- Degen Spartan states no new technology discovered for permanent higher returns.

- The Twitter thread came amid revelations made by analytics firm, Glassnode.

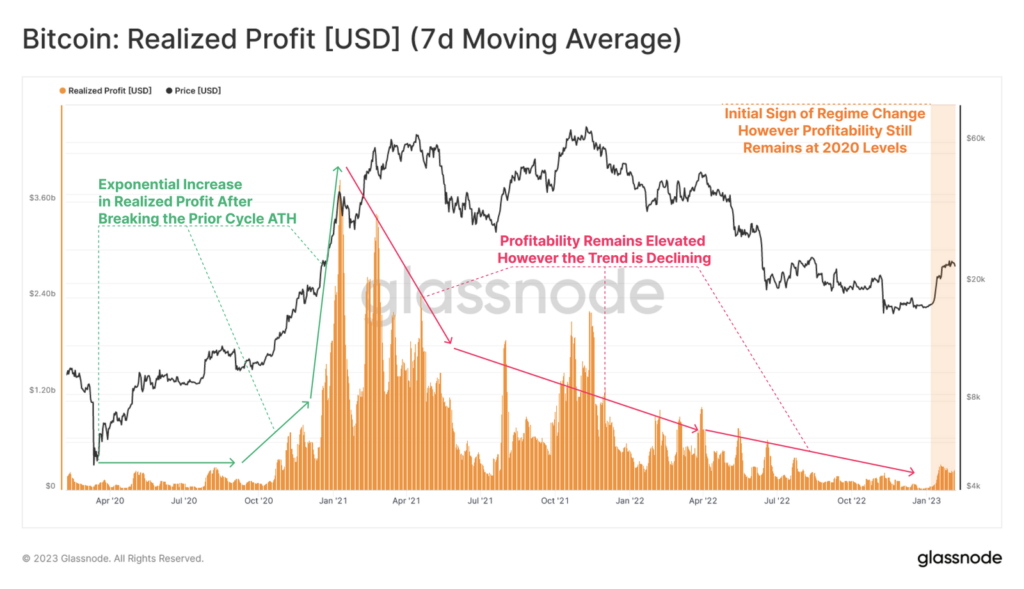

- Glassnode identifies structural changes using the ratio of realized profits and losses.

Popular Crypto Fund Manager DegenSpartan tweeted “no new secret technology for permanently higher returns has been discovered here yet”. Furthermore, he explained that the only obvious cycle-to-cycle trend change was the reduction of profitability with subsequent cycles.

Giving more in-depth insight to these behaviors, DegenSpartan stated that the reduction of profitability was reciprocated by the larger market cap and broader participation and “maturing” of the asset.

Notably, Degen Spartan’s statements came amid recent revelations by the on-chain market intelligence platform, Glassnode. According to Glassnode, multiple on-chain oscillators have reached a point of equilibrium and are normally trending again.

Additionally, this is consistent with findings made during earlier bear markets, during which a shift in the direction of market tides took place. The current consolidation allegedly puts the typical BTC holder into a regime of unrealized profit, showing that a possible turning of the macro market tides is imminent.

Notably, using the ratio of realized profits to realized losses, Glassnode identifies structural changes in the relative dominance of the two categories.

It is important to remember that a capitulation in price action occurred after the Nov 2021 ATH leading to a regime presided over by losses, according to Glassnode. This regime drove the Realized Profit/loss Ratio below 1, with the extent of the situation becoming more severe with each succeeding capitulation in price action.

Nevertheless, according to experts, the community has seen the first extended period of profitability since the exit liquidity event in April 2022, which is a strong indicator of the beginning stages of a shift in the profitability regime.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.