- Robert Kiyosaki claims inflation makes the poor and middle class poorer but benefits the wealthy

- He argues it erodes cash savings of lower-income groups but boosts alternative assets held by the rich.

- Kiyosaki views inflation as exacerbating the wealth gap due to Fed policies.

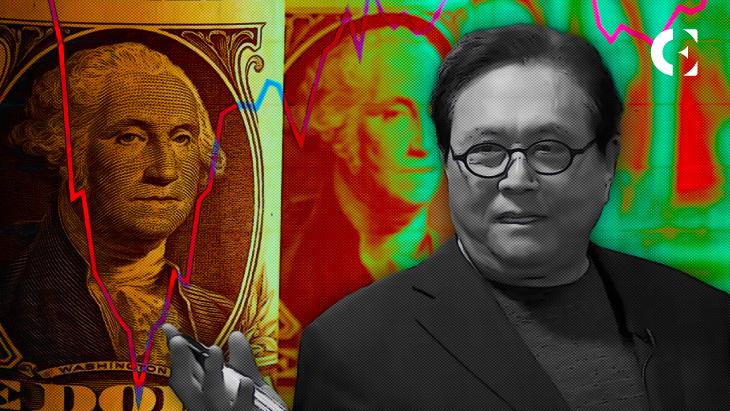

In a recent tweet, the author of Rich Dad, Poor Dad, Robert Kiyosaki, claimed that inflation makes lower-income groups poorer while benefiting the wealthy.

Kiyosaki states that inflation erodes the purchasing power of dollar savings held by the poor and middle class, who rely on these funds. Meanwhile, the rich are shielded by investing in alternative assets like gold, silver, and bitcoin rather than cash.

The author views inflation as widening the wealth gap by devaluing the US dollar, which most Americans work for and keep their money in. But inflation can also drive up the prices of scarce real assets that wealthy investors tend to hold as a hedge.

Kiyosaki has frequently criticized Federal Reserve policies like quantitative easing as detrimental to savers and pensioners on fixed incomes. He advocates alternatives like precious metals and cryptocurrency to bypass dollar erosion.

While inflation’s impacts vary depending on individual financial behaviors, the tweet highlights a common perception that loose Fed policy predominantly punishes lower-income groups without assets.

Kiyosaki has expressed strong support for Bitcoin and cryptocurrencies, viewing Bitcoin as a safeguard against the conventional financial system and a potential store of value in the future. He holds the opinion that the US dollar’s stability is uncertain, and cryptocurrencies and precious metals could offer a shield for investors.

Kiyosaki anticipates that the price of Bitcoin may reach $100,000 or potentially even $1 million in the event of a global economic crisis. He has been an investor in Bitcoin since its price was very low and maintains investments in it, along with holdings in gold and silver.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.