- MATIC’s bearish trend persists despite the Polygon 2.0 upgrade, reflecting profit-taking and hesitant derivative investors.

- Falling market cap and trading volume signal waning investor confidence in MATIC’s current price.

- Overbought conditions and lack of buying activity may lead to further MATIC price decline.

The Polygon (MATIC) market has witnessed significant adverse sentiment in the recent 24 hours, with prices plummeting to an intraday low of $0.5458 despite the launch of the Polygon 2.0 upgrade.

Consequently, MATIC was trading at $0.5543 at press time, down 1.44% from its intraday high. The adverse attitude might be linked to profit-taking by investors who may have expected a price increase due to the upgrading.

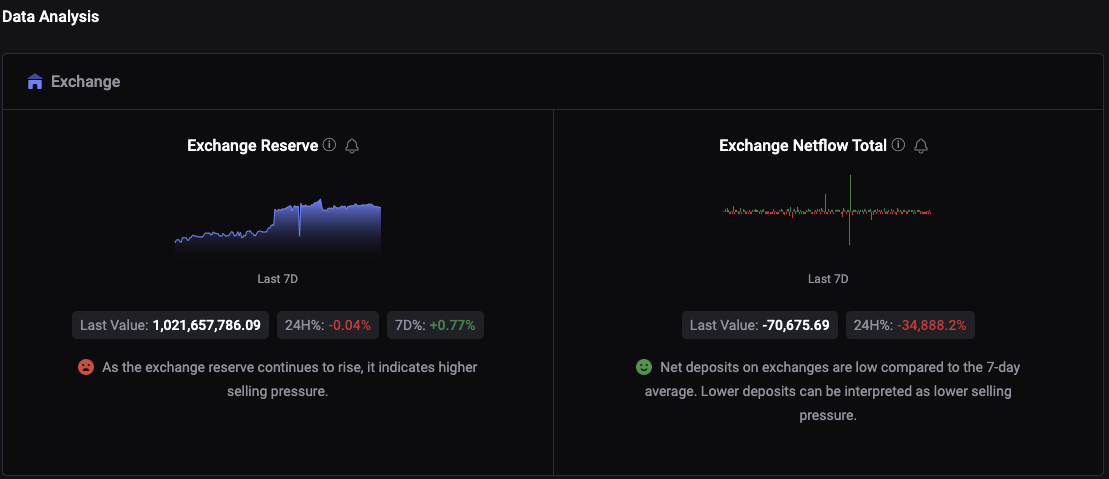

Furthermore, Polygon’s Binance Funding Rate went red, suggesting that derivatives investors hesitated to purchase MATIC at its present price. Furthermore, the growing Exchange Reserve indicates more significant selling pressure on the token as more investors deposit MATIC tokens into exchanges, presumably suggesting a willingness to sell.

With a decrease of 1.46% and 18.80%, respectively, MATIC’s market cap and 24-hour trading volume achieved $5,154,422,539 and $243,978,139. This decline implies that investors have lost faith in MATIC and that trading activity has slowed, suggesting there may be insufficient demand for MATIC at its present price.

MATIC/USD Technical Analysis

On the MATICUSD price chart, the Bollinger bands are moving linearly, with the upper, middle, and lower bands touching $0.567, $0.555, and $0.543, respectively. However, the pointing downward implies a possible negative trend in the price of MATIC. This move might be due to selling pressure and a lack of buyer interest at present prices, which could lead to a further decline in investor confidence and trading activity for MATIC.

With a stochastic RSI of 88.01, the price of MATIC may continue to fall soon. This high rating indicates that the asset is overbought and due for a correction, which might result in more selling pressure and a price reduction.

Furthermore, the present lack of purchasing activity suggests that investors may be cautious about initiating or adding to existing holdings in MATIC, compounding the negative trend.

In conclusion, despite the Polygon 2.0 upgrade, MATIC faces bearish sentiment, with declining prices and overbought conditions, raising concerns for its short-term prospects.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.