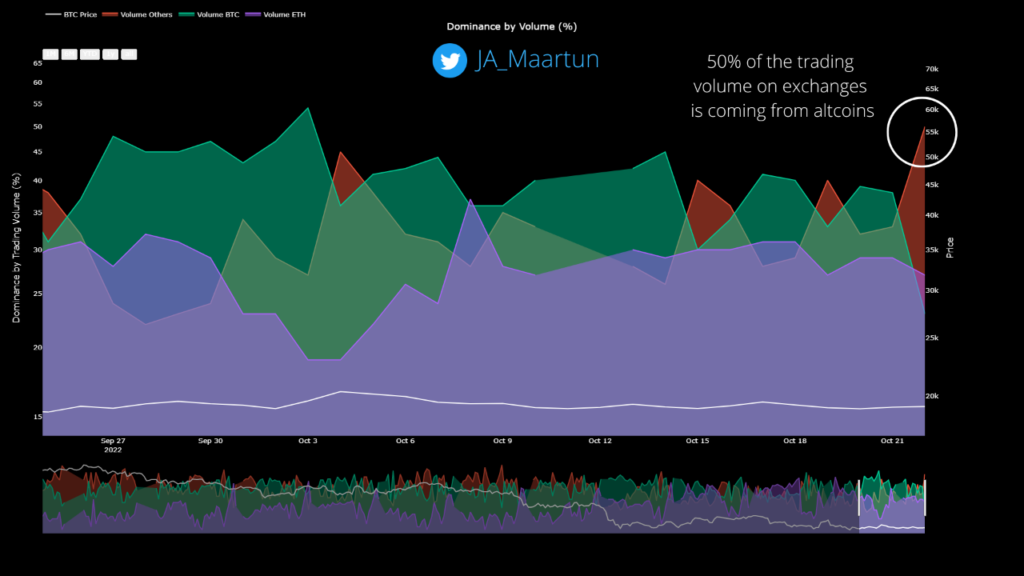

- 50% of exchange trading volume yesterday was altcoin trading volume.

- Historical data shows that this altcoin dominance is something to worry about.

- ETH has risen more than 2% while BTC struggled to post a 1% gain.

According to a Quicktake posted on the crypto market intelligence firm, CryptoQuant, 12 hours ago from the time of writing, recent statistics relating to Dominance by Volume (%) should have crypto traders and investors worrying about their portfolios.

The post stated that

After a period of 1 month where #Bitcoin was the most traded coin on exchanges, altcoins started to dominate. Yesterday, 50% of the trading volume on exchanges came from altcoins. Based on historical data, this is not good for the market.

As can be seen in the chart shared in the blog post, 50% of the trade volume on exchanges has been linked to altcoin trading.

17 crypto investors voted on the post. Of the total number of voters, 2 voters (12%) are bullish on the crypto market, and 15 voters (88%) still have a bearish outlook on the crypto market.

When it comes to the price of the crypto market leader, Bitcoin (BTC), it has risen 0.87% over the last 24 hours according to CoinMarketCap at press time. On the other hand, Ethereum (ETH) has seen its price rise by more than 2% in the same time period.

Being the largest altcoin by market cap, the price rise seen in ETH in comparison to BTC suggests that altcoins are more dominant in the crypto market at the moment. Despite this, however, BTC still has a comfortable lead in terms of market cap over ETH. Currently, the market cap of BTC is $370,751,984,277, while ETH’s market cap stands at $163,591,929,281.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.