- Michael Saylor says he believes that the recent ETH merge will make BTC stronger.

- The number of addresses holding 1 or more BTC has reached an ATH.

- Despite a daily climb, ETH’s price is still down around 7% for the week.

Michael Saylor, well-known Bitcoin (BTC) supporter and chairman of the MicroStrategy board, recently revealed that he believes the Ethereum (ETH) merge will make BTC stronger, instead of the other way around. Saylor shared this opinion while he was attending a conference in Australia.

The main basis of his argument is his belief that the move to proof-of-stake (PoS) will make ETH less of a crypto asset. Saylor was quoted as saying that “proof-of-work is the only universally proven method for creating a digital commodity”.

There seems to be some truth to Saylors beliefs considering the number of addresses holding one or more BTC has once again reached an all-time high on September 17 (yesterday).

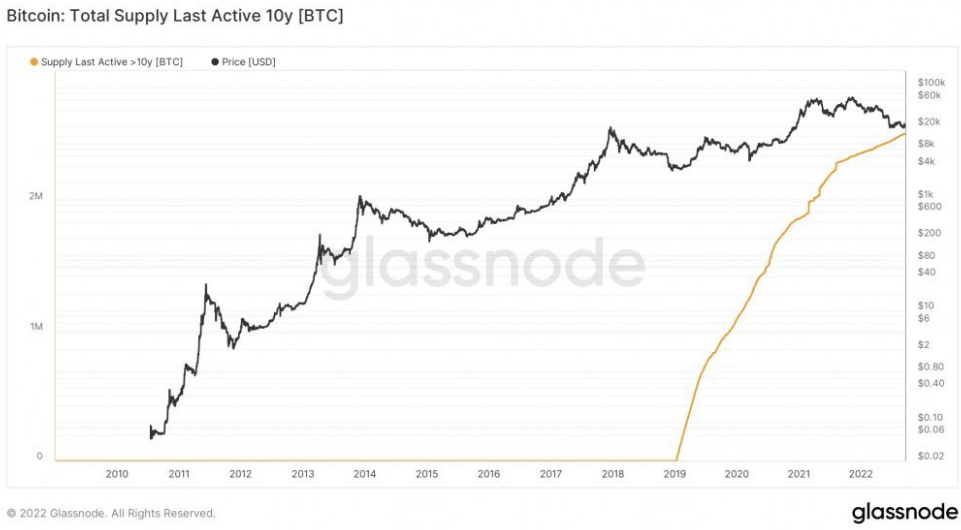

In addition to this, BTC also showed strength per the amount of supply last active in ten years. This metric is now also at an all-time high of 2,516,592.726.

On the derivatives side, data from Coinglass indicated that more than $27 million worth of BTC had been liquidated over the last 24 hours. Open futures for BTC were at a cumulative $14.68 billion, which means that BTC traders are active on long and short positions.

ETH is currently trading at $1,456.93 after a 1.65% increase in price over the last 24 hours. The altcoin, however, is still down more than 7% over the last week.

According to CoinMarketCap, BTC is once again over the $20k mark and is currently trading at $20,063.82 after a 0.094% increase in price over the last day. Similar to ETH, the crypto market leader is also still down more than 7% over the last week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.