- Santiment indicates that stablecoins have increased withdrawals from exchanges.

- The FTX drama played a big role in these withdrawals.

- This high number of withdrawals have a negative impact on the liquidity of exchanges.

The FTX meltdown has already had far-reaching consequences in the cryptocurrency market. Data from the market intelligence firm, Santiment, indicates that because of this, people are starting to take matters into their own hands.

Some of the big names in the crypto industry like Dan Held, Changpeng Zhao, and Michael Saylor advised people to self-custody. They stated that cryptocurrency on an exchange is, basically, completely at the mercy of that exchange, and are vulnerable to any problems that may come about.

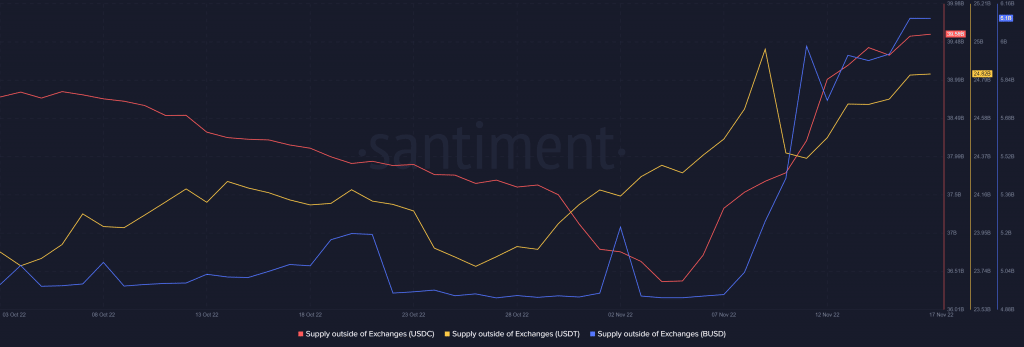

It seems like most people heeded this warning as data from Santiment indicates that stablecoins have seen increased withdrawals from exchanges. The Supply Outside of Exchanges metrics indicates that USDC, USDT, and BUSD have experienced significant exchange outflows over the last few days.

The outflow for USDC alone was $39.58 billion, while USDT’s outflows stood at $24.82 billion. At the time of writing, outflows for BUSD stood at $6.1 billion.

Although the interest rate hikes could be a factor impacting the high outflow numbers of stablecoins at the moment, many believe that the FTX drama also played a big role in these withdrawals.

Unfortunately, this high number of withdrawals has a negative impact on the liquidity of exchanges. This means that there could soon be a severe shortage of tradable assets on the market as more consumers pull their funds out of exchanges.

This, in turn, could then induce illiquidity if the panic in the market continues as it is now. Some even go as far as to believe that we could see a crypto equivalent of a bank run if the confidence in the crypto market continues to decline.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.