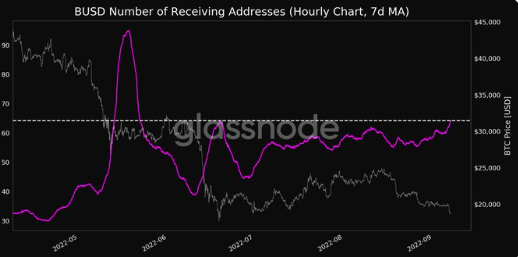

- BUSD’s receiving addresses (7d MA) reached a 3-month high of 64.173.

- The stablecoin is one of the few cryptos in green lane today.

- Existing balances and new deposits of USDC, USDP, and TUSD stablecoins will be subject to a BUSD Auto-Conversion.

The on-chain market intelligence firm Glassnode took to Twitter on 7 September with some news about the Binance stablecoin BUSD. According to the Twitter post, BUSD’s receiving addresses (7d MA) reached a 3-month high of 64.173.

In addition to this, according to the market tracking website CoinMarketCap, BUSD is one of the few cryptos signaling green today. At the time of writing, BUSD was up 0.03% over the last 24 hours and 0.01% in the green over the last week.

In terms of market cap, BUSD is still the 6th biggest crypto with its market cap of $19,735,348,007. The stablecoin’s 24-hour trading volume is up just over 9% today to now stand at $9,357,956,985.

In related news, Binance recently announced that all existing balances and new deposits of USDC, USDP, and TUSD stablecoins will be subject to a BUSD Auto-Conversion. The exchange cited the desire to enhance liquidity and capital efficiency as the reasons for the decision.

The conversion will have a 1:1 ratio and will take effect on September 29, 2022.

Binance assured users that their choice of withdrawal will not be affected at all, and people will be able to withdraw funds in USDC, USDP, and TUSD at a 1:1 ratio to their BUSD-denominated account balance.

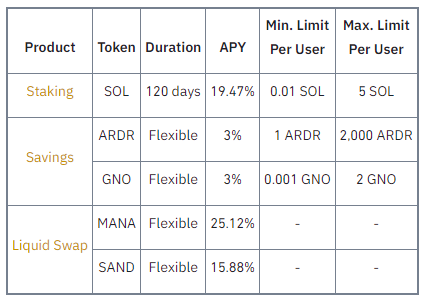

In addition to this, Binance announced on September 7 that they have launched new rewarding offers.

The Binance website stated that Binance Earn is presenting users with a series of rewarding offers each Wednesday.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.