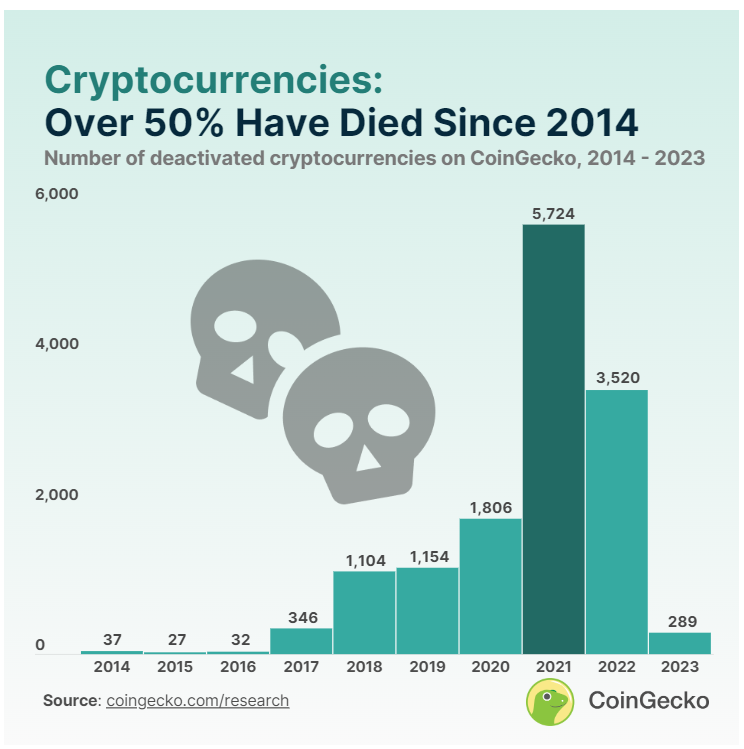

- Over 50% of coins and tokens listed on CoinGecko since 2014 are now considered “dead.”

- Cryptocurrencies launched in 2021 have the highest failure rate, with over 70% failing within three years.

- Projects from the 2020-2021 bull run account for 53% of all dead cryptocurrencies, totaling 7,530 projects.

Cryptocurrency data aggregator CoinGecko reveals that over 50% of all the coins and tokens listed since 2014 have ceased operations or become entirely worthless. This translates to a staggering 14,039 “dead coins” out of the more than 24,000 ever listed on the platform.

The study, conducted by CoinGecko, examines the overall count of coins and tokens collectively known as ‘cryptocurrencies’ once listed on their platform, categorizing them as ‘dead’ or ‘failed.’ The analysis spans from 2014 to 2023.

Cryptocurrencies launched in 2021 exhibit the highest rate of dead coins, with over 70% (5,724 projects) failing within just three years. Following closely is 2022, witnessing a failure rate of approximately 60% (3,520). However, a glimmer of hope emerges in 2023, with less than 10% (289) of listed projects failing so far.

The report further breaks down the data, painting a particularly concerning picture for projects launched during the 2020-2021 bull run. A substantial 53% of all dead cryptocurrencies, totaling 7,530 projects, belong to this period. This figure represents around 70% of the 11,000 crypto projects listed during the bull cycle.

In comparison, the 2017-2018 bull run saw a similar failure rate of around 70%, albeit with a smaller number of project launches at around 3,000.

CoinGecko’s analysis attributes this trend to factors like the ease of deploying tokens and the surge of memecoins, often abandoned shortly after launch due to the absence of a tangible product or utility.

The report also outlines specific reasons for project failure, including a lack of trading activity for 30 days, confirmed scams or “rug pulls,” projects voluntarily deactivating due to closure or token overhauls, and adherence to specific liquidity and activity thresholds.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.