- Bitcoin traded above $126 K but is still 15% below its record high when priced in gold.

- Peter Schiff says BTC must reach about $148 K to match its previous gold-denominated peak.

- He calls the current rally a bear market move while gold approaches $4,000 per ounce.

Veteran economist and gold advocate Peter Schiff argued that Bitcoin’s latest rally is “just a bear market bounce,” even after the token set a new all-time high around $126,198.

Schiff said Bitcoin ( BTC ) must surpass its record high priced in gold before calling it a bull market. Based on current gold prices near $4,000 per ounce, he estimated that BTC would need to reach about $148,000 to match its previous peak in gold terms; roughly 15% below its record. At the time of writing, 1 BTC exchanged for 31.33 gold ounces, down from its December 2024 high of 40 ounces.

Schiff Says Rising Gold Makes Bitcoin’s Target a Moving Goalpost

Responding to a question on X about the exact price Bitcoin would need to hit to match gold’s move, Schiff said the target “keeps rising as gold keeps rising.”

He used the moment to reinforce his long-held criticism that Bitcoin cannot be a reliable store of value until it outperforms gold in real-term valuation.

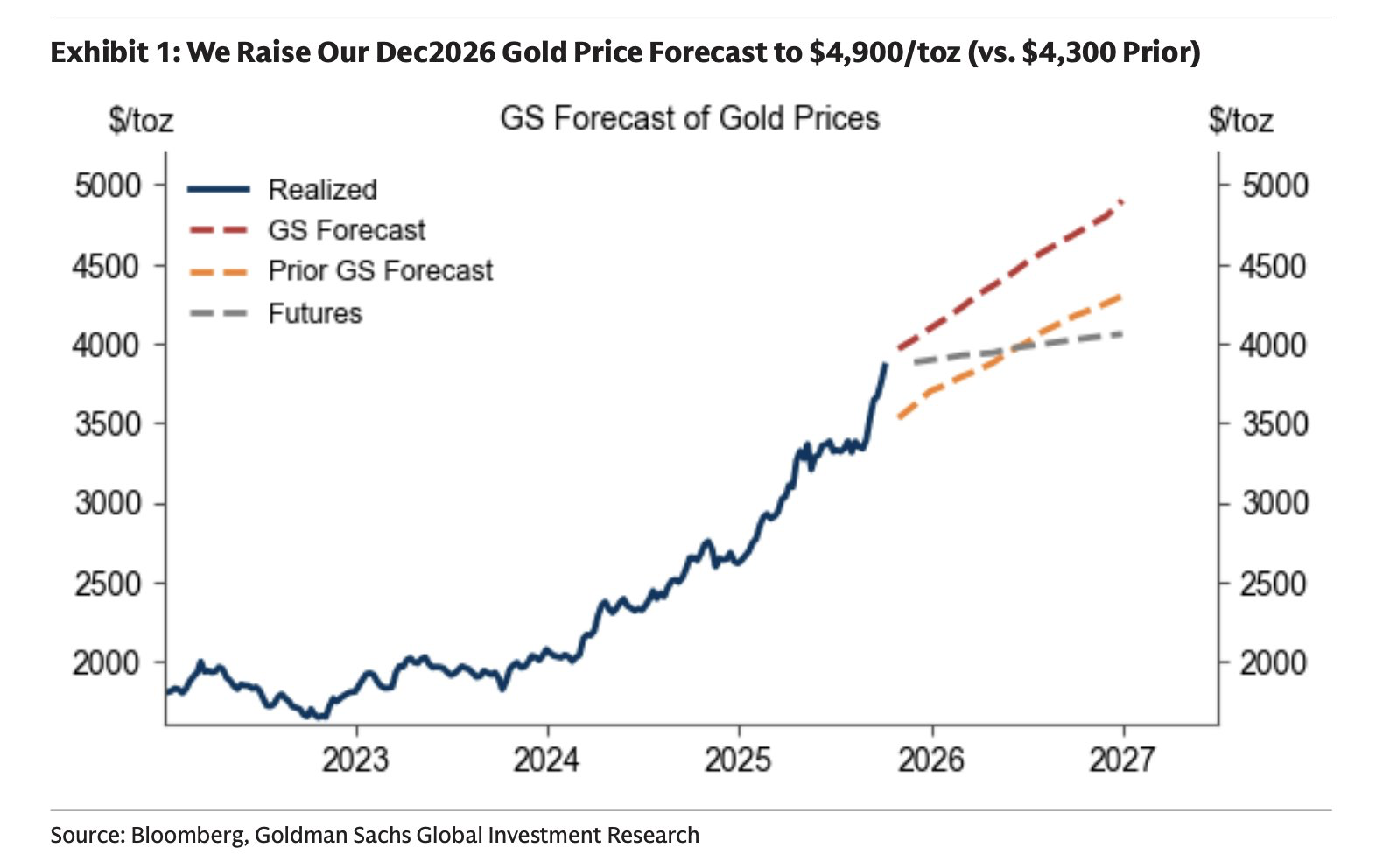

Schiff maintains that gold’s ongoing momentum, with prices approaching $4,000 per ounce, shows why he continues to favor metal over digital assets.

Related: Wall Street Veteran Paul Tudor Jones Renews Bitcoin Call as Institutional Profits Climb

Macro Backdrop Fuels Gold’s Momentum and Investor Caution

Gold’s parabolic climb has come against a broader backdrop of U.S. macroeconomic stress, including the US government shutdown and rising public debt levels.

Furthermore, Ray Dalio, the founder of Bridgewater Associates, has warned that the U.S. government must deal with its escalating debt. Notably, the U.S. government has been spending more than its intake, thus accumulating more debt.

These concerns have driven capital toward safe-haven assets like gold, and secondarily to Bitcoin as an inflation hedge, though Schiff believes Bitcoin’s gains remain speculative until it outpaces gold on a relative basis.

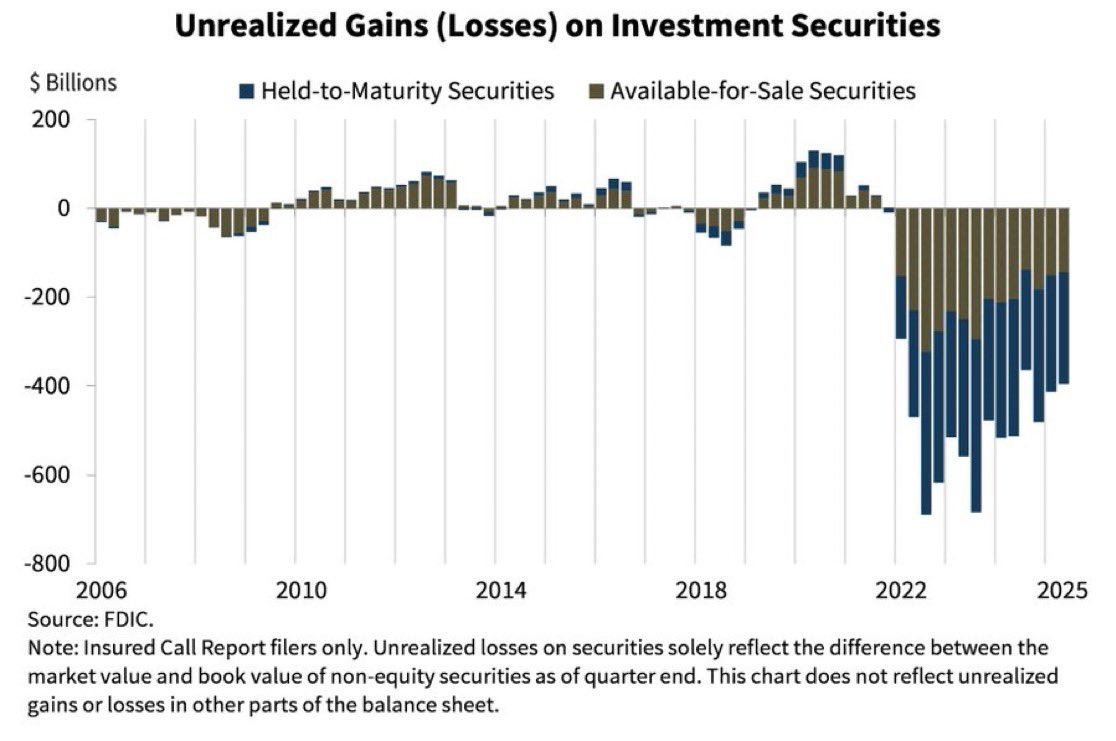

U.S. Banks Still Struggling Under Unrealized Losses

Economic pressure is also visible in the banking sector. According to FDIC data, U.S. banks held about $395 billion in unrealized losses as of Q2 2025, a higher level than during the 2008 financial crisis. Schiff cited this as evidence of systemic weakness that continues to strengthen gold’s dominance.

Institutions Still Split on Bitcoin Valuation

Major banks and funds remain divided on Bitcoin’s next move. Goldman Sachs recently raised its 2026 gold target to $4,900 per ounce, citing institutional demand and geopolitical tensions.

Meanwhile, JPMorgan said Bitcoin was “undervalued against gold,” predicting potential rotation from gold into BTC as liquidity returns to risk assets.

Last week, Citigroup lowered its Bitcoin price target for the end of this year from $135k to $133k. Nevertheless, Citi raised its BTC price target to $181k by the end of next year.

Related: From Cash to Gold: How Reddit Community Feels About Bitcoin’s Identity Shift

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.