- Bullish NKN price prediction ranges from $0.2141 – $0.2416.

- NKN price might also reach $0.3500 this 2023.

- NKN’s bearish market price prediction for 2023 is $0.0752.

As described on its website, NKN is a peer-to-peer decentralized network aiming to disrupt the traditional centralized server model of Internet and telecoms networks. One of the aims of NKN is to utilize unused bandwidth and data, allowing individuals and organizations to efficiently optimize data usage for enhanced network speeds and reduced costs.

The NKN token, the native token of the NKN ecosystem, helps in powering the network. For instance, one of the utilities of NKN tokens is to encourage miners to run their node 24×7 by helping them earn mining rewards. However, will this token continue to rise in the future? Moreover, will the demand for NKN continue to increase within the community?

Let’s now take a detailed look at NKN network’s operations and its native token, NKN. Moreover, this article will conduct a comprehensive analysis of NKN and forecast the price for 2023, 2024, 2025, 2026, till 2050.

Table of contents

- NKN (NKN) Market Overview

- What is NKN (NKN)?

- NKN Current Market Status

- NKN Price Analysis 2023

- NKN Price Prediction 2023-2030 Overview

- NKN Price Prediction 2023

- NKN Price Prediction 2024

- NKN Price Prediction 2025

- NKN Price Prediction 2026

- NKN Price Prediction 2027

- NKN Price Prediction 2028

- NKN Price Prediction 2029

- NKN Price Prediction 2030

- NKN Price Prediction 2040

- NKN Price Prediction 2050

- Conclusion

- FAQ

NKN (NKN) Market Overview

| 🪙 Name | NKN |

| 💱 Symbol | NKN |

| 🏅 Rank | #1249 |

| 💲 Price | $0.0058854476805996 |

| 📊 Price Change (1h) | 1.51 % |

| 📊 Price Change (24h) | 9.31 % |

| 📊 Price Change (7d) | 8.86 % |

| 💵 Market Cap | $4695564.9540985 |

| 💸 Circulating Supply | 797826301.23053 NKN |

| 💰 Total Supply | 797826301.23053 NKN |

NKN (NKN) is currently trading at $0.0058854476805996 and sits at number #1249 on CoinMarketCap in terms of market capitalization. There are 797826301.23053 NKN coins currently in circulation, bringing the total market cap to $4695564.9540985.

Over the past 24 hours, NKN has increased by 9.31%. Looking at the last week, the coin is up by 8.86%.

What is NKN (NKN)?

NKN, as described on its website, is a software overlay network built on top of the current model of the Internet to allow users to share unused bandwidth in order to earn token rewards.

One of the aims of NKN is to utilize unused bandwidth and data, allowing individuals and organizations to efficiently optimize data usage for enhanced network speeds and reduced costs. NKN claims that it will be easier and cheaper for developers to develop on NKN’s distributed network rather than utilizing the traditional approach

The NKN token, the native token of the NKN ecosystem, helps in powering the network. One of the utilities of NKN tokens is to encourage miners to run their node 24×7 by helping them earn mining rewards. Moreover, users can utilize NKN as a means to pay for nConnect’s secure connection, Content Delivery. Moreover, the NKN network mentioned that users could use NKN to pay for Content Delivery, game streaming, group chat subscriptions, and various other services.

NKN utilizes the consensus mechanism called Proof-of-Relay(PoR). The PoR rewards the miners by relaying real-world (useful) data along the network. Moreover, the NKN network stated that the scalable consensus is achieved through the introduction of an entirely novel consensus algorithm MOCA (Majority vOting Cellular Automata). MOCA is developed based on mathematical concepts of the Ising model and cellular automata.

NKN Ecosystem is continuously looking forward to developing new solutions. Some of the current solutions developed within the NKN ecosystem include nMobile, nConnect, and DataRide. nMobile is described as an all-in-one solution for decentralized chat, wallet integration, and solution utilization. nConnect offers a unique remote access solution with the “strongest security and ultimate privacy.” Finally, the DataRide provides custom-built solutions for customers and well-document resources for developers.

NKN Current Market Status

NKN is ranked in the 307 position based on its market capitalization, according to CoinMarketCap. The current circulating supply of the NKN network’s native token is 754,831,362 NKN, while its total supply is 754,831,362.

Moreover, NKN is priced at $0.1083, experiencing a 1.60% fall in seven days. With a market cap of $81,743,735, NKN also witnessed a 1.22% fall in 24 hours. Moreover, NKN is experiencing a fall in its demand as the trading volume, valued at $2,623,052, experienced a fall of 15.95%% in one day.

Some of the crypto exchanges for trading NKN are currently Binance, CoinBase, Bittrex, Huobi, and Gate.io.

Now, let’s dive further and discuss the price analysis of NKN network’s native token, NKN, for 2023.

NKN Price Analysis 2023

Will NKN’s most recent improvements, additions, and modifications help the price of cryptocurrencies rise? Moreover, would the changes in the digital asset industry affect NKN’s sentiment over time? Read more to find out about NKN’s 2023 price analysis.

NKN Price Analysis – Bollinger Bands

The Bollinger Bands is a technical analysis tool that is used to analyze price movement and volatility. Bollinger Bands (BB) utilizes the time period and the stand deviation of the price. Normally, the default value of BB’s period is set at 20. The Bollinger Bands consists of upper and lower bands which can be used together, along with the middle line(simple moving average), to determine whether the price would rise or fall.

The upper band of the BB is calculated by adding 2 times the standard deviations to the middle line, while the lower band is calculated by subtracting 2 times the standard deviation from the middle line. Based on the empirical law of standard deviation, 95% of the data sets will fall within the two standard deviations of the mean. As such, the prices of the cryptocurrency, when the Bollinger bands are applied should stay within the upper and lower bands 95% of the time is the concept behind this.

There were two occasions when NKN experienced a trend reversal. For instance, when the bands expanded indicating high volatility, the altcoin faced a trend reversal and reached the bottom half of the Bollinger Bands. Moreover, whenever the candlesticks broke through the upper band, NKN faced another trend reversal and fell back into the bottom half of the chart.

Currently, NKN is trading in the bottom half of the indicator, which indicates that the altcoin is facing a weak trend. However, NKN faced a weak trend, only after it experienced a surge in its sentiment. Observing its previous pattern, there is a high possibility that NKN could reach the upper trend of the Bollinger Band, which indicates that the altcoin is experiencing a strong trend.

NKN Price Analysis – Relative Strength Index

The Relative Strength Index (RSI) is a momentum indicator utilized to find out the current trend of the price movement and determine if it is in the oversold or overbought region. Traders often use this tool to make decisions about when to buy or sell the tokens. When the RSI is often valued below or at 30, it is considered an oversold region, and a price correction could happen soon. Moreover, when the RSI is valued above or at 70, it is considered as the overbought region, and traders expect the price could fall soon.

The RSI is valued at 45.07, indicating that there is a slight weak trend that NKN is observing. Moreover, the RSI has been experiencing quick trend reversals over the past few days as it crossed above and below the SMA. Currently, the RSI has formed below the SMA, which is considered that the NKN may continue to fall.

However, over the few days, NKN was moving sideways, which is considered a sign of consolidation. Moreover, RSI will play a key role in helping traders in determining NKN’s market sentiment over the coming days. Ultimately, traders should wait for any confirmation before conducting trade with NKN.

NKN Price Analysis – Moving Averages

Looking at the charts, NKN’s MA indicators had first formed a death cross, after the 50MA crossed below the 200MA. After 2023, NKN experienced a golden cross, after the 50 MA crossed above the 200MA. During the duration of the golden cross, NKN was trading above the MA indicators, which is considered a bullish sentiment.

However, after a few days, NKN started showing signs of consolidation as it was trading in between the MA indicators. Moreover, the gap between the indicators continues to remain the same. Ultimately, future candlesticks’ trajectory could decide NKN’s long-term market sentiment.

NKN Price Analysis – Moving Averages Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) indicator can be used to identify potential price trends, momentums, and reversals in markets. MACD will simplify the reading of a moving average cross easier. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Moving Average) indicator from the short-term EMA. Normally, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Moreover, MACD is considered a lagging indicator as it cannot provide trade signals without any past price data.

Traders have reported that occasionally the Moving Average could create false signals about the price momentum, however, MACD plays an important role as it can confirm the trends and identify the potential reversals.

Furthermore, there are two methods through which traders can speculate the price’s momentum: the crossover method and the histogram method. In the crossover method, when the MACD line crosses above the signal line, the trend could change from a downtrend to a long trend. However, if MACD crosses below the signal line, this could indicate the start of a downtrend.

In the Histogram method, the bars above the signal line indicate an uptrend. Meanwhile, the Histogram bars below the signal line indicate a bearish trend.

Looking at the MACD indicator, NKN is currently showing signs of short-term bearish signal. The MACD line is currently below the signal line, which indicates that bears have entered the market. However, when we look at the histogram model, the red bars are reducing and the distance between the MACD and the signal is also decreasing. This could indicate that NKN could soon run with the bulls.

However, whether NKN will experience a bullish sentiment in the long term or short term is still unclear. Hence, Long-term traders should wait patiently before entering the market with NKN.

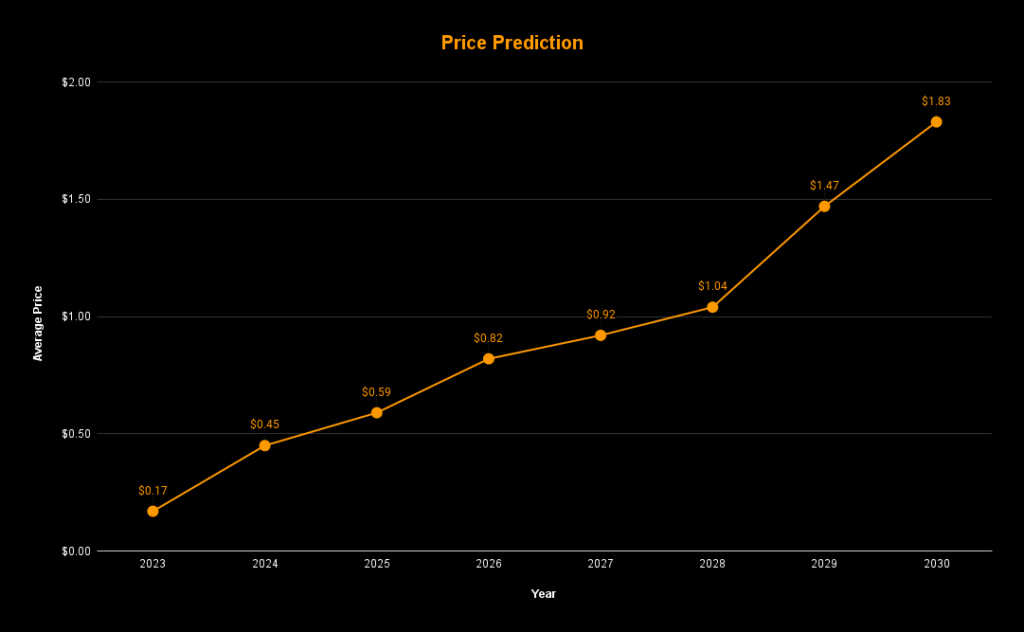

NKN Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $0.08 | $0.17 | $0.35 |

| 2024 | $0.33 | $0.45 | $0.51 |

| 2025 | $0.48 | $0.59 | $0.78 |

| 2026 | $0.64 | $0.82 | $0.90 |

| 2027 | $0.84 | $0.92 | $1.27 |

| 2028 | $0.96 | $1.04 | $1.66 |

| 2029 | $1.03 | $1.47 | $1.81 |

| 2030 | $1.37 | $1.83 | $2.09 |

| 2040 | $3.75 | $3.96 | $4.15 |

| 2050 | $7.24 | $7.45 | $7.63 |

NKN Price Prediction 2023

The chart highlights that NKN’s long-term trend is not yet confirmed. However, MACD shows that NKN’s short-term bearish season going to expire, as the red bars on the histogram model are reducing and the distance between the MACD line and the signal is reducing. If the MACD line crosses above the signal line, then, NKN’s bullish trend could start soon.

Moreover, the ADX indicator reports that the strength of the indicator is strong. If the ADX continues to reside within the strong trend region, then, there is a high probability that NKN could experience a bullish trend. However, it is still unclear if NKN’s upcoming bullish sentiment would be for a long term or a short term.

Meanwhile, the price prediction of NKN for 2023 remains to be bullish and is expected to reach beyond the level of $0.2141. The bearish price prediction range for NKN is between $0.0752 to $0.0884.

| Bullish Price Prediction | Bearish Price Prediction |

| $0.2141 – $0.2416 | $0.0752 – $0.0884 |

NKN Price Prediction – Resistance and Support Levels

Looking at the charts, NKN is trading in between the Resistance 1 and Support. If the long-term bullish trend arrives for NKN, there is a high possibility that NKN could reach Resistance 1 at $0.2144. If NKN further continues above Resistance 1, then, it could reach the Resistance 2 area at $0.3500, which is the extremely bullish trend for 2023.

However, if NKN continues to fall under the bears’ spell, then, NKN could fall into the Support region at $0.0752.

NKN Price Prediction 2024

Traders are looking forward to this year as it could be a historic moment for cryptocurrencies, as the Bitcoin halving is expected to happen in 2024. Most of the time, whenever BTC rises, traders have observed a similar surge in the altcoins. NKN could also be affected by Bitcoin halving and could trade beyond the price of $0.5 by the end of 2024.

NKN Price Prediction 2025

NKN could still experience the after-effects of the Bitcoin halving and is expected to trade above its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, NKN will continue to rise in 2025 forming new resistance levels. It is expected that NKN would trade beyond the $0.7 level.

NKN Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, NKN could tumble into its support region of $0.8. Moreover, when NKN remains in the oversold region, there could be a price correction soon. NKN, by the end of 2026, could be trading beyond the $0.9 resistance level after experiencing the price correction.

NKN Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. NKN is expected to rise after its slumber in the bear season. Moreover, NKN could even break more resistance levels as it continues to recover from the bearish run. Therefore, NKN is expected to trade at $1.2 by the end of 2027.

NKN Price Prediction 2028

Once again, the crypto community is looking forward to this year as there will be a Bitcoin halving. Alike many altcoins, NKN will continue to form new higher highs and is expected to move in an upward trajectory. Hence, NKN would be trading at $1.6 after experiencing a massive surge by the end of 2028.

NKN Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment and the slight price surge expected after the aftermath, NKN could be trading at $1.8 by the end of 2029.

NKN Price Prediction 2030

After witnessing a bullish run in the market, NKN and many altcoins would show signs of consolidation and might trade sideways for some time while experiencing minor spikes. Therefore, by the end of 2030, NKN could be trading at $2.

NKN Price Prediction 2040

The long-term forecast for NKN indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point. However, NKN may face a slight fall before starting its upward journey once again. It is expected that the price of NKN could reach $4 by 2040.

| Minimum Price | Average Price | Maximum Price |

| $3.75 | $3.96 | $4.15 |

NKN Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, NKN could surpass the resistance level of $7.

| Minimum Price | Average Price | Maximum Price |

| $7.24 | $7.45 | $7.63 |

Conclusion

To summarize, if investors continue to show interest in NKN and add these tokens to their portfolio, then, it could continue to rise up. NKN’s bullish price prediction shows that it could pass beyond the $0.2416 level. Moreover, NKN could surpass the $7 level by the end of 2050.

FAQ

NKN, as described on its website, is a software overlay network built on top of the current model of the Internet to allow users to share unused bandwidth in order to earn token rewards.

One of the aims of NKN is to utilize unused bandwidth and data, allowing individuals and organizations to efficiently optimize data usage for enhanced network speeds and reduced costs. NKN claims that it will be easier and cheaper for developers to develop on NKN’s distributed network rather than utilizing the traditional approach

The NKN token, the native token of the NKN ecosystem, helps in powering the network.

NKN can be traded on many exchanges such as Binance, CoinBase, Bittrex, Huobi, and Gate.io.

As NKN’s ecosystem continues to grow and the demand for the native continues to rise, then, NKN could reach $1 by the end of 2027.

NKN’s ecosystem has various potentials, thus, it could drive its native token’s price upwards. If NKN continues to showcase a bullish sentiment, then, the altcoin could trade at $4 by 2040.

The lowest price of NKN is $0.006411.

NKN achieved it’s All-Time High of $1.48 in 2021.

The maximum supply of the NKN is 1,000,000,000 NKN.

The NKN project was launched in 2018.

NKN can be stored in a cold wallet, hot wallet, or exchange wallet.

Reportedly, CEO Yanbo Li, CTO Yilun Zhang, and co-CEO Zheng “Bruce” Li are the co-founders of the NKN project.

NKN is expected to reach $0.2141 in 2023.

NKN is expected to reach $0.5 in 2024.

NKN is expected to reach $0.7 in 2025.

NKN is expected to reach $0.9 in 2026.

NKN is expected to reach $01.2 in 2027.

NKN is expected to reach $1.6 in 2028.

NKN is expected to reach $1.8 in 2029.

NKN is expected to reach $2 in 2030.

NKN is expected to reach $4 in 2040.

NKN is expected to reach $7 in 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.