Introduction

In the ever-changing landscape of cryptocurrencies, the current market presents a unique playground for traders, especially in leverage trading using CFDs. This approach allows traders to magnify their potential gains from even the smallest market movements. A case in point is Solana (SOL), whose recent price activity exemplifies the lucrative opportunities in leverage trading in such a volatile market.

Solana’s Market Resilience

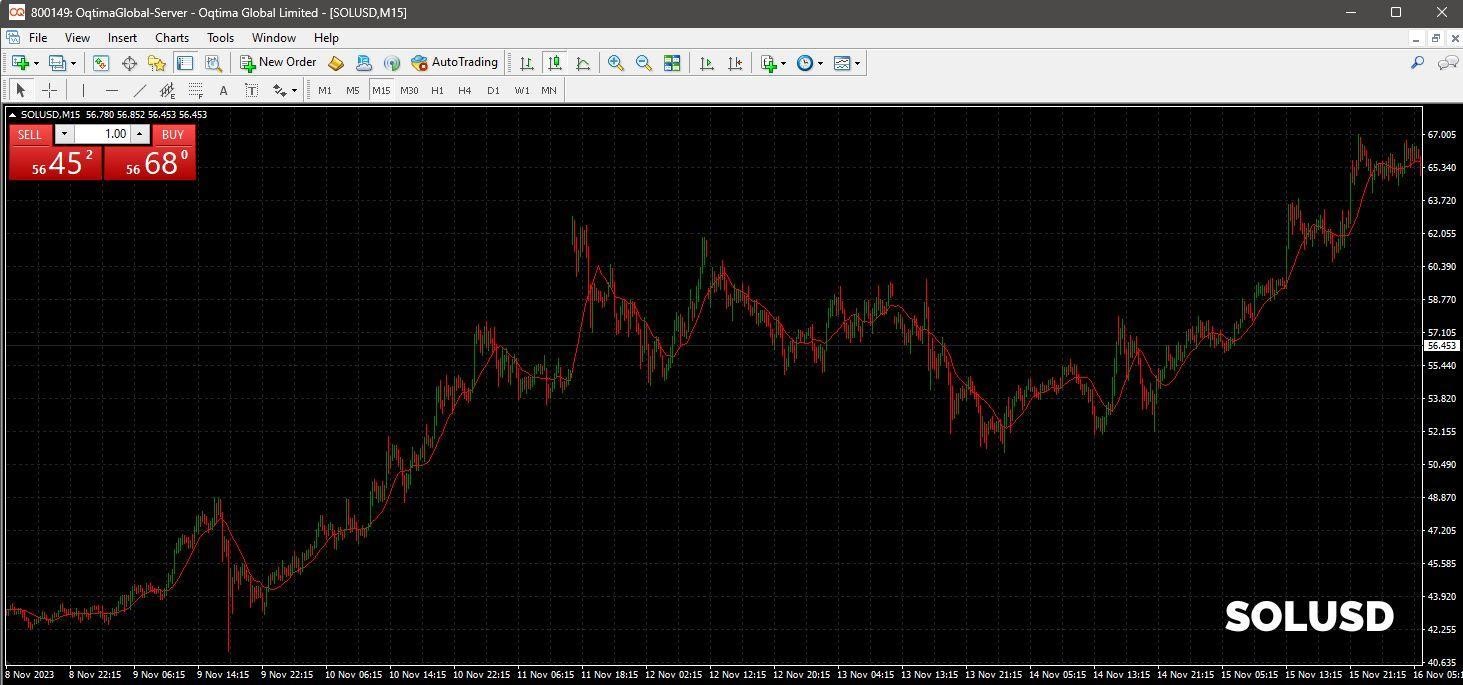

Solana, a prominent player in the crypto world, recently demonstrated remarkable resilience in the past two weeks in the face of market turbulence. After experiencing a sharp decline to $51.27, SOL managed an impressive recovery, rebounding to $55.31. For leverage traders, these kinds of price movements are golden opportunities. They offer a chance to enter and exit trades at strategic points, thus maximizing potential returns. Solana’s journey through this period of volatility is an excellent example of how leverage trading can be employed effectively in the crypto market, turning market volatility into a potential advantage.

The Importance of Macro Analysis in CFD Trading

In leverage trading, particularly in the crypto domain, understanding macroeconomic factors is vital. The case of Solana, significantly impacted by FTX’s strategic decisions regarding their SOL liquidity, underscores the importance of macro analysis. Traders who are well-versed in these broader economic, financial, and political developments can anticipate potential market movements. This insight is particularly valuable in leverage trading, where the ability to predict market trends can greatly influence trading success. Thus, macro analysis not only complements technical analysis but is a critical component in a trader’s decision-making process, especially when trading on margin.

Technical Analysis in Leverage Trading

Technical analysis is an indispensable tool in leverage trading, especially in volatile markets like cryptocurrency. Focusing on Solana, we see how analyzing price resistance, support levels, and other chart patterns is vital. For instance, when SOL dipped to $51.27, it formed a significant support level.

A trader noticing a rebound from this level could infer a strong buying interest at this price, which is crucial for making leverage trades. Similarly, Solana’s previous peak at $63.80 may act as a resistance level. Leverage traders can use these insights to determine their entry and exit points, optimizing their chances for higher returns.

Furthermore, recognizing chart patterns, such as bullish or bearish trends, could give additional signals to traders. In essence, technical analysis helps traders understand not just market trends but also the psychology behind market movements, which is essential in leverage trading.

OQtima: A Platform for Leveraged Crypto Trading

Our current pick for this type of operation would be OQtima, an innovative CFD broker established in 2021 that stands out in the realm of crypto trading. It serves a wide spectrum of traders, from seasoned professionals to novices, providing a flexible and user-friendly platform for leverage trading. While OQtima offers a high leverage of up to 1:500 for most products, it strategically limits the maximum leverage on cryptocurrencies to 20:1. This approach balances the need to protect traders’ assets against the inherent volatility of the crypto market while still offering them leverage opportunities.

In the case of Solana, a trader using OQtima’s platform could have utilized this leverage to magnify their potential profits.

Suppose a trader decides to take a position in Solana (SOL) using OQtima’s platform. The trader has $500 to invest and chooses to use the maximum leverage of 20:1 available for cryptocurrencies. Here’s how it works:

Initial investment: The trader starts with $500.

Leveraged position: With 20:1 leverage, the trader’s buying power is increased to $10,000 ($500 * 20).

Entry point: The trader buys SOL at $51.27.

Exit point: The trader sells SOL at $55.31.

Price movement: The price of SOL moves from $51.27 to $55.31, a $4.04 increase per SOL.

Unleveraged profit: Without leverage, a $500 investment would buy approximately 9.75 SOL ($500 / $51.27). The profit would be 9.75 SOL * $4.04 = $39.39.

Leveraged profit: With leverage, the trader can buy approximately 195 SOL ($10,000 / $51.27). The profit is now 195 SOL * $4.04 = $787.80.

This example demonstrates how leverage can significantly amplify profits. The trader’s initial $500, with the aid of leverage, allows for a much larger position and a correspondingly higher profit from the same price movement. However, while leverage can magnify profits in trading, it’s equally important to acknowledge the added risk it introduces. Effective risk management is vital to leveraging strategies, especially in volatile markets like cryptocurrencies.

Traders should always consider using tools like stop-loss orders to limit potential losses. A stop-loss order automatically closes a trading position once it reaches a predefined loss threshold, helping to protect the trader’s capital from significant market swings. Additionally, traders should only invest funds they can afford to lose and continuously monitor their positions. Understanding and managing these risks is crucial for sustainable and responsible leverage trading.

Moreover, OQtima’s adaptability extends to its payment options. The platform accepts deposits in a variety of cryptocurrencies, making it highly accessible for crypto enthusiasts. OQtima adheres to the regulatory standards set by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority of the Seychelles. The platform’s flexibility, adherence to regulations, and competitive trading conditions like low spreads and efficient execution times position it as an ideal choice for traders aiming to capitalize on the dynamic and volatile crypto market.

Conclusion

The current volatile crypto market, exemplified by Solana’s price movements, offers significant opportunities for leverage trading. Platforms like OQtima enable traders to effectively exploit these market movements. However, it is crucial to remember that while leverage can amplify gains, it also increases risk. Traders should make informed and responsible decisions, considering both the opportunities and the potential pitfalls of leverage trading.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.