- Litecoin sustains bullish structure despite ETF delay and market recalibration

- Rising open interest indicates renewed trader confidence and leveraged optimism

- Strong EMA alignment and exchange outflows reinforce long-term accumulation trend

Litecoin (LTC) maintained its bullish setup on the 4-hour chart despite a temporary setback from the delayed decision on Canary Capital’s spot Litecoin ETF. The token traded near $120.54, reflecting stability even as traders recalibrated short-term expectations.

According to Polymarket data, there is a 94% projected probability of ETF approval, but

regulators have postponed the verdict, removing what many view as a key bullish driver. Still, Litecoin’s underlying technical structure remains strong, with indicators suggesting momentum may persist if support zones hold.

Moving Averages Signal Sustained Strength

Litecoin continued trading above all major exponential moving averages, reinforcing its upward trend. The 20 EMA stood at $119.06, while the 50 EMA at $115.47, 100 EMA at $113.27, and 200 EMA at $112.71 formed a tight cluster of dynamic support.

Related: Shiba Inu (SHIB) Price Prediction: Analysts Track Breakout From Key Triangle

This alignment confirms persistent bullish momentum since the rebound from a $104 swing low. Moreover, price action between $118 and $124.83 suggests ongoing consolidation before the next directional move.

A close above the $121.96 Fibonacci level could reestablish upward momentum toward $124.83. However, a dip below $118 might invite short-term weakness, with further support expected around $117.32 and $112.69. These zones coincide with the 0.618 and 1.618 Fibonacci levels, providing layered defenses against downside pressure.

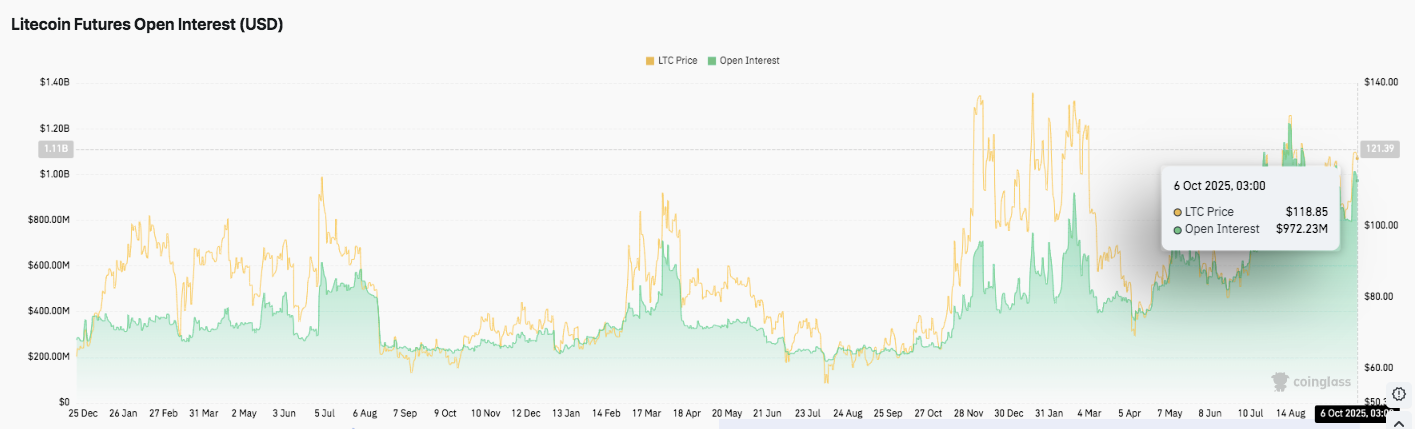

Rising Open Interest Reflects Renewed Participation

Besides price stability, derivatives data show strengthening trader participation. Litecoin’s open interest reached $972.23 million as of October 6, 2025, rising alongside price appreciation. This parallel climb signals increasing leverage exposure and growing optimism among market participants.

Historically, similar surges in open interest have preceded notable price volatility. Hence, sustained growth above $110 could reinforce bullish momentum while inviting fresh inflows from speculative traders.

Related: BNB Price Prediction: BNB Holds $1,200, Eyes $1,300 Breakout

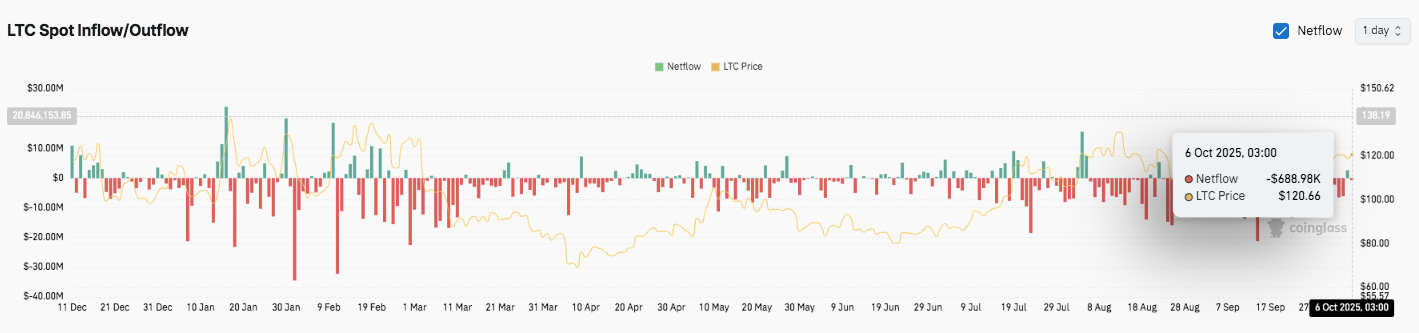

Exchange Outflows Highlight Accumulation Trend

Additionally, on-chain data shows persistent LTC outflows from exchanges throughout 2025. Frequent red bars on the netflow chart indicate that holders are moving coins to private wallets, a sign of accumulation and long-term conviction.

On October 6, Litecoin recorded a net outflow of about $688,000 while trading near $120.66. Such consistent withdrawals typically reduce selling pressure and strengthen market stability.

Technical Outlook for Litecoin (LTC/USD)

Key levels remain clearly defined as October progresses.

- Upside levels: $121.96, $123.50, and $124.83 stand as immediate resistance zones. A breakout above $124.83 could open a move toward $127.00 and the psychological barrier at $130.00.

- Downside levels: $118.93 is the first key support, followed by $117.32 and $112.69 near the 200 EMA. Holding above $118 keeps the short-term bullish bias intact.

- Resistance ceiling: The $123.50–$124.83 area remains the pivotal zone to flip for medium-term bullish continuation. Sustained closes above this region could confirm trend strength and target higher Fibonacci extensions.

The current structure shows Litecoin consolidating above all major exponential moving averages, reflecting strong bullish momentum. Price compression between $118 and $124 suggests a potential volatility expansion phase ahead.

Will Litecoin Extend Its Rally?

Litecoin’s price action heading into mid-October depends on buyers maintaining the $118–$119 support zone. A successful defense could trigger renewed momentum toward $127 and possibly $130.

Conversely, failure to hold above $117 could expose LTC to a deeper pullback toward $113–$112, aligning with the 200 EMA support. The technical setup remains constructive overall, but confirmation above $124.83 is essential to validate the next bullish leg.

Related: Dogecoin Price Prediction: 401(k) Inclusion Rumor Sparks Bullish Buzz

For now, LTC stays within a pivotal range. The tightening structure, rising open interest, and strong EMA alignment suggest that a decisive breakout could define the next major directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.