- Litecoin holds strong above key Fibonacci support, signaling renewed bullish structure.

- Rising open interest and inflows highlight growing trader confidence and accumulation.

- ETF optimism and technical alignment could drive Litecoin toward the $140 resistance zone.

Litecoin is showing renewed strength after months of subdued performance, as both technical and market indicators align for a potential upside. The cryptocurrency, which has traded around $128.84 after a brief rally to $132.84, appears to be entering a consolidation phase before its next move. Analysts believe that strong structural support and surging market participation could fuel a continuation rally toward $140 if bullish momentum holds steady.

Market Structure and Price Momentum

Litecoin recently broke above the key Fibonacci 0.786 level at $125.91, which shows that buyers are active despite pullbacks on the short side. The short-lived rejection at $132.84 implies traders took profits after the rally but the overall setup remains constructive. Key supports are being formed between $120 and $126, levels where historically accumulation has occurred during previous price consolidations.

Moreover, the alignment of the 20, 50, 100 and 200 EMAs in an uptrend is an indicator of a well-established uptrend. The 20 EMA currently rests around $120.72, solidifying the $120-$126 zone as a critical bullish defense level.

As long as the price remains above $125.91, traders expect renewed momentum towards $135 and potentially $140. However, a fall below $120 could be inviting weakness in the short-term with a possible test at $116-$112 before recovery.

Derivatives and On-Chain Metrics

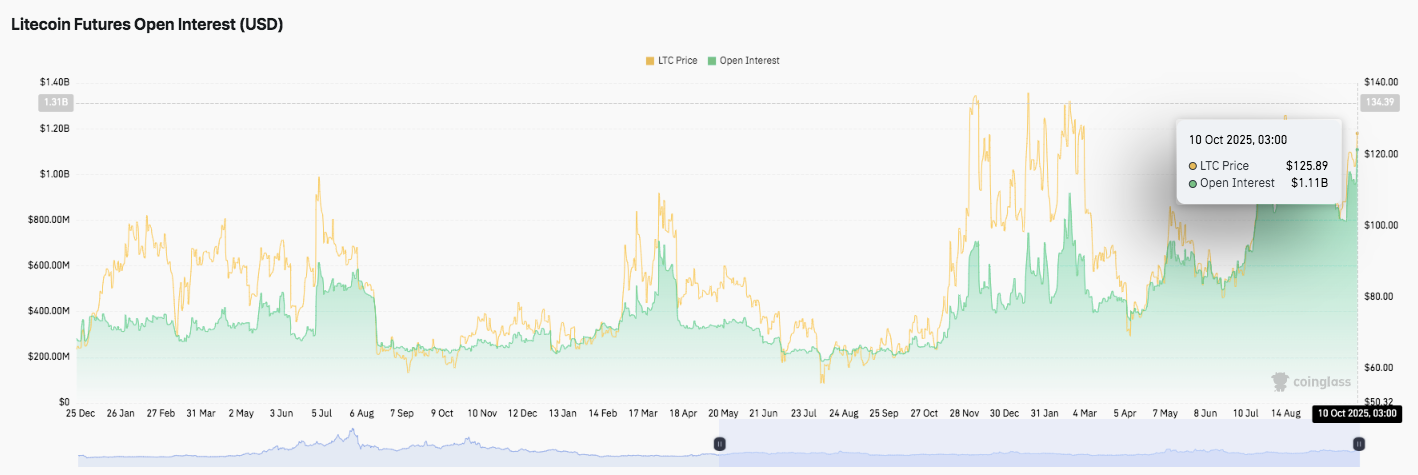

In the derivatives market, open interest in Litecoin has been increasing significantly throughout 2025. Data as of October 10 indicates open interest at $1.11 billion, representing one of the biggest levels this year.

This growth is an indication of increased speculative activity and growing level of trader confidence. Earlier in the year, open interest hovered below $400 million during consolidation stages but started rising in July, moving with the coin’s positive price action.

Related: Cardano Price Prediction: Hydra Node 1.0 Launch Sparks Fresh Optimism

This consistent rise in both open interest and price often points to the start of a strong market phase. It indicates that traders are positioning for larger moves as volatility returns. The increasing leverage across futures platforms suggests that the next breakout whether bullish or bearish could trigger substantial momentum shifts.

Inflows, Sentiment, and ETF Prospects

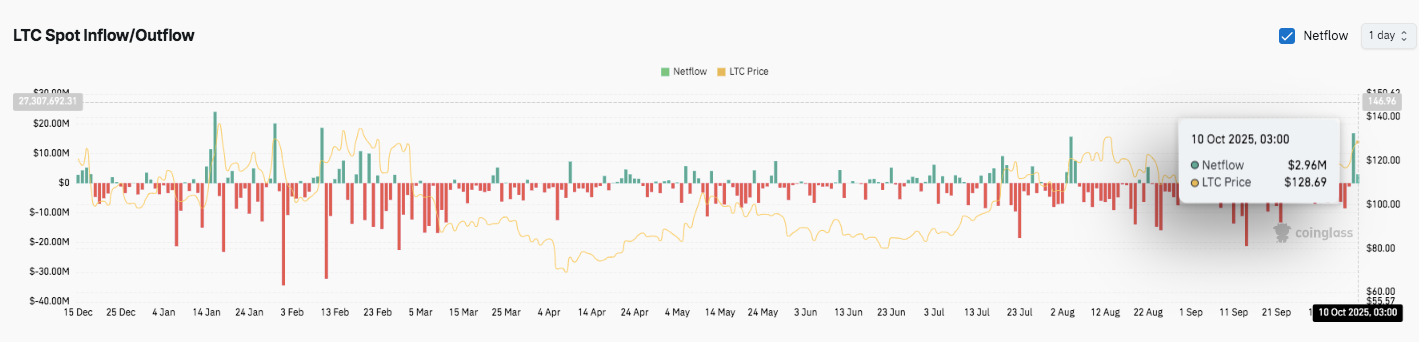

Litecoin’s on-chain flows further reinforce its improving sentiment. After months of negative netflows between March and September, inflows turned positive in October, registering a $2.96 million net inflow on October 10. Historically, such inflow spikes have preceded price recoveries, hinting that investors are once again accumulating.

Besides, regulatory optimism has added another layer to Litecoin’s bullish setup. Market participants are growing confident about a potential Litecoin spot ETF approval by late 2025. Prediction data from Polymarket indicates a 96% probability of approval, a large increase from earlier in the year. This optimism is similar to the trends preceding the launch of Bitcoin and Ethereum ETFs, which both caused substantial market rallies.

Litecoin’s long history, strong security profile, and classification as a non-security asset make it a likely early candidate for ETF inclusion. Its inclusion in the SEC’s universal crypto ETF listing standards strengthens this view, while statements from industry leaders emphasize that the asset meets most regulatory criteria for approval.

Technical Outlook for Litecoin Price

Key levels remain well-defined heading into mid-October.

Upside levels: $132.84 (recent high) is the first resistance, followed by $135.00 and $137.00. A confirmed breakout above these could extend toward $140.00 and $145.50 if momentum strengthens.

Downside levels: $125.91 (Fib 0.786) acts as immediate support, followed by $120.47 (Fib 0.618 and 20-EMA confluence) and $116.64. A breakdown below $116 could expose deeper retracements toward $112.82 and $108.00.

Resistance ceiling: $132.84 remains the key level to flip for medium-term bullish continuation. Sustained closes above this resistance would confirm renewed upward pressure, targeting the $140 zone.

Technical picture: Litecoin is consolidating above major moving averages, with all EMAs (20, 50, 100, and 200) aligned in ascending order a sign of ongoing trend strength. The structure suggests an ascending channel formation, where buyers are defending key supports to sustain higher-low construction.

Will Litecoin Continue Rising?

Litecoin’s October price prediction hinges on whether bulls can hold the demand zone between $125-$120 and retake $133. A bullish breakout from the lows backed by positive inflows and increase in open interest could catalyse LTC’s upward march towards the highs of $140.

Related: Shiba Inu Price Prediction: Analysts Eye $0.000014 Recovery As Holder Count Surges

Conversely, if the day ends without holding $120 there is a risk of the correction reaching $116-$112. For now, LTC continues to sit in a critical zone where near-term sentiment is guided by ETF optimism and technical strength.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.