- The price of ETH is trading at $1,100.41 according to CoinMarketCap.

- Large ETH whales accumulated $1.03 billion worth of ETH yesterday.

- Bears may bring ETH’s price below the current support level.

The price of Ethereum (ETH) has fallen 2.74% over the last 24 hours according to CoinMarketCap, taking the price of ETH down to $1,100.41 at press time. This has added to ETH’s negative weekly price movement as the altcoin’s price is now down 12.49% over the last 7 days.

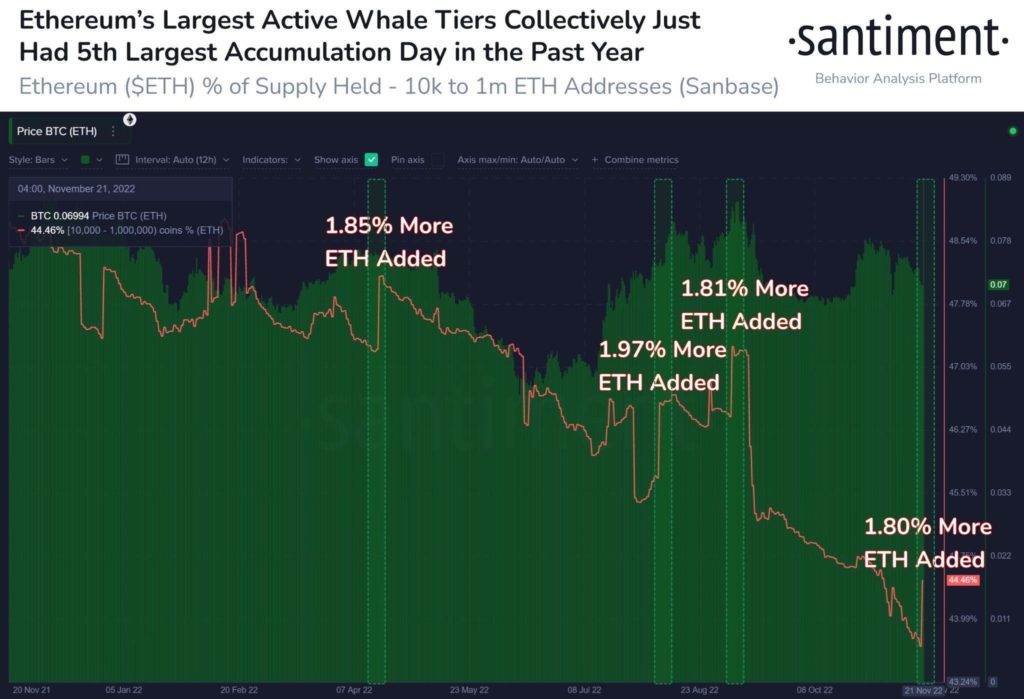

While ETH’s continued price decline may be testing holders’ grit in this bear market, large whales (holding $10.9 million to $1.09 billion) have seen the price fall as an opportunity to purchase ETH at a discount.

In a tweet made this morning by the blockchain analytics firm, Santiment, large ETH whales added 947,940 more ETH yesterday. This is approximately $1.03 billion at current prices. The tweet added that this is the 5th largest single day add in the past year.

The previous 4 instances of large ETH whales accumulating substantial amounts of ETH saw ETH’s price gain an average of 3.2+% against BTC’s price in the days that followed.

At press time, ETH’s price has weakened against BTC by 0.59% over the last 24 hours. After reaching a daily high at $1,140.70, ETH’s price has retraced since to trade closer to its daily low at $1,084.86.

When it comes to ETH’s daily chart, the price of ETH has fallen to the support level of $1,105.75 after it dropped from a high of $1,227.07 on November 20, 2022, to its current level today. Bears are currently applying pressure to the $1,105.75 support level as can be seen by the relative positions of the daily 9 and 20 EMA lines. This suggests that the level may not hold.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.