- Crypto Quant shared a report that suggests BTC could reach $100k by 2024.

- The report stated that BTC’s halving could be the catalyst that pushes BTC’s price up.

- BTC is currently changing hands at $30,061.48 after a 6.24% price increase.

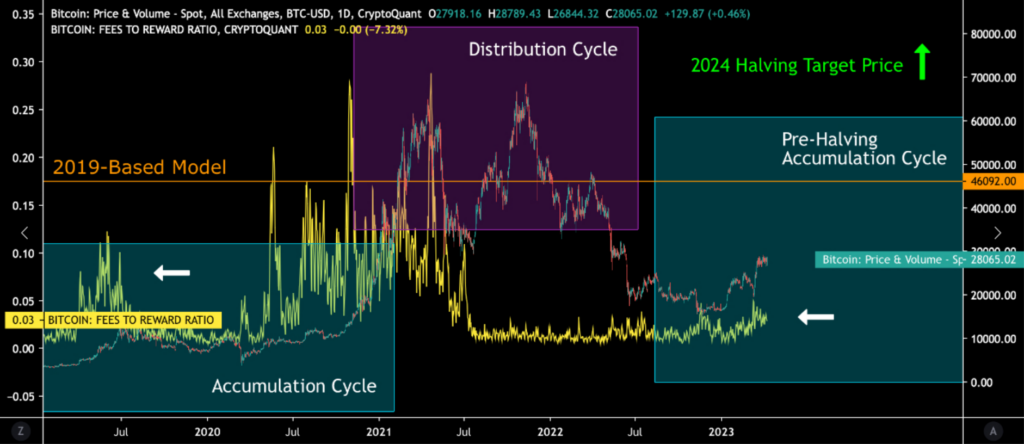

So far, the start of 2023 has been kind to BTC as the crypto is up by about 69% year-to-date. Earlier this week, CryptoQuant shared a thesis about what the price of the crypto market leader, Bitcoin (BTC), could do within the next year. The main idea behind the thesis is that BTC could reach $100,000 by 2024.

In this thesis, it was pointed out that during the accumulation cycle of 2019, “the fees to reward ratio spiked before the summer relief rally rising to 0.12.” The same thing happened again in 2020, where the fees-to-reward ratio reached 0.29 in November. Now it seems that the fees to reward ratio is once again spiking, according to the report.

The writer also referred to the fact that BTC is coming closer to reaching a $46,092 price level which he predicted back in 2019, and that the leading crypto could reach this price as soon as “the summer of 2023”. In addition to this, the writer placed emphasis on the fact that Bitcoin’s halving event is coming up. Some believe that the halving could happen as soon as April of 2024.

The thesis was concluded by the writer stating that if BTC is able to reach the predicted $46,092 price level, it will not be a far stretch for the crypto market leader to reach $100,000 after the 2024 halving.

BTC experienced a rather exciting past 24 hours as the crypto trades at $30,061.48 at press time. This is after BTC’s price increased 6.24% over the last 24 hours according to CoinMarketCap. BTC is also still up by more than 7% over the last seven days.

Another metric in the green zone is BTC’s 24-hour trading volume which now stands at $23,788,863,100 after an increase of more than 90% since yesterday.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.