- Robert Kiyosaki warns of an imminent “massive crash.”

- He recommends gold, silver, Bitcoin, and Ethereum as protection.

- Analysts are divided on whether his warnings hold merit.

Leading financial commentator Robert Kiyosaki has again warned that a global financial collapse is imminent. In a post on X, the investor predicted a “massive crash” that could “wipe out millions,” urging followers to safeguard their wealth by investing in gold, silver, Bitcoin, and Ethereum.

Why Kiyosaki Recommends Gold, Bitcoin, and Ethereum

Kiyosaki believes that tangible and digital assets offer better protection against what he views as a fragile global economy. “Protect yourself,” he wrote, adding that holders of precious metals and cryptocurrencies would fare better than those reliant on paper money.

In October, Kiyosaki made a similar warning shortly after a sharp crypto sell-off triggered by new U.S. tariffs on China. The 100% tariff announcement sent Bitcoin plunging from $122,000, wiping out nearly $19 billion in leveraged positions within hours.

Kiyosaki cited the chaos as further proof of financial fragility. He warned that both digital and traditional systems are built on “paper promises,” and again urged investors to shift toward tangible assets such as gold, silver, Bitcoin, and Ethereum.

Today, Bitcoin is trading at $110,079, representing a 0.2% increase over the past day. At the same time, it is still experiencing a 7.1% decline in the past month. Ethereum’s price follows suit by trading at a gain of 0.4% in the past day and a 12% loss in the past month.

Related: Robert Kiyosaki Labels the U.S. Dollar “Fake Money” Amid Inflation Concerns

Analysts Divided on ‘Massive Crash’ Warning

Kiyosaki’s post sparked wide discussion among traders and analysts. Many pointed out that he has been forecasting similar crashes for more than a decade. Critics argue that his repeated warnings have yet to be proven right, often coinciding with market pullbacks rather than long-term collapses.

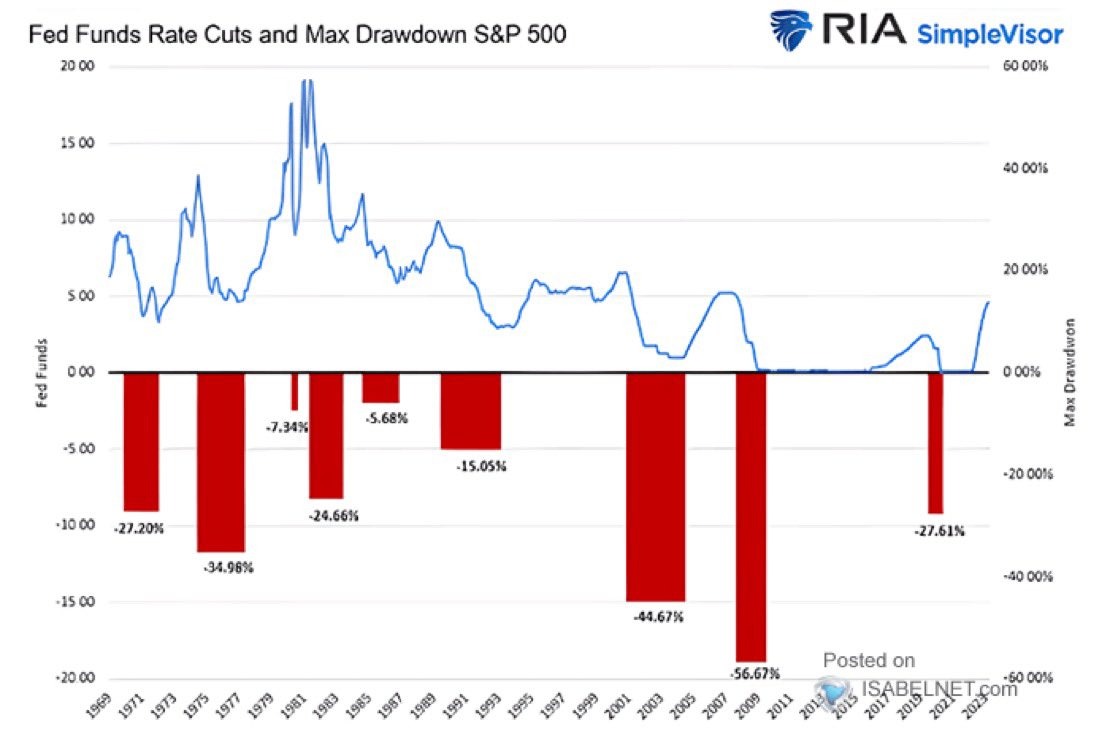

Others, however, noted that recent economic patterns resemble conditions that preceded past market downturns. Analyst Jonesy noted that the recent rate cuts echo those seen before major drawdowns in 2000, 2007, and 2020. “Rate cuts have started again,” he said. “This isn’t fearmongering, it’s history repeating itself.”

Bitcoin Advocates See Opportunity Amid Warnings

Supporters of Kiyosaki’s view argue that his concerns are justified. Investor Avinash Mishra cited the ballooning U.S. national debt, now over $35 trillion, and ongoing fiscal deficits as evidence that the financial system is under strain.

“This bubble’s primed to burst,” he said. “I’ve been stacking silver and Bitcoin since 2020 as protection against the fiat trap.”

Some crypto proponents responded to Kiyosaki’s comments with a different tone, arguing that Bitcoin tends to recover strongly from market turbulence.

Related: Ethereum Price Prediction: Heavy ETF Outflows Weigh on ETH Price Action

Online commentator “Puck” described the warnings as another phase of fear-driven narratives, saying that Bitcoin’s volatility often precedes major upswings.

“Crashes fuel the next rally,” he wrote, emphasizing that BTC remains resilient above $110,000 despite recent corrections.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.