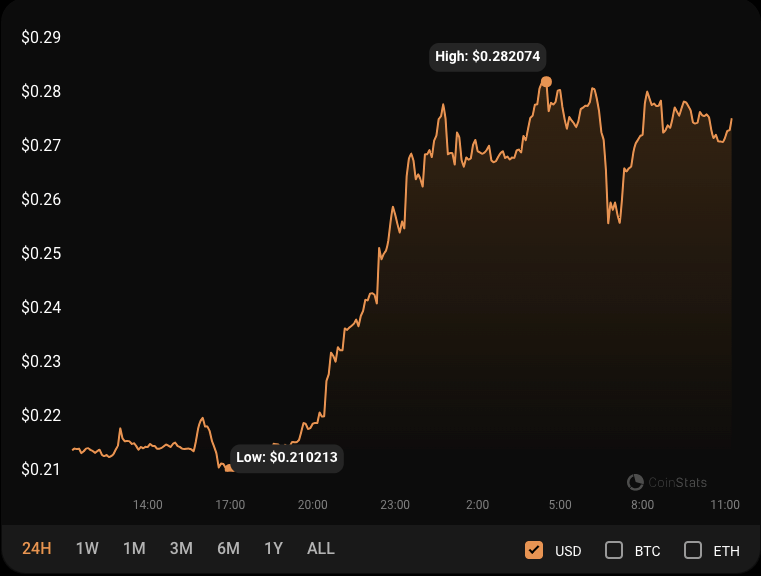

- LOOM’s meteoric 500% surge raises questions about sustainability amid market turbulence.

- Bullish momentum meets technical resistance as LOOM hits $0.28, signaling caution.

- Overbought indicators warn of a looming correction for LOOM, urging traders to tread carefully.

Amidst a turbulent cryptocurrency market landscape, the Loom Network (LOOM) emerges as an unlikely beacon of bullish energy, surging to a 500% increase in recent weeks. However, seasoned traders signal caution beneath the electrifying uptick, whispering warnings of a potential looming correction.

An Unexpected Surge Sails on Rocky Waters

In an era where Bitcoin and Ethereum have witnessed disheartening dips, LOOM has defied gravity, soaring to $0.28, its highest since June 2018. Consequently, the token has witnessed a jaw-dropping 573% increment in market capitalization, sparking a wildfire of discussion and speculation across crypto forums and platforms.

Despite the lack of ground-breaking news or revolutionary project advancements from the Loom Network, this Ethereum-based decentralized application (DeFi) platform has nonetheless captivated the crypto community, remarkably appreciating by approximately 529% over the past 30 days.

The reasons behind LOOM’s enviable rise remain shrouded in mystery and speculation. Some analysts harbor skepticism, contemplating the sustainability of this unexpected breakout.

Moreover, debates rumble regarding whether the staggering price rise manifests LOOM’s multichain interoperable platform’s merits or a more sinister pump-and-dump scheme weaving its web amidst the market.

Cautious Voices Amidst the Euphoria

Notably, crypto trader BitcoinHabebe has sounded an alarm, illuminating that LOOM is navigating treacherous waters, hitting a formidable weekly resistance around $0.28.

Besides, various indicators hint towards an “overbought” status, with bearish divergences ominously lurking across numerous timeframes. Hence, BitcoinHabebe warns that the token is poised on a precarious precipice, and a dramatic dump could be an impending reality.

Despite the boisterous celebrations echoing through the halls of LOOM traders, caution weaves through the narrative as the token stalls at this major technical resistance.

LOOM/USD Technical Analysis

The stochastic RSI on the LOOM/USD 24-hour price chart is 92.36, indicating that the market is overbought. This high rating suggests that the price of LOOM has been fast climbing and that a correction is imminent. As a result, traders should be cautious and consider taking profits or using risk management methods to safeguard their earnings.

Furthermore, the Money Flow Index (MFI) rating of 83.46 confirms LOOM/USD’s overbought state. The MFI monitors the influx and outflow of money into an asset, and a score of 83.46 indicates that LOOM has lately had substantial purchasing pressure. This trend emphasizes the need for traders to exercise care and profit-taking or risk-management initiatives.

In conclusion, LOOM’s remarkable surge raises excitement and caution in the crypto world, with the market’s overbought status hinting at potential turbulence ahead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.